S&P 500 Daily Perspective for Fri 23 Jun 2023

Still bearish but partially stabilizing

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation, but it has flagged some deterioration in the market since the start of this week.

GDR Model Position

The GDR Model has closed its long position as the market has shown some deterioration this week.

S&P 500 Futures Market Profile Analysis

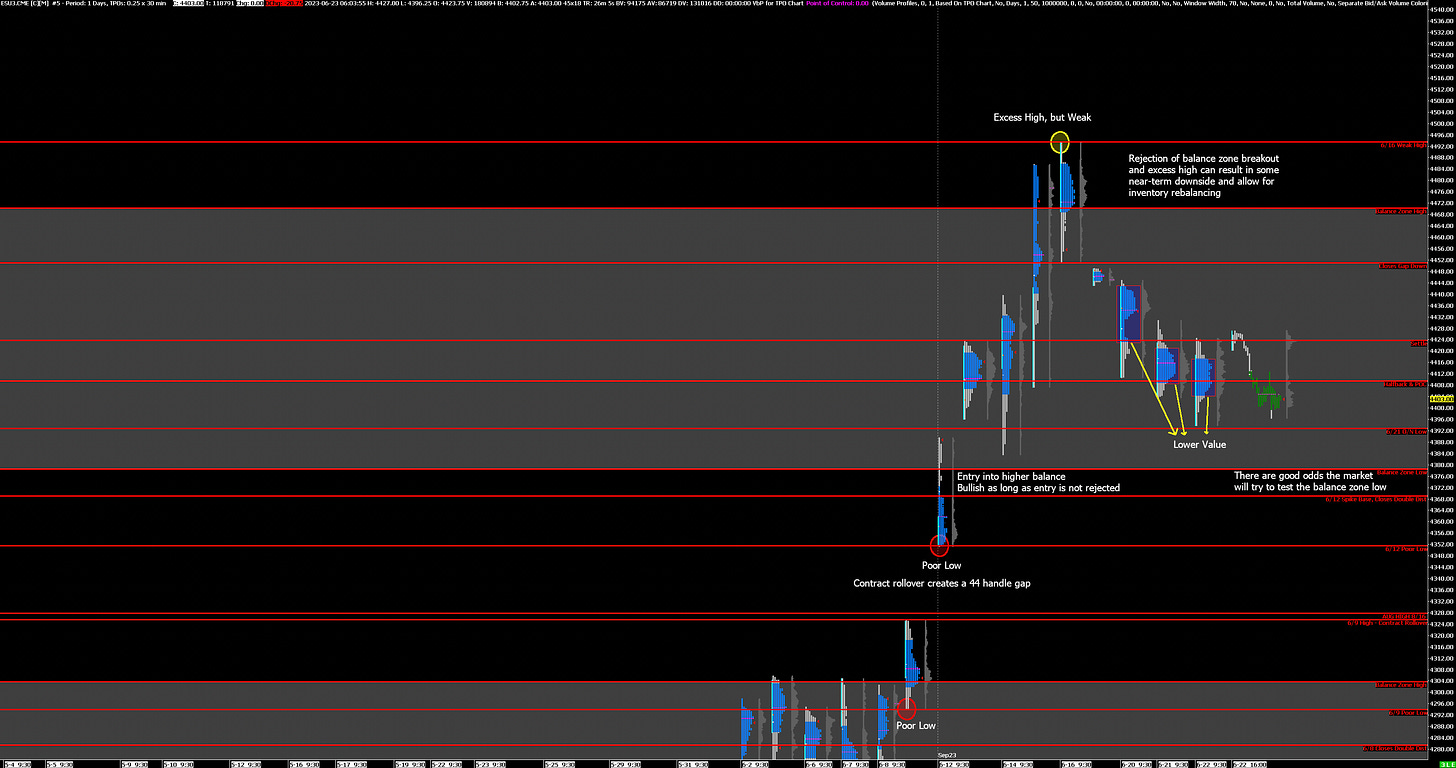

Near-Term Outlook: bearish but stabilizing, likely targetting balance zone low

Alternate Outlook: short-term balance, consolidation

Key Levels

Bullish: 4424 (Y’day Settle Price), 4451 (Closes Gap Down), 4470 (Top of Current Balance Zone)

Bearish: 4392 (Y’day O/N Swing Low), 4378 (Bottom of Current Balance Zone), 4369 (6/12 Spike Base)

Market Narrative

There hasn’t been a material change from Wednesday’s outlook, except the bearish near-term outlook has been further reaffirmed. While yesterday posted a strong close, note that value is overlapping to lower when compared with Wednesday’s value. The base case is still for a test the balance zone low at around 4378.

It seems fairly unlikely that the market might take-off higher again from here so the second most likely outlook is for the market to trade in a short-term balance for some time. Do keep in mind that the Fed Chair’s testimony on monetary policy to Congress beginning today can add volatility to the market.

Economic Calendar

9:45am - Markit Manufacturing and Services PMIs

Next Week: CB Consumer Confidence (Tue), Fed Chair Powell Speaks (Wed???), PCE (Fri)