S&P 500 Futures Daily Insights for Wed 14 Dec 2022

GDR is firmly Bullish going into FOMC day. Market Profile also looks more Bullish after today despite the ~115pt Gap fill

GDR Model Insights for the Current Week

GDR Model Performance (2022): +26.78%

Market Tone: Bullish (previous week: Bullish)

Positioning: +243.52% Long (previous day: +248.69% Long)

Commentary: GDR is back in firmly Bullish mode. The response to tomorrow’s FOMC day remains critical

S&P 500 Futures Market Profile Insights for Tomorrow

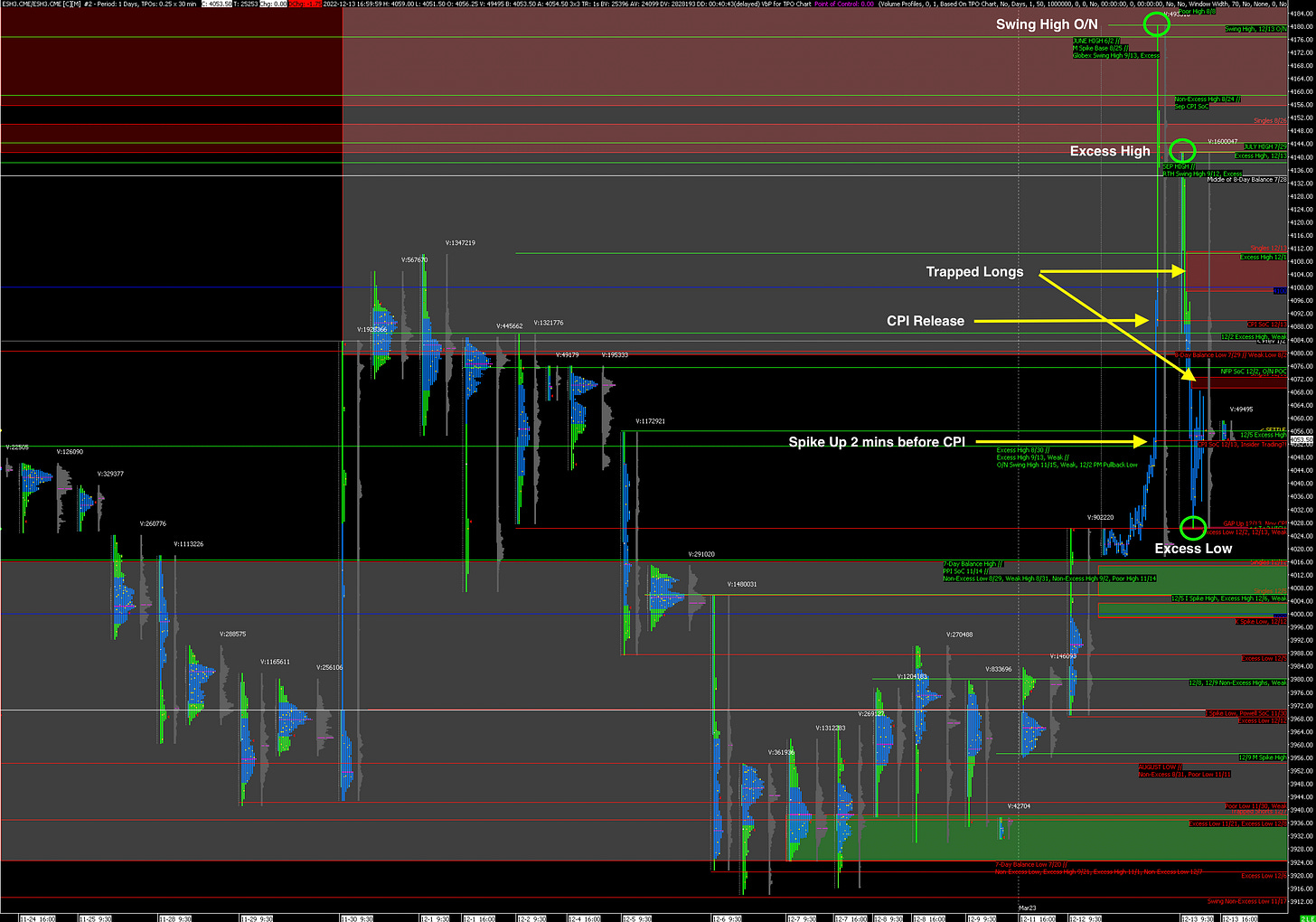

ES futures opened the regular traind session on a gigantic ~115pt Gap Up, which was then entirely filled but for a tick. Most may see this as Bearish, but from a Market Profile perspective I would argue that today was quite Bullish for the (relatively) longer-term. Gaps are considered to be poor structure and need repair; they lower the odds of sustained upside. However, today the market filled the Gap but did not re-enter yesterday’s range. In other words, the ES repaired poor structure that would have decreased the odds of further upside, while rejecting previous lower prices.

Tomorrow is undoubtedly another day for cautious trading given the FOMC release, but as far as Market Profile goes the S&P looks more Bullish than Bearish at this point.

Potential Market-Moving Events Tomorrow

08:30am - Import and Export Prices

02:00pm - Fed Interest Rate Decision

02:30pm - FOMC Press Conference