S&P 500 Futures Daily Insights for Tue 4 Apr 2023

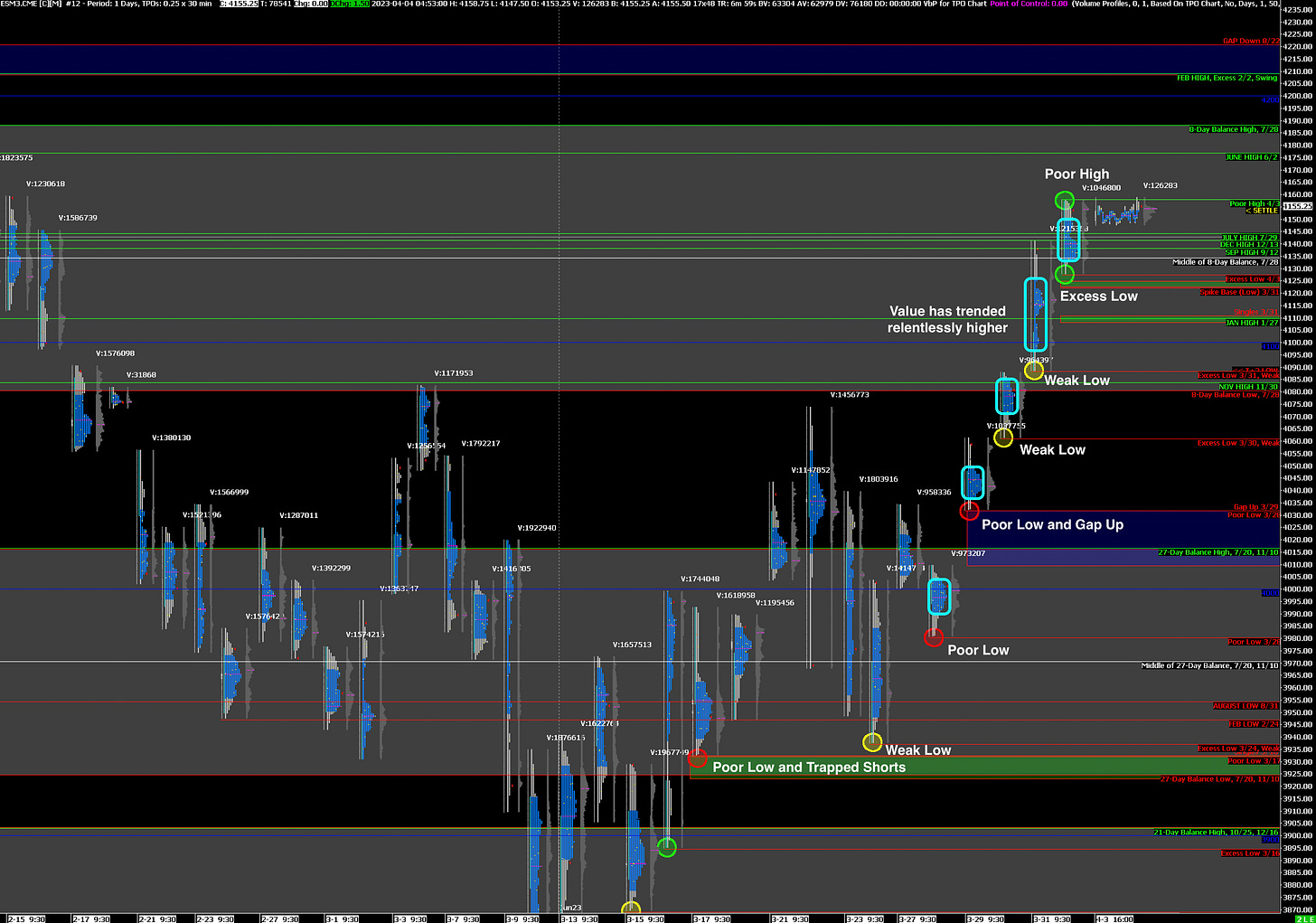

Some Liquidation yesterday but no sign of serious Selling. Value continues to build higher for now

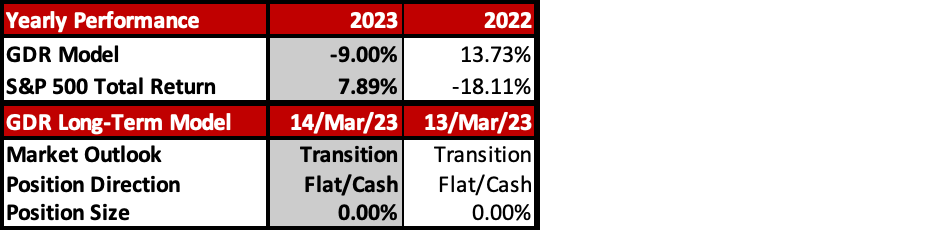

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish as Value Continues to Build Higher

Alternate Outlook: Overly Long Inventories keep increasing the odds of at least a Liquidation Break

Key Levels for Today:

Bullish: 4158 (Poor High), 4188 (Balance Zone High), 4221 (Closes Gap Down)

Bearish: 4128 (Y’day Excess Low), 4088 (Friday Weak Low), 4061 (Weak Low)

Welcome to the latest instalment of “Short-Term Inventories Are Too Damn Long”. There was some Liquidation yesterday, but not nearly enough for a meaningful Inventory correction. Moreover, the Poor High for the day suggests that short-term Longs are beginning to get nervous. More importantly though, the implication of the Poor High is the same: there has been no serious selling.

Judging from Value developing clearly higher for 5 days in a row now, the market is clearly Bullish. More upside is the base case, but remain aware of the high potential for meaningful Liquidation in the near-term.

Potential Market-Moving Events Today

10:00am - JOLTs Job Openings, Factory Orders

1:30pm - FOMC Member Rosengren Speaks