S&P 500 Daily Perspective for Thu 29 Jun 2023

Short-term balance, could go either way

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

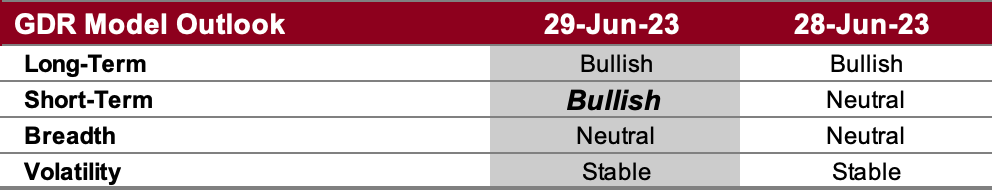

GDR Model Outlook

The GDR Model is now back to bullish following some recent stabilization.

GDR Model Position

The GDR Model is in cash, but a re-entry into a long position is becoming more likely.

S&P 500 Futures Market Profile Analysis

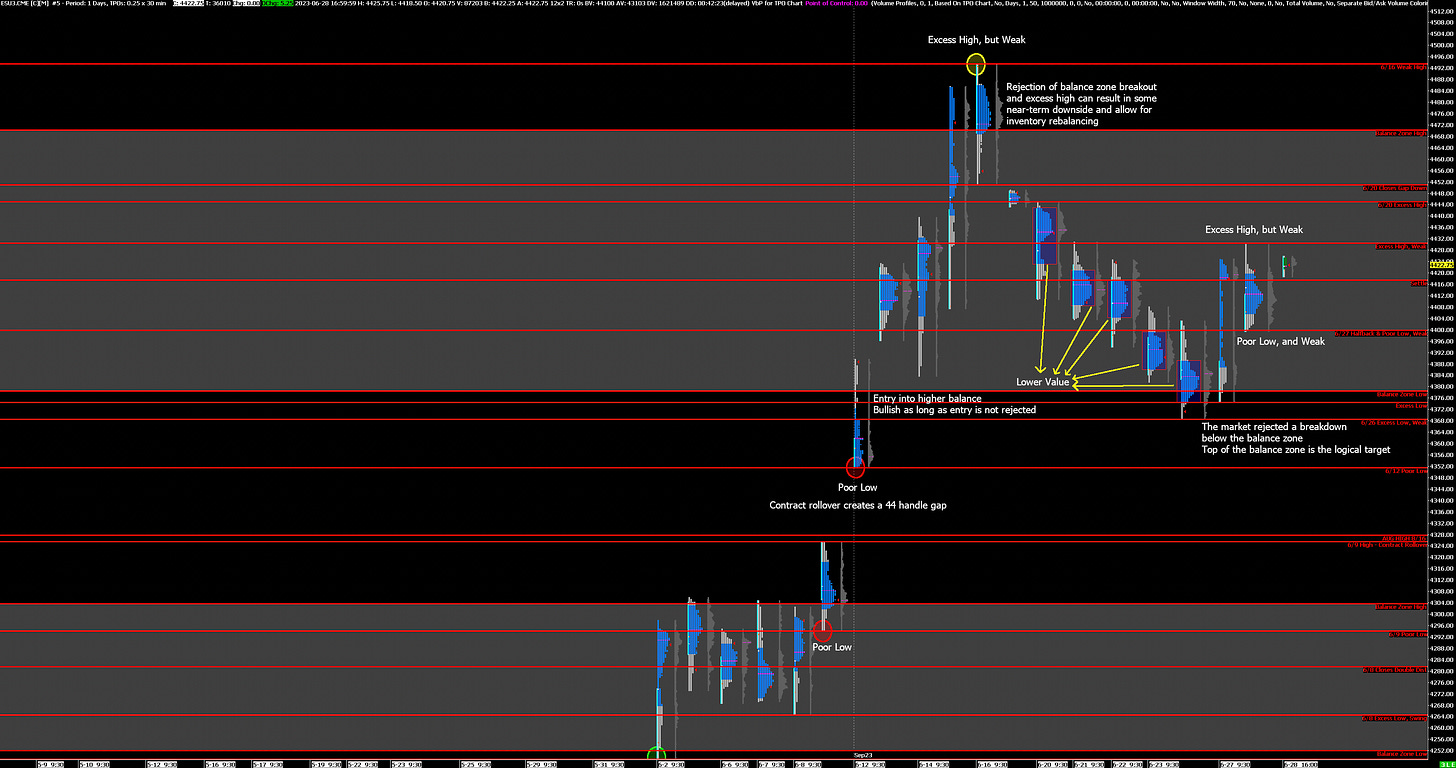

Near-Term Outlook: balanced day, could go either way

Alternate Outlook: N/A

Key Levels

Bullish: 4430 (Weak High), 4451 (Closes 6/20 Gap Down), 4470 (Top of Current Balance Zone)

Bearish: 4400 (Poor Low, Weak Low), 4378 (Bottom of Current Balance Zone), 4368 (6/26 Weak Low)

Market Narrative

Yesterday was a balanced day. As set out in yesterday’s outlook, staying above Tuesday’s halfback would keep the bullish near-term outlook, however, while the market touched that price level twice and rallied, it left a poor low there. On the other hand, while yesterday’s high has decent excess, it’s also weak. As such, today can be treated as short-term balance, with edges at yesterday’s high and low. Balance trading guidelines can be a helpful guide on how to approach the day.

Economic Calendar

2:30am - Fed Chair Powell Speaks

8:30am - Initial Jobless Claims, Q1 GDP Revision

10:00am - Pending Home Sales

Tomorrow: PCE (8:30am)