S&P 500 Futures Daily Insights for Wed 7 Dec 2022

Despite the selloff, GDR was much less Bearish today. Market Structure is also looking more Bullish now

GDR Model Insights for the Current Week

GDR Model Performance (2022): +20.61%

Market Tone: Bullish (previous week: Bullish)

Positioning: +257.44% Long (previous day: +247.22% Long)

Commentary: GDR was less Bearish today compared with yesterday, but still undergoing a test of the longer-term Bullish idea. Again a reminder that GDR is price blind - the S&P can have a 1-2% down day while at the same time GDR flags a more Bullish market (and vice versa). Take this as a sign that the bigger players that have the size to move the market didn’t agree with today’s drop lower, and remember that it usually pays better to trade on the same side as size.

S&P 500 Futures Market Profile Insights for Tomorrow

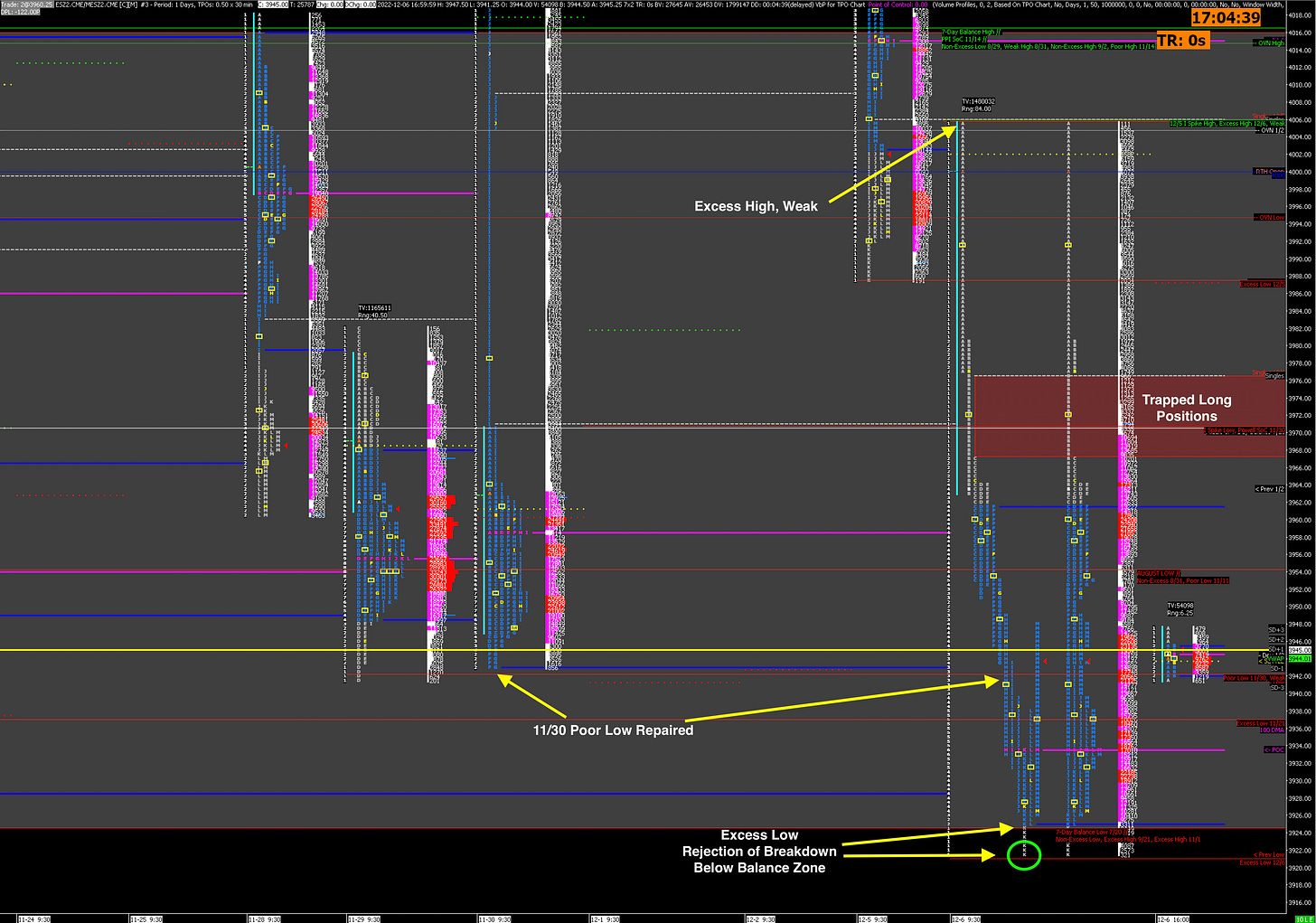

Today was a definitive trend day down, however it was dominated by emotional trading and left poor structure above. Here is the breakdown of why today makes the market more Bullish:

Today’s High has Excess, and while that is undeniably a proper High, it was made at an exacting level, specifically at the high of yesterday’s Spike Lower at the end of the day. This suggests the presence of weak-hands momentum sellers from the start

There is a decent Trapped Long Position soon after

The Poor Low from 11/30 that I flagged repeatedly as logical target was repaired. See here, here, here and here

The market put in an Excess Low today that rejects a breakdown under the current Balance Zone

Today’s close was within value after some day trader short-covering

There is no guarantee that the market turns Bullish from here, but on a multi-day time frame Balance Rules apply, specifically 1) go with a break out of Balance, and 2) fade a failure to break out of Balance. Today we had the latter. Acceptance within the current Balance Zone should prove markedly more Bullish than Bearish.

Do keep in mind however, that we do have four consecutive Excess Highs now - a good reality check that, as favorable as odds may be, there are never certainties in trading.

Potential Market-Moving Events Tomorrow

08:30am - Nonfarm Productivity, Unit Labor Costs