S&P 500 Futures Daily Insights for Wed 1 Mar 2023

Looking for the bid as Poor Structure continues to add upward pressure

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Looking for the Bid

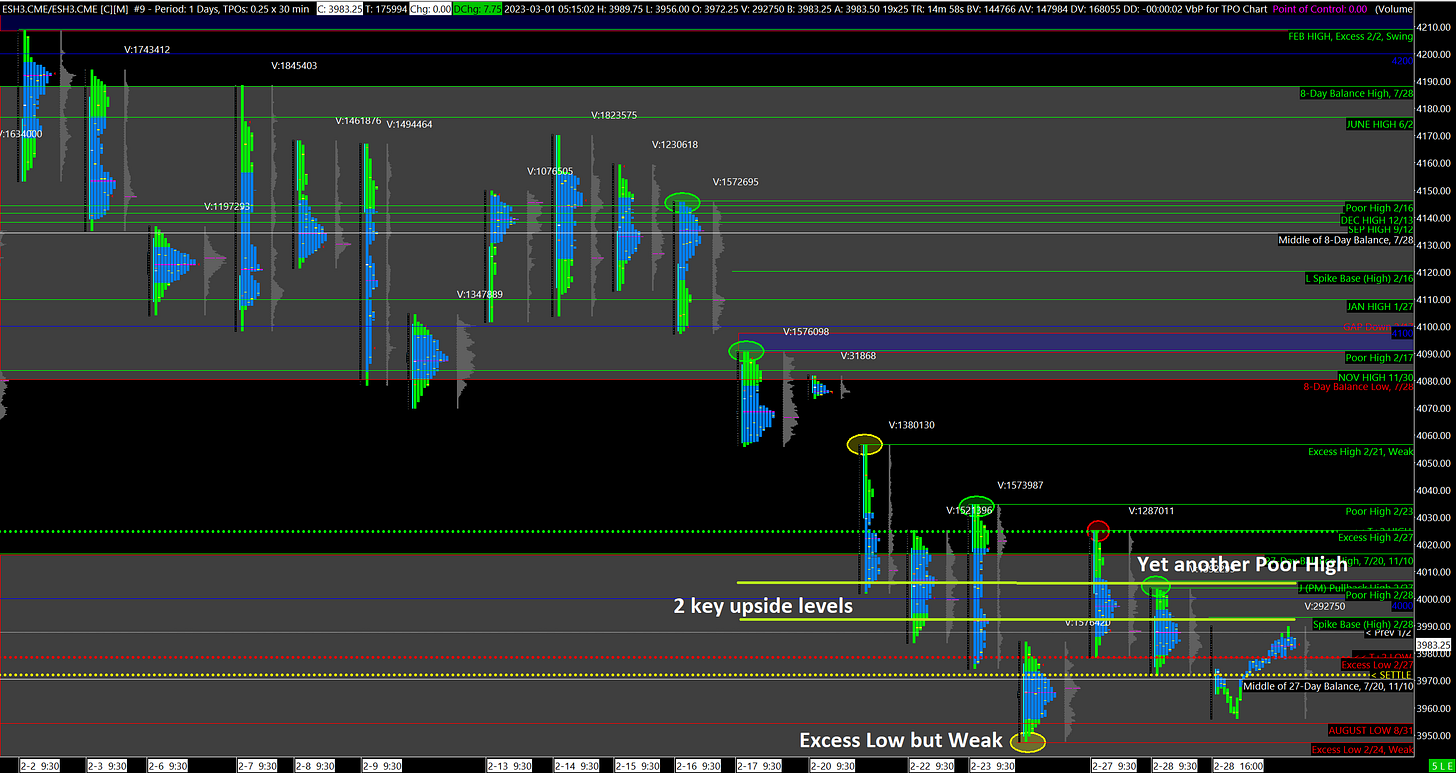

Yesterday was another trading day dominated by momentum traders that ended on a small Spike Lower and left behind yet another Poor High. Therefore the outlook remains identical as before: there is Poor Structure above all the way to the 4150 area, but the market must find the bid before repairing that structure.

Specifically, the Poor Structure above is indicate of short-term momentum traders dominating the market, who tend to be fickle in retaining positions. To repair that Structure, at least 1 of 2 things must happen:

Prices advertize low enough to attract longer-term money buying, and/or

The inventories for the same short-term traders who have been shorting the market down becomes too short and they are forced to cover their positions for risk management reasons

Without at least one of the above happening, the string of Poor and Weak Highs above is likely to remain. The most likely evidence for #1 is consecutive Excess Lows at seemingly random levels. #1 is sunstainable Bullish activity. The evidence for #2 is a frantic increase in ES prices that leave behind Gaps, and Trapped Short positions. #2 weakens the market.

Potential Market-Moving Events Today

09:45am - Markit Manufacturing PMI

10:00am - ISM Manufacturing PMI