S&P 500 Daily Perspective for Fri 9 Jun 2023

Still in bullish consolidation with an attempt to breakout likely

GDR Model Insights for the S&P 500

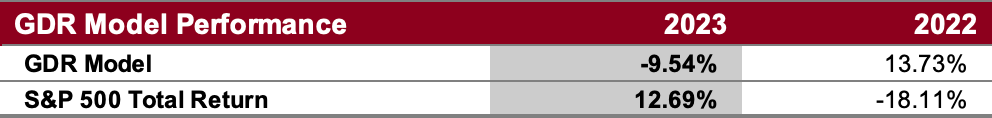

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

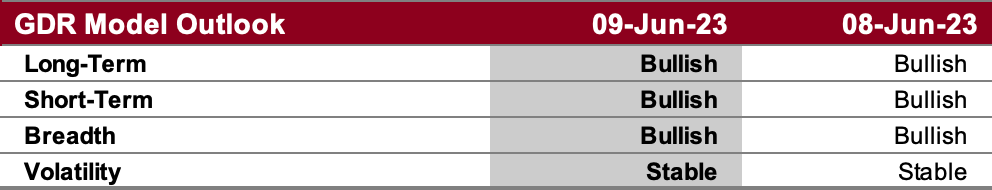

GDR Model Outlook

The GDR Model is now bullish following last week’s breakout from consolidation.

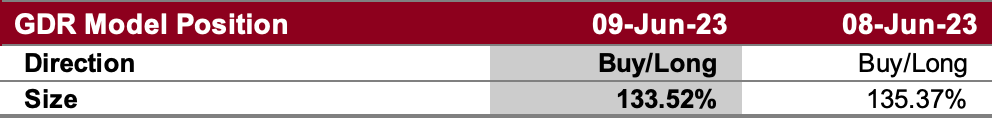

GDR Model Position

The GDR Model has opened a long position following consolidation earlier this week.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: breakout to take out August 2022 high target

Alternate Outlook: failed breakout and revisit of balance zone low

Key Levels

Bullish: 4304 (Top of Current Balance Zone), 4306 (6/5 Poor High), 4328 (August 2022 High)

Bearish: 4282 (Closes Y’Day Double Distribution), 4252 (Bottom of Current Balance Zone), 4240 (Closes 6/2 Gap Up)

Market Narrative

Still not many changes from the outlook set at the start of the week: as expected the market is consolidating a bit after finding resistance at the current balance zone high.

Yesterday left behind an excess low after repairing Wednesday’s poor low. The market now looks set to take a third attempt at breaking out of the current balance zone. When and if that happens, monitoring for continuation will be critical. Do note that next week has a couple of critical economic releases scheduled.

Economic Calendar

Today - none notable

Next Week: CPI (Tue), Fed Interest Rate Decision (Wed), FOMC Press Conference (Wed)