GDR Model Weekly Insights for Tue 3 Jan 2023

Overnight trading currently well above Friday's Spike, but decisive moves unlikely to happen before the FOMC Minutes release tomorrow

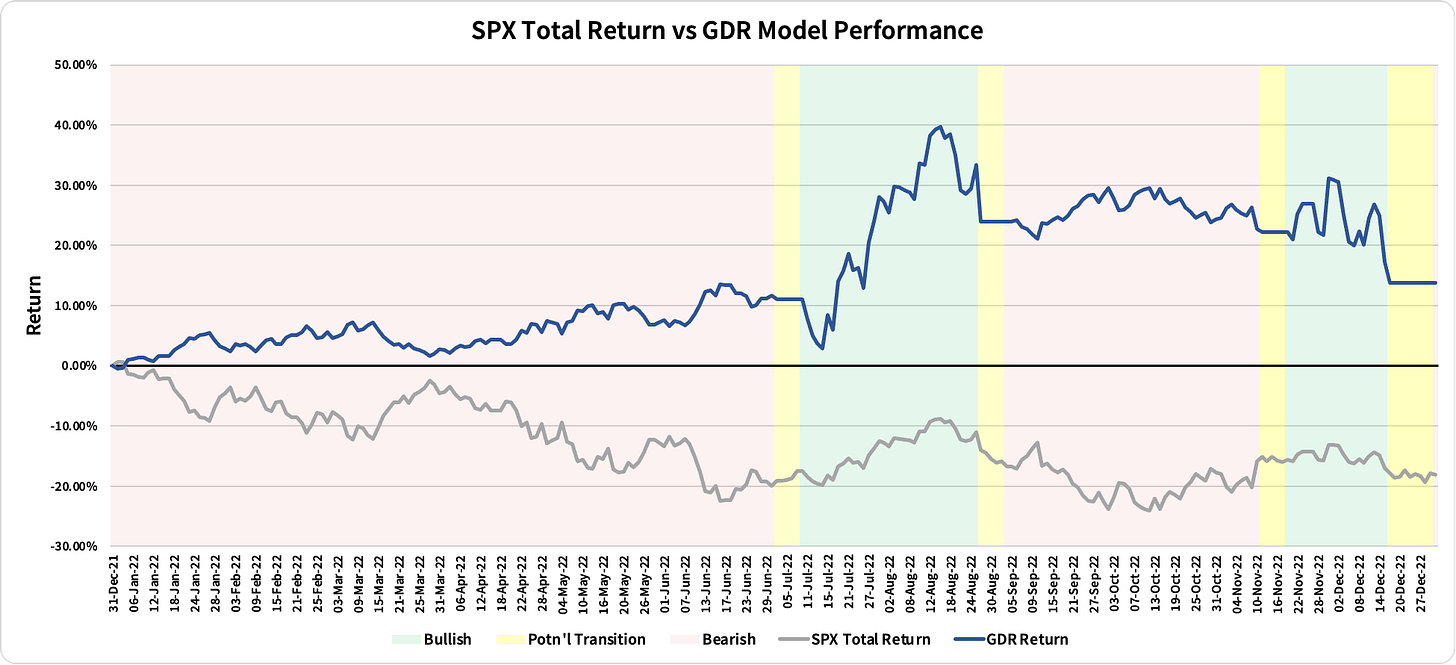

Review: 2022 Performance as of the close of 30 Dec 2022

GDR Model: +13.73%

S&P 500 Total Return: -18.11%

Information Ratio: 2.17

GDR Model Insights for the Week Ahead

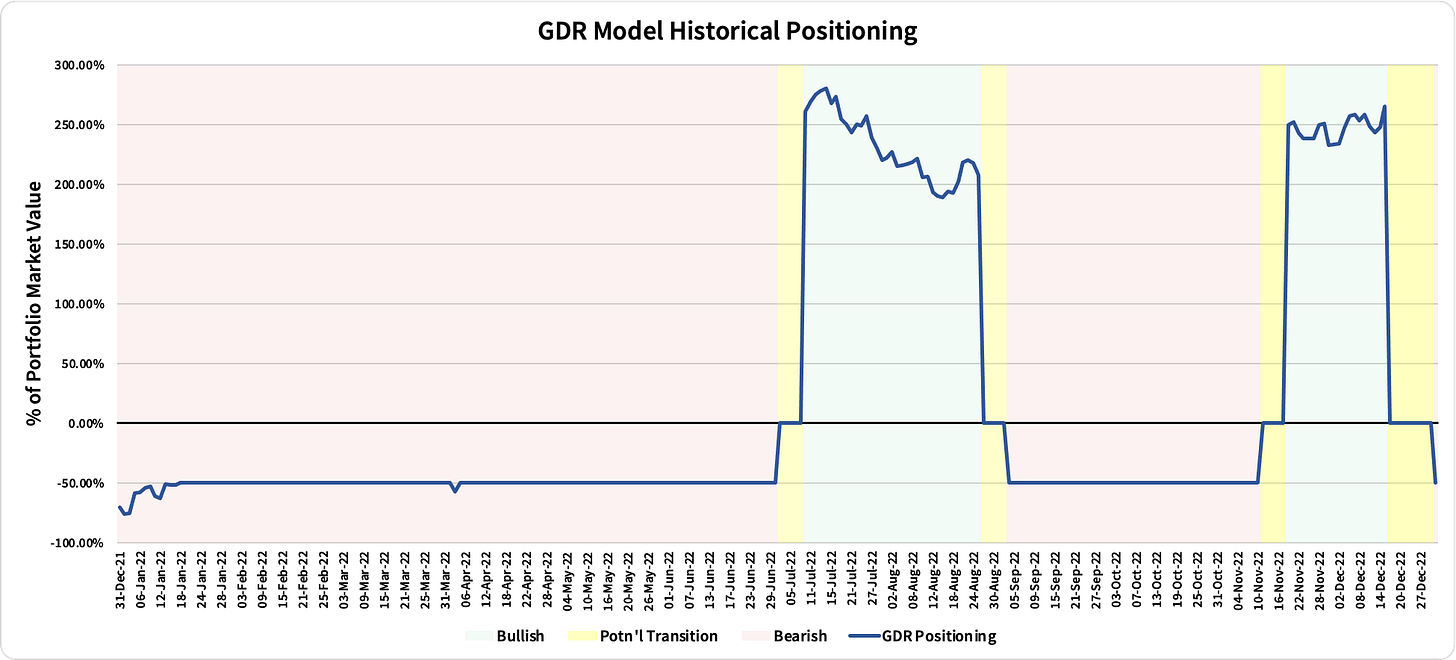

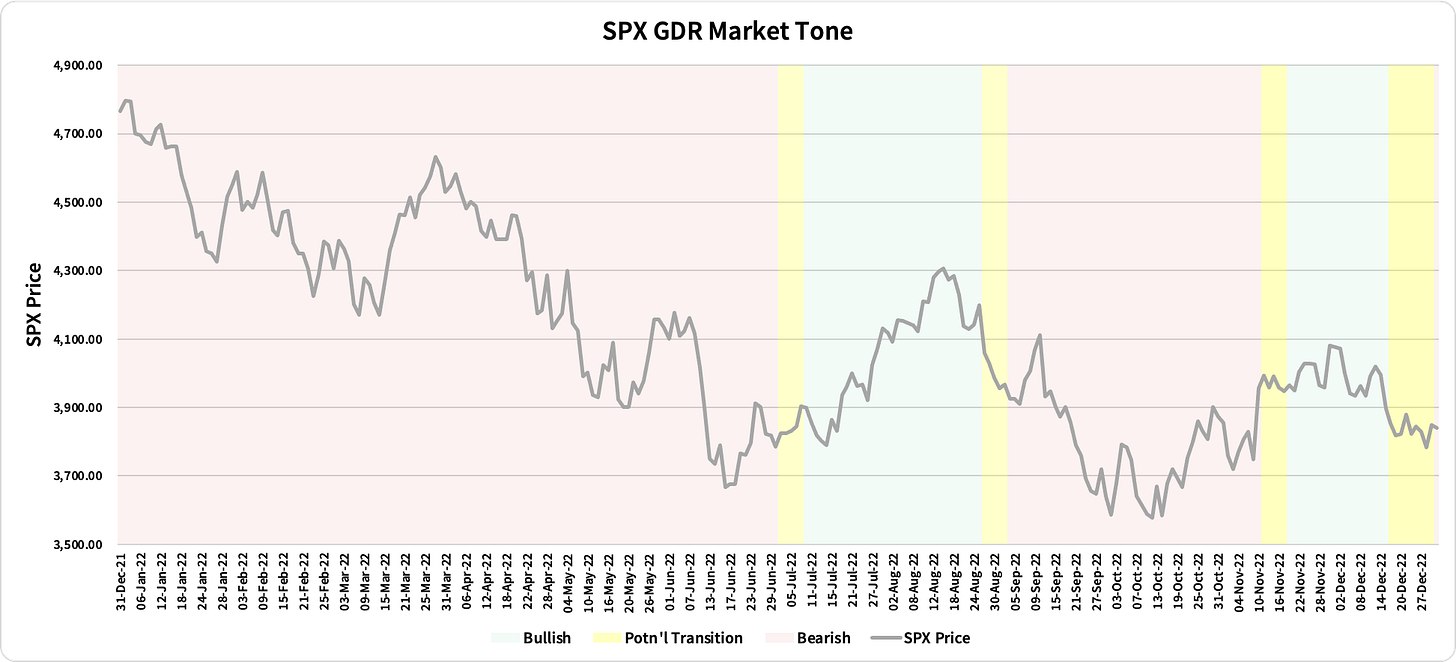

Market Tone: Bearish (previous week: Transition)

Positioning: -50.00% Short (previous day: 0.00% Flat)

Commentary: GDR returned to Bearish mode last week, the crucial releases this week can easily rock the boat and see a return back to Transition or have the Bearish idea reaffirmed.

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: At the Edge of Balance, Spike Rules

In a sense, going into today we are at a near inverse of where we were going into last Thursday 12/29, but instead of a Spike Lower to the lower Edge of Balance, today we have a Spike Higher and the ES is now trading at the top Edge of Balance.

Currently the market is trading well above Friday’s Spike, which is Bullish, though that can easily change before the open. For practical purposes, the Spike itself can be treated as a form of Balance. In other words, accepting above the Spike is Bullish, while returning below the Spike and accepting those levels is Bearish.

Be mindful that the ES may reject the upper bounds of the current large Balance Zone (gray rectangle) yet again. Should that happen the logical targets are the middle and lower end of Balance. One noteworthy aspect of today’s trading so far is that the Overnight Low sits at a very mechanical level, right on top of Friday’s Halfback.

Finally, despite the lower liquidity usually seen in the first week of the calendary year, there is potential for higher volatility given the key Fed and Employment Data releases coming up. Trade carefully.

Potential Market-Moving Events

Today 09:45am - Manufacturing PMI

Later this Week: JOLTs Job Openings (Wed), FOMC Meeting Minutes (Wed), Nonfarm Payrolls (Fri)