S&P 500 Daily Perspective for Wed 28 Jun 2023

Bullish following rejected breakdown below balance zone

GDR Model Insights for the S&P 500

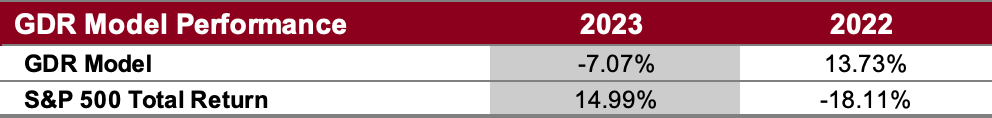

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

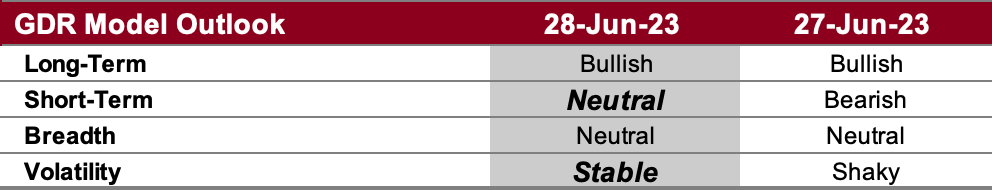

GDR Model Outlook

The GDR Model is now slightly bullish following some recent stabilization.

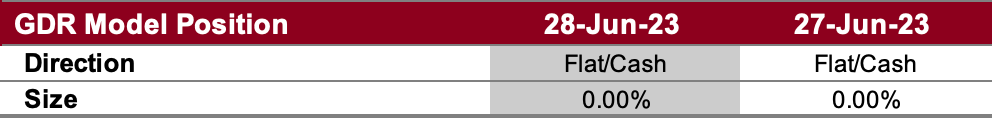

GDR Model Position

The GDR Model closed its long position as the market showed some deterioration last week.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: rejected breakdown below balance zone, bullish

Alternate Outlook: sell-off to repair poor structure from yesteday’s short-covering rally

Key Levels

Bullish: 4425 (Poor High, Weak High), 4451 (Closes 6/20 Gap Down), 4470 (Top of Current Balance Zone)

Bearish: 4400 (Halfback), 4378 (Bottom of Current Balance Zone), 4368 (6/26 Weak Low)

Market Narrative

Yesterday was marked by a short-covering rally following a rejected breakdown below the current balance zone. The market is now bullish with the top of the current balance zone (4378) as the logical target. Staying above yesterday’s halfback would retain the bullish near-term outlook.

Nonetheless, it’s important to note that yesterday’s rally is built on very poor structure, which, if not repaired soon, is definitely something to carry forward. Additionally, keep in mind that Fed Chair Powell has a speech coming up today and another tomorrow overnight. Be prepared for potential additional volatility.

Economic Calendar

8:30am - Retail Inventories

9:30am - Fed Chair Powell Speaks

Next Week: Fed Chair Powell Speaks (Thu), PCE (Fri)