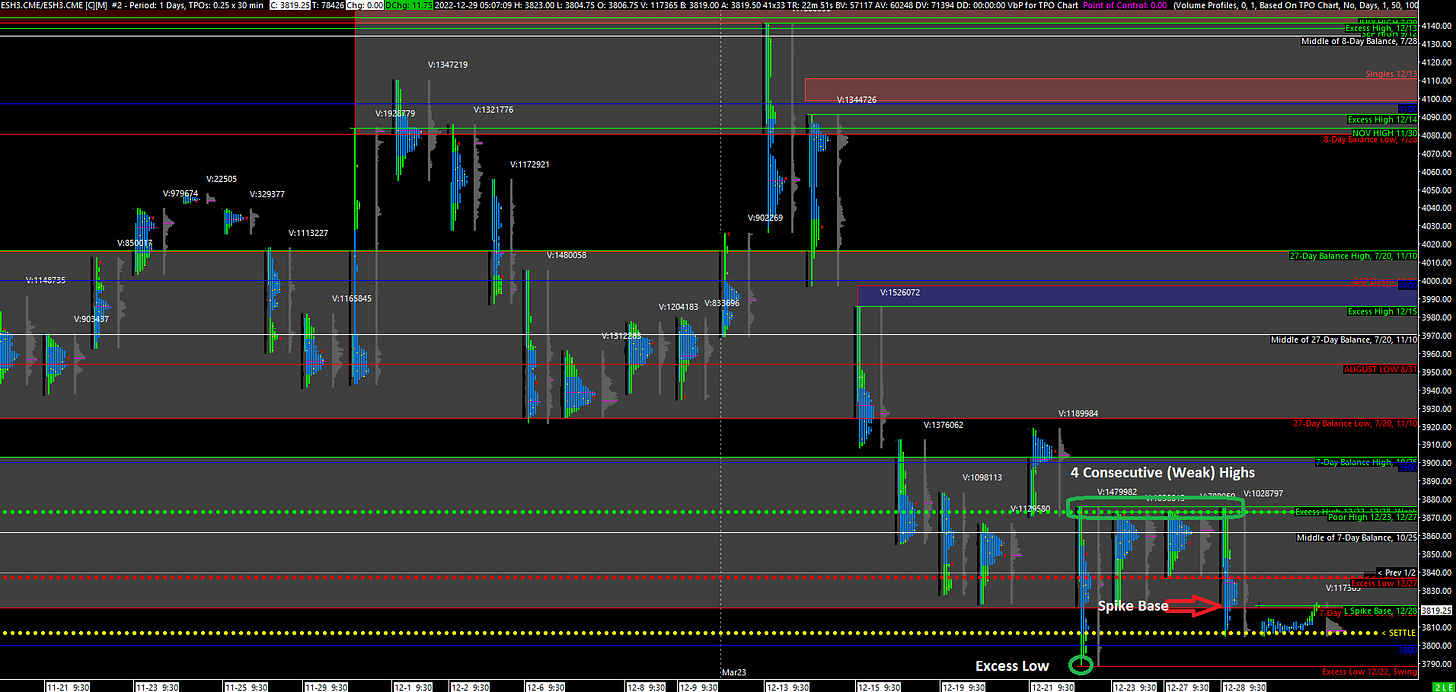

S&P 500 Futures Daily Insights for Thu 29 Dec 2022

Spike Rules apply today and coincide with a potential breakdown from recent Balance Zone

GDR Model Insights for the Current Week

GDR Model Performance (2022): +13.73%

S&P 500 Total Return (2022): -19.33%

Market Tone: Transition (previous week: Potential Transition to Bearish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: At the Edge of Balance, Spike Rules

Yesterday is a good remainder that in trading we can only speak in odds and probabilities. Despite slightly taking out the previous Poor Highs, the ES then sold off all the way to the Edge of Balance and ended the day on a small Spike lower outside of Balance. Not much has changed in the last two days: the 4 consecutive Highs at the same level imply weak-hands momentum traders hitting bids at that specific level. Highs (or Lows) made in this manner don’t tend to last too long.

Because the market closed on a Spike Lower yesterday, Spike Rules apply today. Specifically:

if the market opens below the Spike (3804.50) and accepts then it’s the most Bearish outcome

if the market opens inside the Spike (between 3804.50 and 3821.75) then it shows acceptance of these lower prices and you can treat the Spike as a small Balance Area

if the market opens above the Spike (3821.75) and accepts then it shows rejection of lower prices and you can treat yesterday’s Low as having Excess

On a final note, it’s worth mentioning that lower market participation this week probably gives the weaker-hands traders mentioned above more leeway to trade at exacting levels and be successful. At this point, that’s probably a key reason why the 4 consecutive recent Highs have yet to be taken out.

Potential Market-Moving Events Today

08:30am - Initial Jobless Claims