S&P 500 Futures Daily Insights for Wed 4 Jan 2023

With Employment data and FOMC Minutes coming out, today has the potential to finally break the current Balance Zone

GDR Model Insights for the Current Week

GDR Model Performance (2023): +0.20%

S&P 500 Total Return (2023): -0.40%

Market Tone: Bearish (previous week: Transition)

Positioning: -50.00% Short (previous day: -50.00% Short)

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Balance Rules, slightly Bullish but could go either way

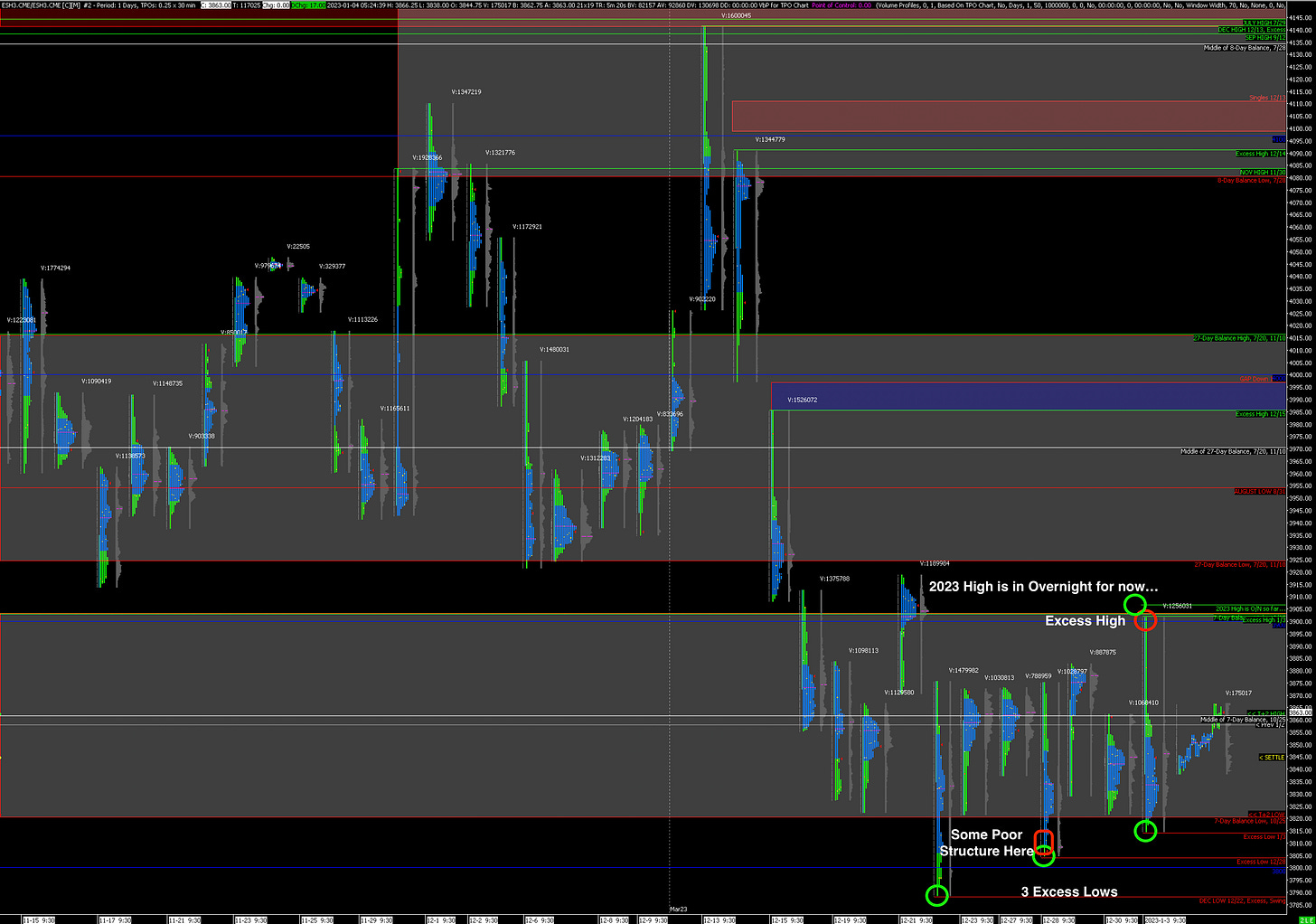

Yesterday’s trading tested the top of the current Balance Zone both in the Overnight session and in Regular Trading. The market failed to breakout above it and sold off strongly in the opposite direction leaving an Excess High. However, the ES wasn’t able break down below the Balance Zone, leaving behind an Excess Low.

In the current overnight session we are now back in the middle of the Balance Zone. Given the Employment data to be released at 8.30am and the Fed Minutes at 2pm, it’s probably generally wise to not be hasty about taking trades. Having said that, I lean slightly Bullish because:

there are 3 almost consecutive Excess Lows, and

typically after testing the edge of a Balance Zone and failing to break it, the next logical targets are the middle (already hit) and the opposite edge of that same Balance Zone

Potential Market-Moving Events Today

10:00am - JOLTs Job Openings, ISM Manufacturing PMI

02:00pm - FOMC Meeting Minutes