S&P 500 Futures Daily Insights for Wed 22 Mar 2023

Potential for Over Long Inventories may cause Fed Day Liquidation

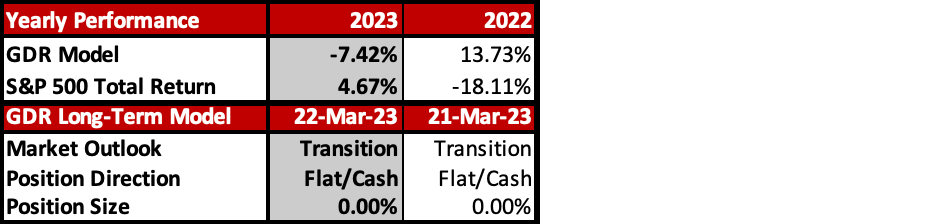

GDR Model Insights for the Current Week

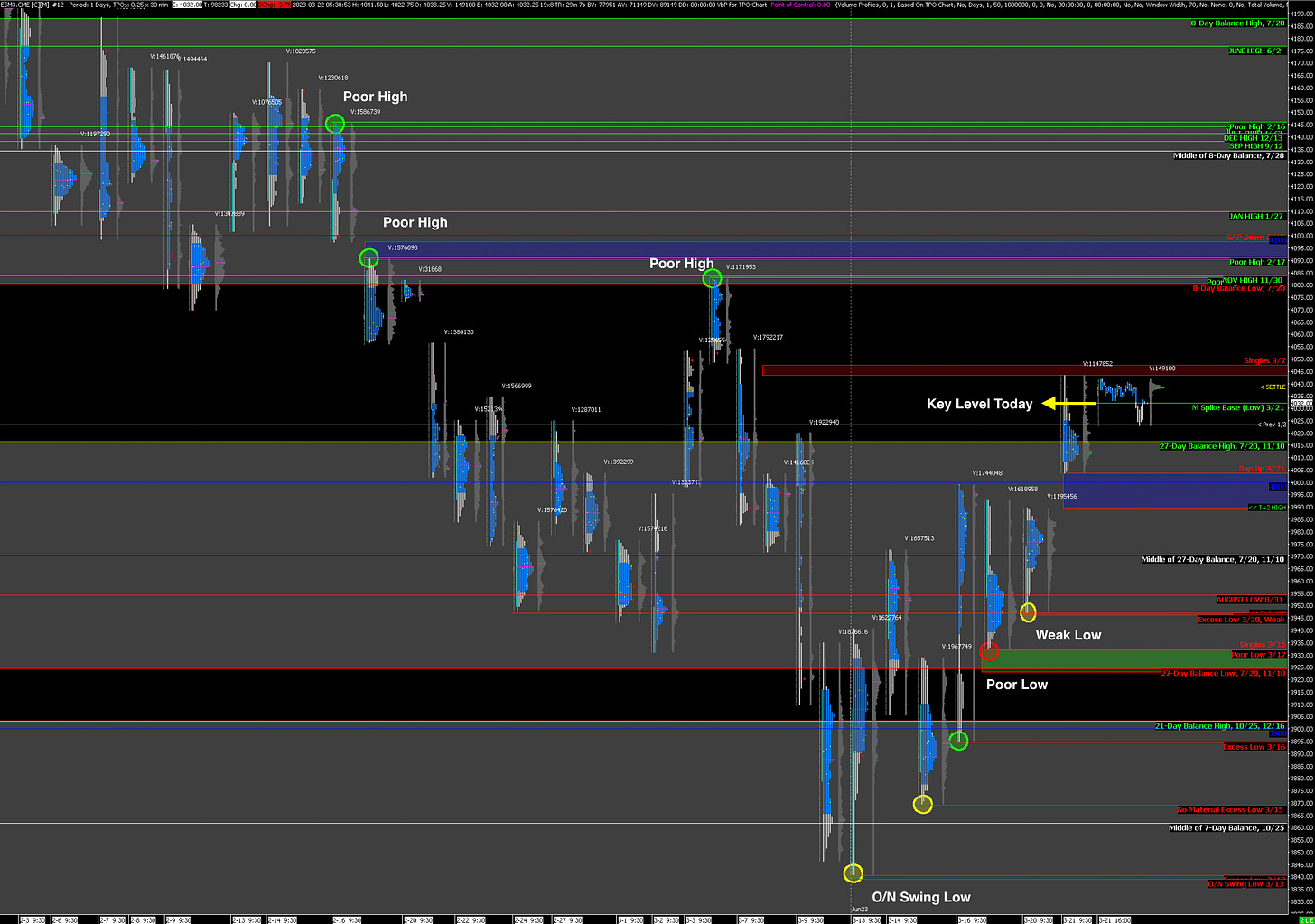

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish as Value Builds Higher with Poor Structure Above

Counterpoint: FOMC Liquidation on Overly Long Short-Term Inventories

Yesterday opened on a Gap Up that was only partially filled allowing short-term traders to push the market higher ending the day on a spike. As such, Spike Rules apply on RTH open today where the range inside the Spike serves as a small short-term Balance.

Keep in mind that the FOMC will anounce its interest rate decision today. This comes on the back of plenty of uncertainty in which the Fed finds itself squeezed between continuing to fight inflation or avoiding more damage to the financial sector. As of this morning, Fed Funds futures put the probability of a 25 basis point hike at 89%. There is a chance that short-term Inventories in the ES have gotten too long and regardless of what the Fed announces a liquidation may ensue. This implies that long positions carry outsized risk going into today.

Finally here are the key levels for today:

Bullish: 4044 (Y’day and Spike High), 4083 (Poor High), 4098 (closes Gap Down)

Bearish: 4032 (Spike Base), 4016 (Top of Balance Zone), 3989 (closes Gap Up)

Potential Market-Moving Events Today

2:00pm - Fed Interest Rate Decision

2:30pm - FOMC Press Conference