S&P 500 Daily Perspective for Wed 7 Jun 2023

Still in bullish consolidation

GDR Model Insights for the S&P 500

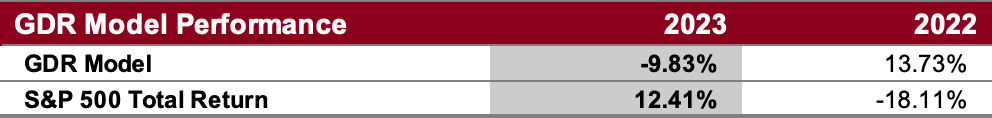

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

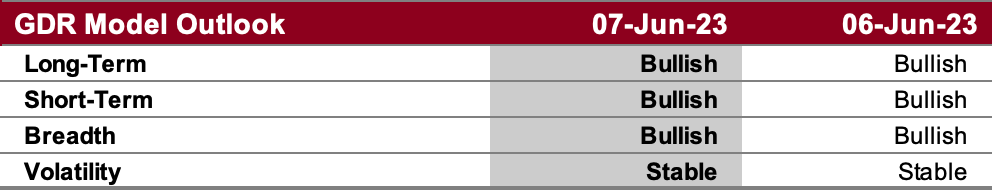

GDR Model Outlook

The GDR Model is now bullish following last week’s breakout from consolidation.

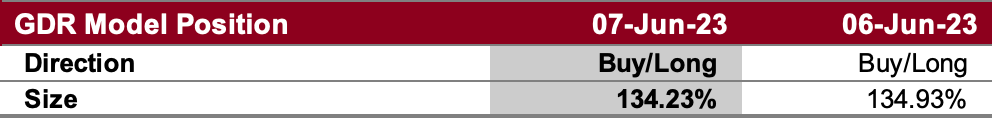

GDR Model Position

The GDR Model has opened a long position following yesterday’s consolidation.

S&P 500 Futures Market Profile Analysis

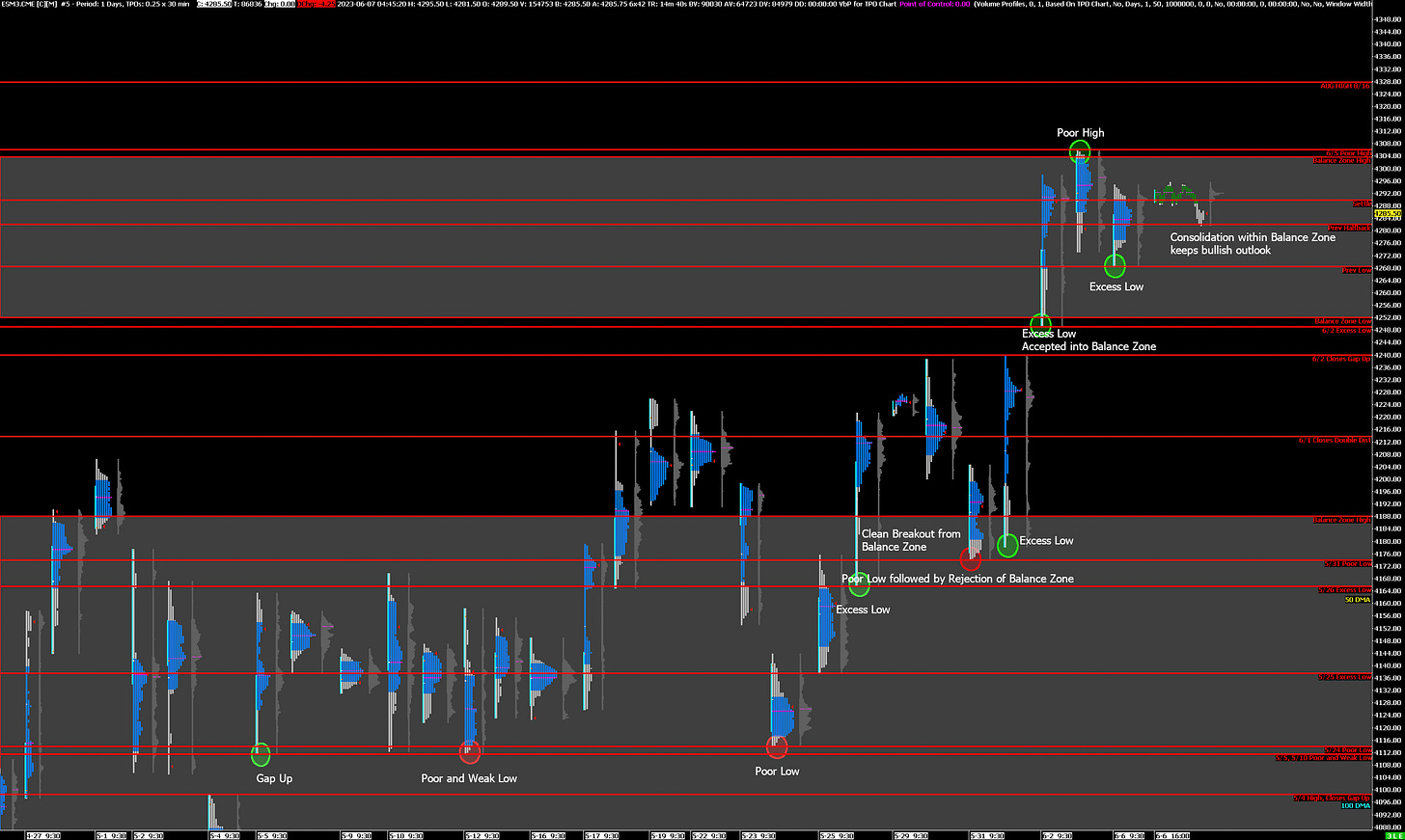

Near-Term Outlook: in bullish consolidation

Alternate Outlook: breakout to take out August 2022 high target

Key Levels

Bullish: 4304 (Top of Current Balance Zone), 4306 (Poor High), 4328 (August 2022 High)

Bearish: 4268 (Prev Low), 4252 (Bottom of Current Balance Zone), 4240 (Closes Gap Up)

Market Narrative

Not many changes from Monday’s outlook or yesterday’s: as expected the market is consolidating a bit after finding resistance at the current balance zone high.

The next logical target is the August 2022 high at 4328. However, before getting there the ES may face resistance at the current balance zone high around 4304. Trading down to the balance zone low (4252) would not change the bullish outlook as long as breakdowns are rejected.

Economic Calendar

Today - none notable

Later this Week: none notable