S&P 500 Futures Daily Insights for Thu 15 Dec 2022

Another test of the GDR Bullish idea. Market Profile remains more Bullish than Bearish

GDR Model Insights for the Current Week

GDR Model Performance (2022): +24.92%

Market Tone: Bullish (previous week: Bullish)

Positioning: +247.84% Long (previous day: +243.52% Long)

Commentary: Today closed with yet another test of the Bullish idea, however, the Bearishness wasn’t overwhelming. From developing/using this model over the last few years, I would expect the current Bullish Market Tone to continue beyond this week, but as always a single day can make all the difference

S&P 500 Futures Market Profile Insights for Tomorrow

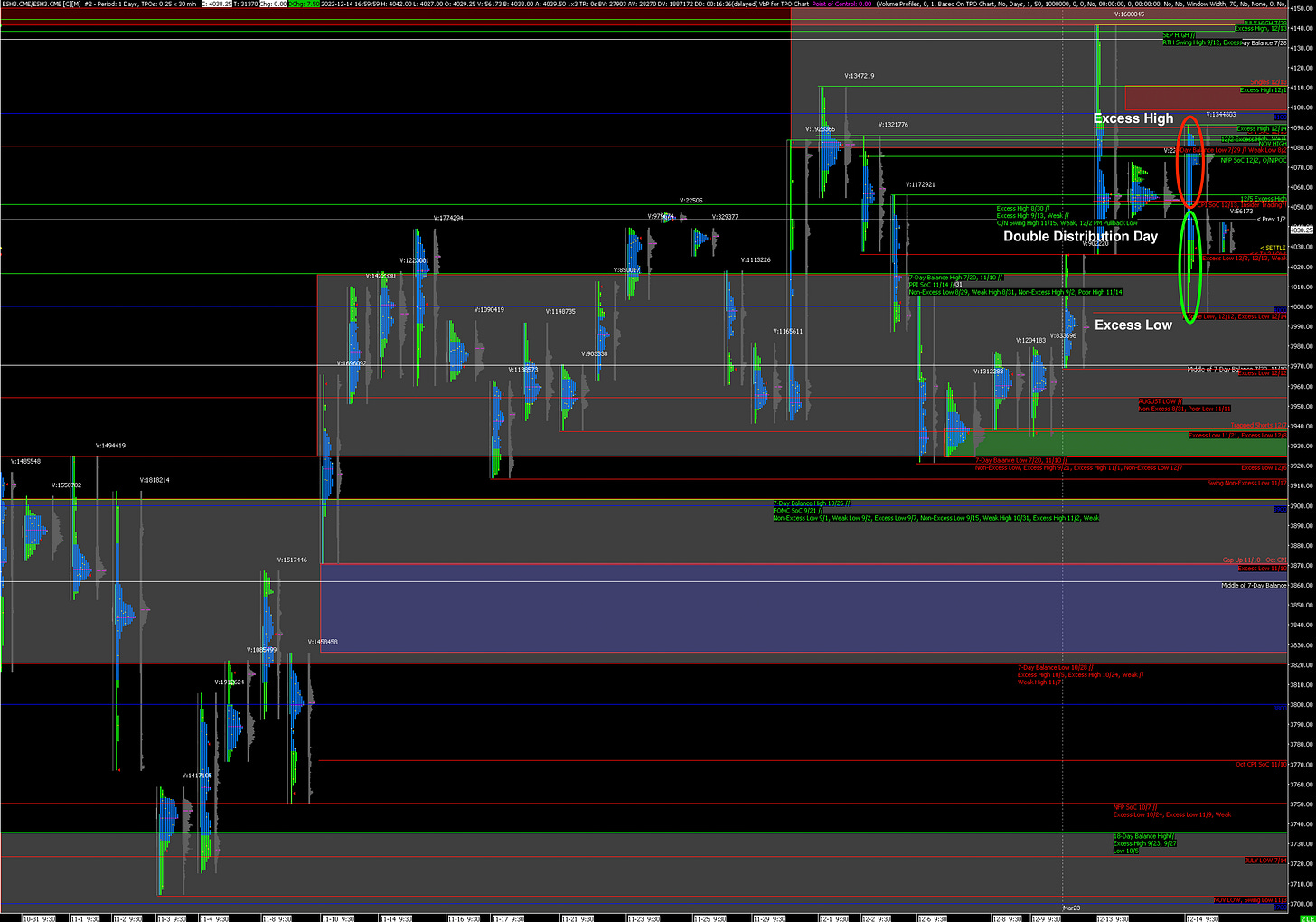

Today the ES put in an Excess High and an Excess Low on either side of what turned out to be a Double Distribution day. In the process, the market has repaired all the poor structure below put in during the CPI rally earlier this week.

Double Distribution days are best treated as distinct, specifically for today the pre-FOMC part of the trading session can be treated as a separate day from post-FOMC. While the ES futures closing below the Value Area would ordinarily be seen as weak, given the nature of Double Distributions, for now I will regard the last couple of days as a liquidation break within a longer Bullish trend.

For me to change my mind and turn more Neutral/Bearish, the SPX would have to return to the Balance Zone below (which was rejected today) and find acceptance within it.

Potential Market-Moving Events Tomorrow

08:30am - Initial Jobless Claims, Retail Sales, Philadelphia Fed Manufacturing Index, Empire State Manufacturing Index

09:15am - Industrial Production

10:00am - Business Inventories