S&P 500 Futures Daily Insights for Wed 16 Nov 2022

GDR Model is on course to turn Bullish at the end of the week, but poor market structure below remains

GDR Model Insights for the Current Week

GDR Model Performance (2022): +22.21%

Market Tone: Potential Transition to Bullish (previous week: Bearish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

Commentary: yesterday’s test of GDR’s Bullish idea was successful today. GDR Model continues on course to turn Bullish at the end of this week.

S&P 500 Market Structure Insights for Tomorrow

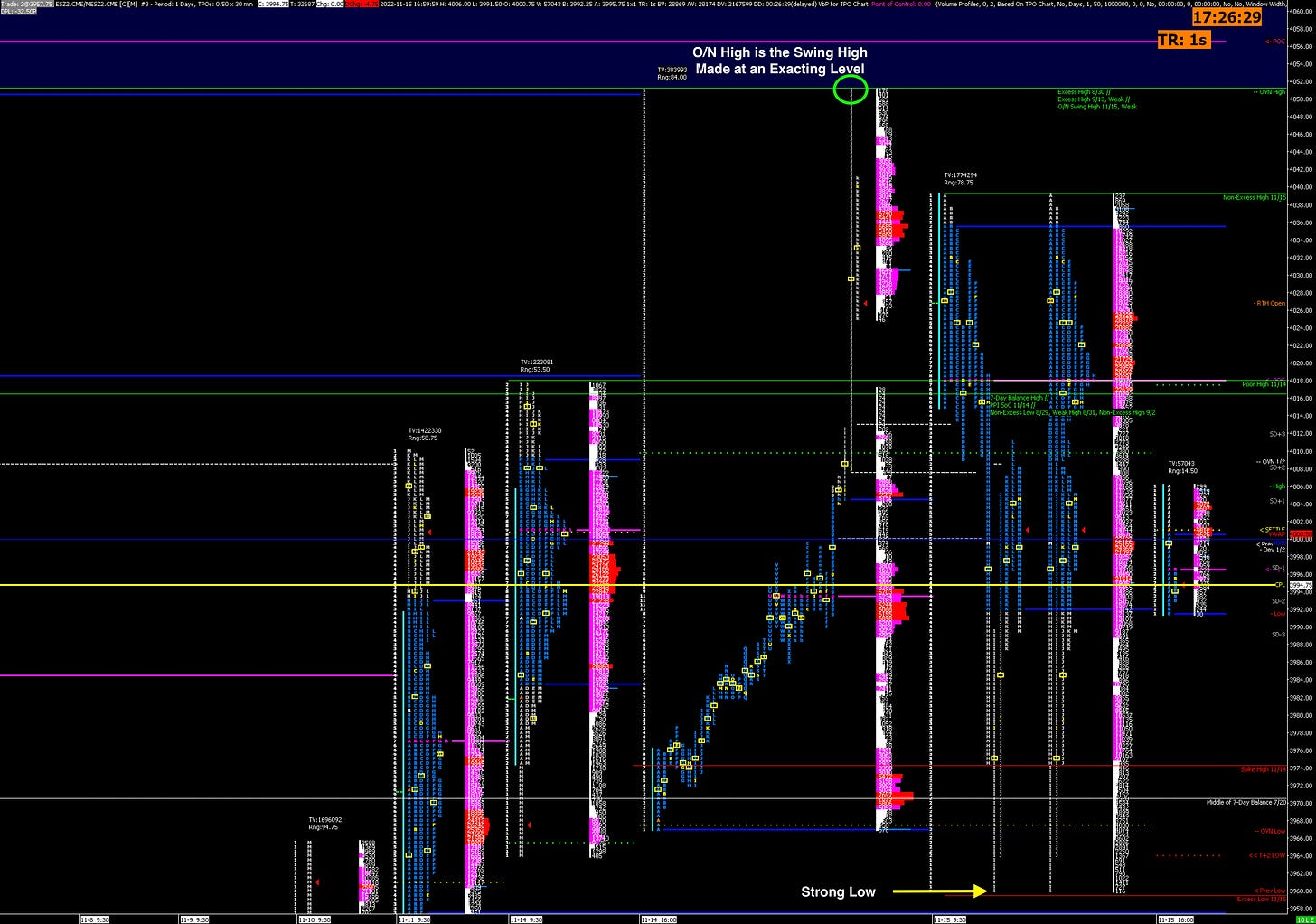

Following the PPI data release this morning, the S&P 500 rallied all the way up to the bottom of a previous Gap down to the tick before selling off. In addition to the exacting level where today’s selloff started, the current swing high is now made in the overnight session. These typically don’t last long - we had a similar situation happen recently where the prevailing swing high was also in the overnight.

The early afternoon sell-off following reports of a Russian missile hitting Poland provided an opportunity for overly long inventories to correct a little bit. Liquidation breaks like this tend to strengthen the market - i.e. they have the opposite effect of short covering. Nevertheless, market structure below remains poor and will likely need repair. The 3950 and 3935 look like good short-term targets should we find more selling in the coming days.

Potential Market-Moving Events Tomorrow

08:30am - Retail Sales, Import and Export Prices

09:15am - Industrial Production

09:50am - FOMC Member Williams Speaks

10:00am - Business Inventories, Retail Inventories

02:35pm - Fed Member Waller Speaks