S&P 500 Daily Perspective for Fri 12 May 2023

Short-term balance once again...

GDR Model Insights for the S&P 500

GDR Model Performance

Overall this year has been challenging for the Model’s style due to low confidence in the market.

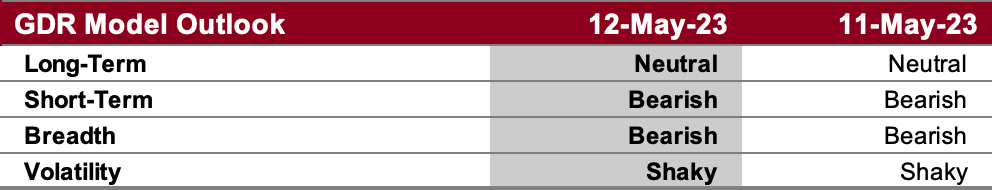

GDR Model Outlook

The overall Model deteriorated and is now mostly Bearish in the near-term. However, keep in mind that inflation data coming out today can swiftly change the picture.

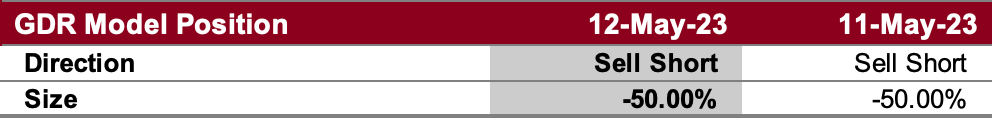

GDR Model Position

The model has opened a small short position as the market’s conditions have continued to deteriorate. This is a tentative position so it’s possible it might not last for long.

S&P 500 Futures Market Profile Analysis

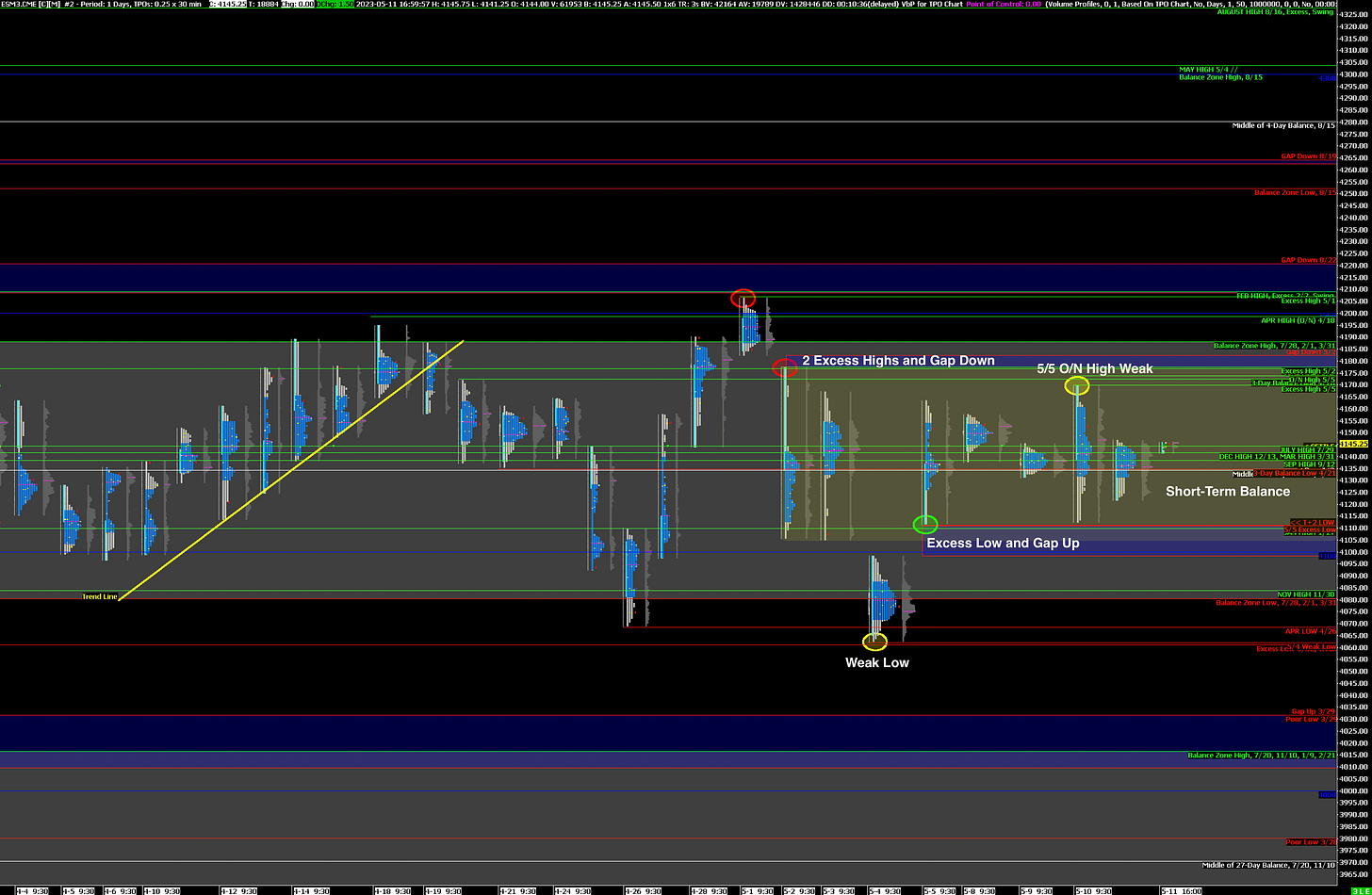

Near-Term Outlook: Still in Short-Term Balance, could go either way

Alternate Outlook: N/A

Bullish: 4170 (5/10 High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4136 (Prev POC), 4098 (Closes Gap Up), 4080 (Bottom of Current Balance Zone)

Market Narrative

Not much changed in the market except for a contraction in Volatility. As such, Thursday’s outlook still broadly applies coming into Friday. This time the trading range didn’t even come close to breaking Short-Term Balance, let alone the wider Balance Zone.

The market is in Balance and can break in either direction. Balance Trading Guidelines will shed light on how to approach the market until a new trend is established.

Economic Calendar

Today at 10:00am - Michigan Consumer Sentiment

Next Week: none notable