S&P 500 Futures Daily Insights for Thu 1 Dec 2022

GDR Model had noted yesterday has strongly Bullish, but beware of strong upward moves dominated by short covering

GDR Model Insights for the Current Week

GDR Model Performance (2022): +31.14%

Market Tone: Bullish (previous week: Bullish)

Positioning: +232.86% Long (previous day: +250.90% Long)

Commentary: GDR Model flagged a strongly Bullish day yesterday and today was a natural continuation of it given the myriad market moving events. GDR continues in a strong Bullish mode.

S&P 500 Futures Market Profile Insights for Tomorrow

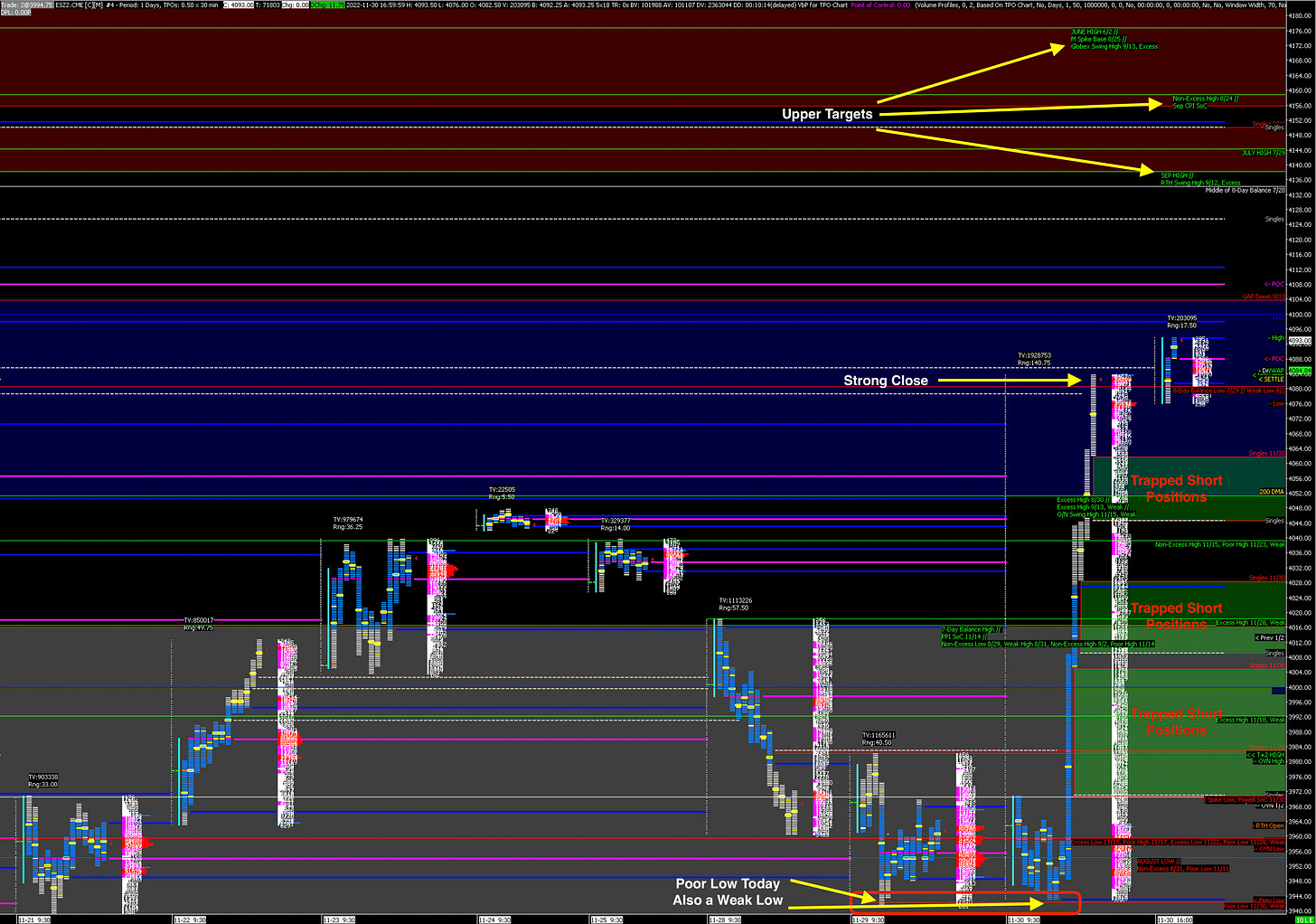

As highlighted in yesterday’s update, Balance Rules applied going into today - we had a strong breakout from Balance and out of the previous Balance Zone. The ES also closed most of the Gap Down from 9/13 as it entered a previous Balance Zone I had noted from late July/early August.

Currently it seems as though the ES is intent on targeting the 4180 area, which would repair plenty of poor structure from the late August sell-off. Nonetheless, 4140 seems like a logical spot for some resistance as it coincides with the July and September Highs, as well as the middle of the late July Balance Zone.

Today the market left behind a Poor Low, which drastically increases the odds that the market will revisit that level. At this point it seems unlikely that the ES might head back down imminently as the very large Trapped Short positions below will likely provide responsive buying. However, keep in mind that today was most likely dominated by short covering which weakens the market. Once demand from short covering dries the market all but inevitably must revisit lower levels.

Potential Market-Moving Events Tomorrow

08:30am - PCE Price Index, Initial Jobless Claims, Personal Spending

09:30am - FOMC Member Bowman Speaks

09:45am - Manufacturing PMI

10:00am - ISM Manufacturing PMI, ISM Manufacturing Employment