S&P 500 Daily Perspective for Tue 30 May 2023

Bullish following clean breakout from balance zone

GDR Model Insights for the S&P 500

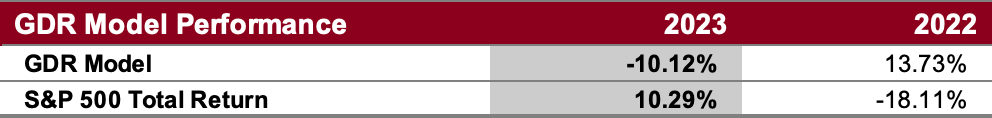

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

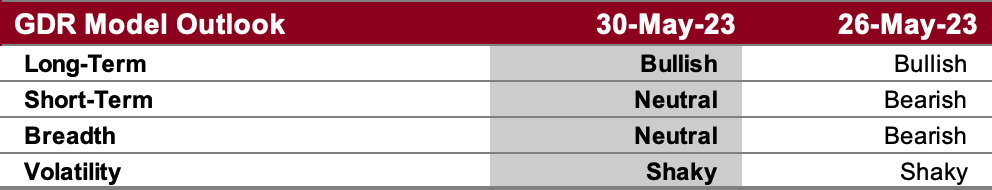

GDR Model Outlook

The GDR Model strengthened again at the end of last week and is now tilting bullish again.

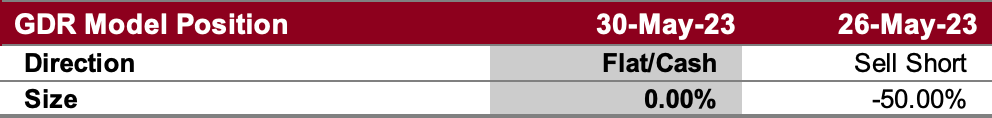

GDR Model Position

The strength last Friday was enough for the GDR Model to close its short position. It is now back to cash, but should strength be sustained it will most likely enter a bullish position soon.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish following clean breakout from balance zone

Alternate Outlook: consolidation into short-term balance

Key Levels

Bullish: 4226 (Poor High), 4244 (O/N Swing High), 4252 (Bottom of Upper Balance Zone)

Bearish: 4188 (Top of Lower Balance Zone, Closes Double Distribution), 4165 (Prev Low), 4138 (5/25 Low), 4114-4111 (Poor Low and Weak Low, Trapped Shorts)

Market Narrative

Friday’s market was strong from the open, making a clean breakout from the balance zone it had been stuck in for several weeks. The ES is now looking bullish, especially when taking into account that the longer a market spends in balance the more explosive the move out of balance is likely to be.

On the other hand, it is notable that Friday’s market profile suggests short-covering, which can weaken a market. Nonetheless it seems unlikely that the market could break back down on Tuesday. Balance between the previous Balance Zone High (4188) and the 5/19 Poor High (4226) seems like the second most likely scenario should the market not continue higher.

Economic Calendar

9:00am - S&P/Case-Shiller House Price Index

10:00am - CB Consumer Confidence

Later This Week: Nonfarm Payrolls (Fri)