S&P 500 Daily Perspective for Thu 11 May 2023

Still in short-term balance...

GDR Model Insights for the S&P 500

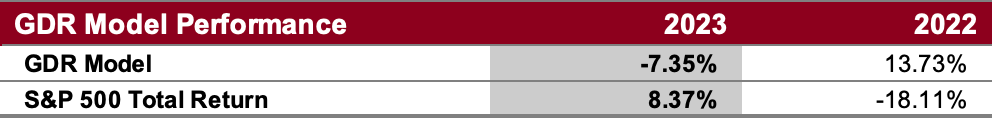

GDR Model Performance

Overall this year has been challenging for the Model’s style due to low confidence in the market.

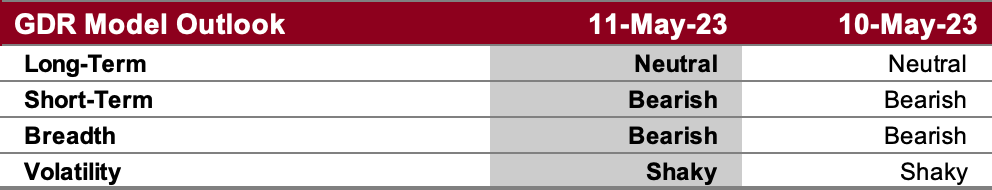

GDR Model Outlook

The overall Model deteriorated and is now mostly Bearish in the near-term. However, keep in mind that inflation data coming out today can swiftly change the picture.

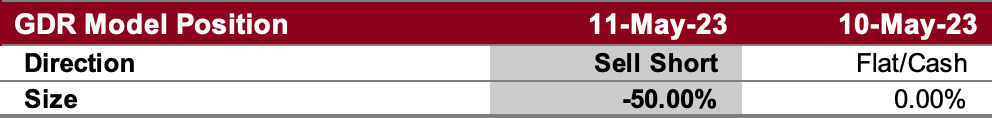

GDR Model Position

The model has opened a small short position as the market’s conditions have continued to deteriorate. This is a tentative position so it’s possible it might not last for long.

S&P 500 Futures Market Profile Analysis

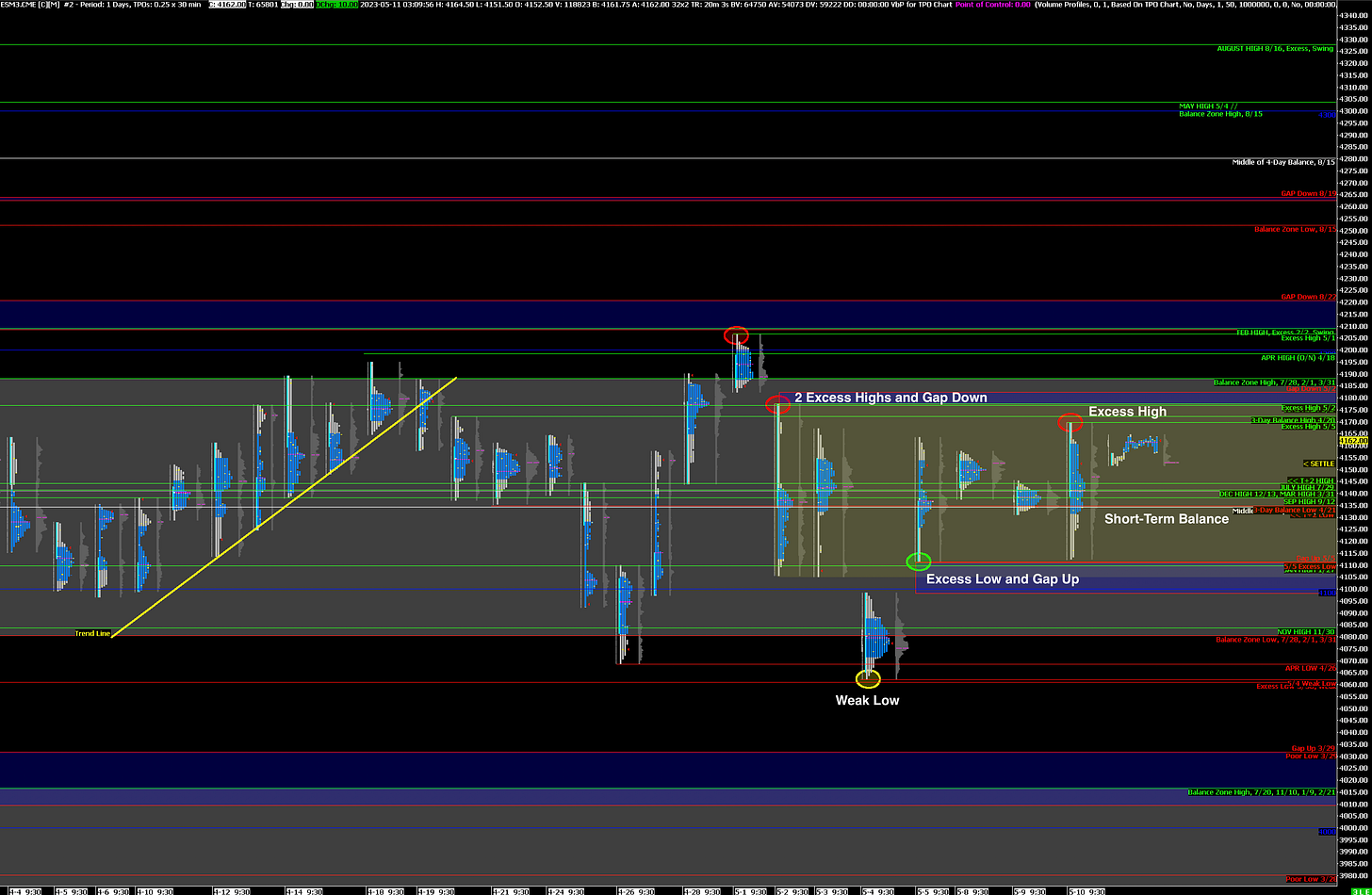

Near-Term Outlook: Still in Short-Term Balance

Alternate Outlook: N/A

Bullish: 4170 (Prev High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4141 (Prev POC and Halfback), 4098 (Closes Gap Up), 4080 (Bottom of Current Balance Zone)

Market Narrative

While Volatility certainly increased yesterday following the CPI data release, yesterday’s trading still ended up being rotational without clear directionality. Moreover, note that yesterday’s range didn’t break Short-Term Balance and therefore it didn’t even come close to challenging the current Balance Zone.

Therefore the current outlook remains applicable: the market is in Balance and can break in either direction. Balance Trading Guidelines will shed light on how to approach the market until a new trend is established.

Economic Calendar

Today at 8:30am - PPI, Initial Jobless Claims

Today at 10:15am - FOMC Member Waller Speaks