S&P 500 Daily Perspective for Wed 31 May 2023

In short-term balance with a bullish edge

GDR Model Insights for the S&P 500

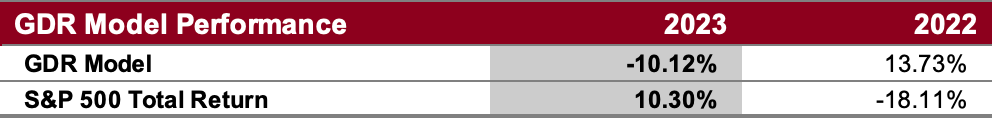

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

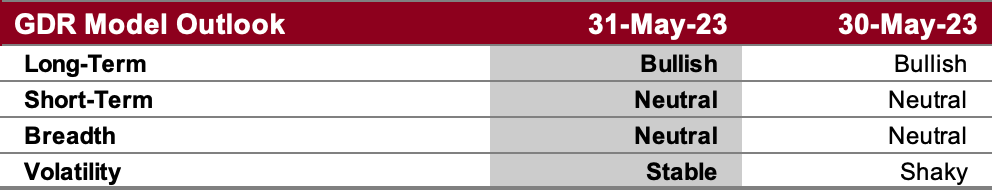

GDR Model Outlook

The GDR Model strengthened again at the end of last week and is now tilting bullish again.

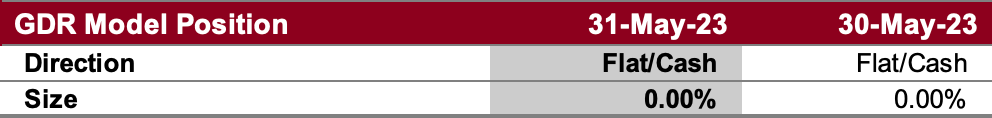

GDR Model Position

The strength last Friday was enough for the GDR Model to close its short position. It is now back to cash, but should strength be sustained it will most likely enter a bullish position soon.

S&P 500 Futures Market Profile Analysis

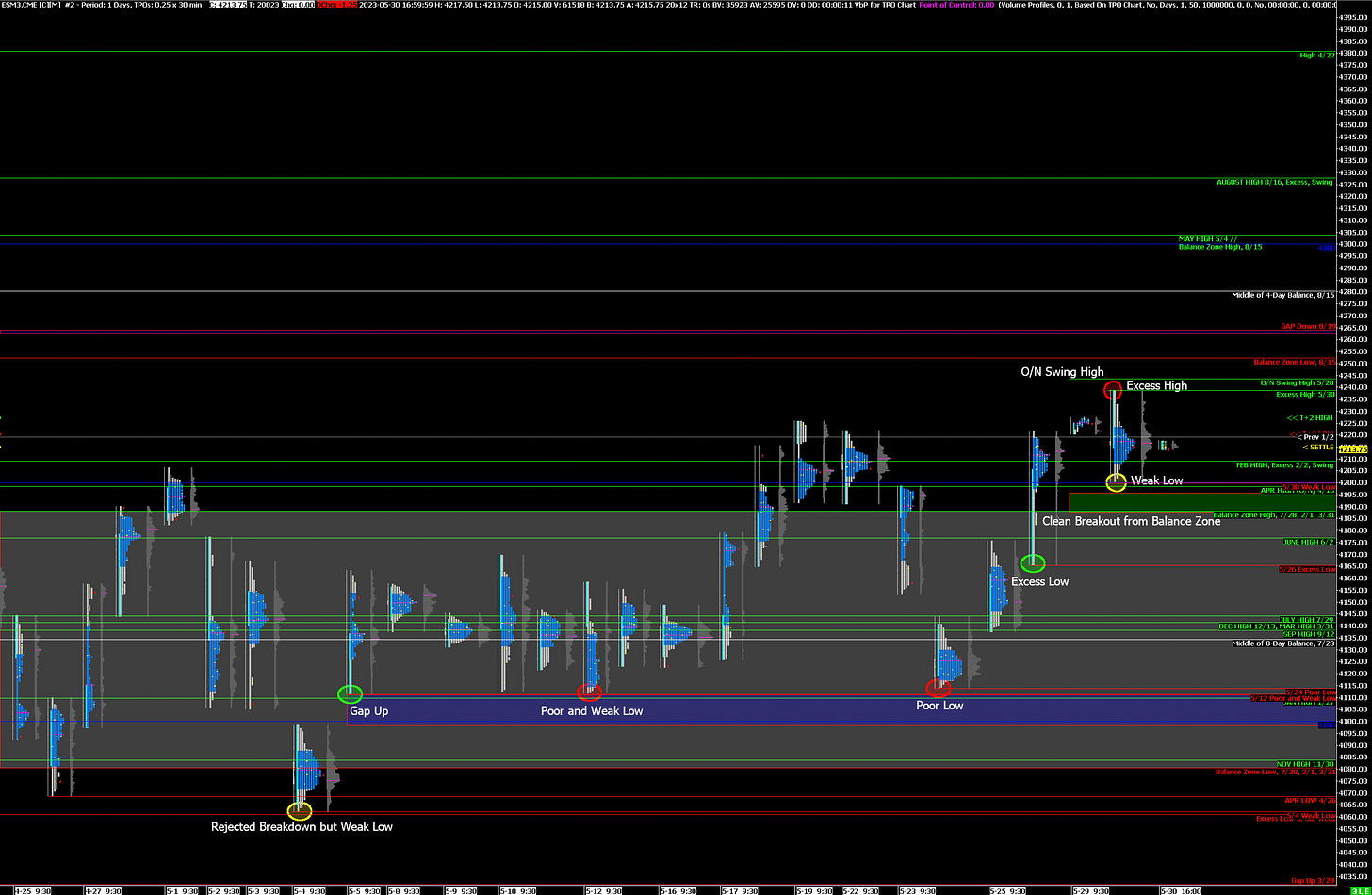

Near-Term Outlook: bullish following consolidation

Alternate Outlook: further consolidation into short-term balance

Key Levels

Bullish: 4222 (T+2 Settlement High), 4244 (O/N Swing High), 4252 (Bottom of Upper Balance Zone)

Bearish: 4200 (Weak Low), 4188 (Top of Lower Balance Zone, Closes Double Distribution), 4165 (Prev Low)

Market Narrative

While the today’s gap up was filled relatively quickly, value ended higher today than Friday, therefore, except for a tightening of short-term balance, there isn’t much change in outlook compared to yesterday. The ES remains bullish as long as it continues to hold above the previous balance zone.

Economic Calendar

8:50am - FOMC Member Bowman Speaks

9:45am - Chicago PMI

10:00am - JOLTs Job Openings

1:30pm - FOMC Member Jefferson Speaks

2:00pm - Beige Book

Later This Week: Nonfarm Payrolls (Fri)