S&P 500 Futures Daily Insights for Thu 6 Apr 2023

Some more Inventory correction yesterday, but still no participation of serious money

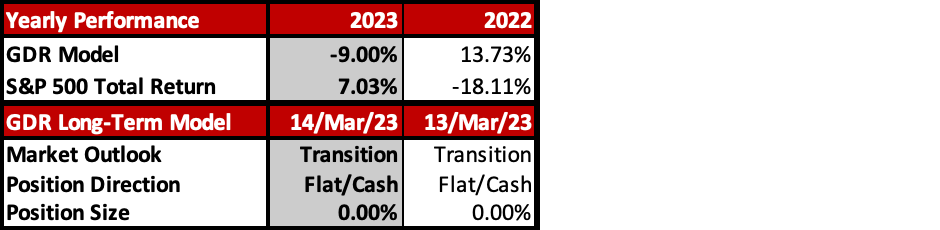

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

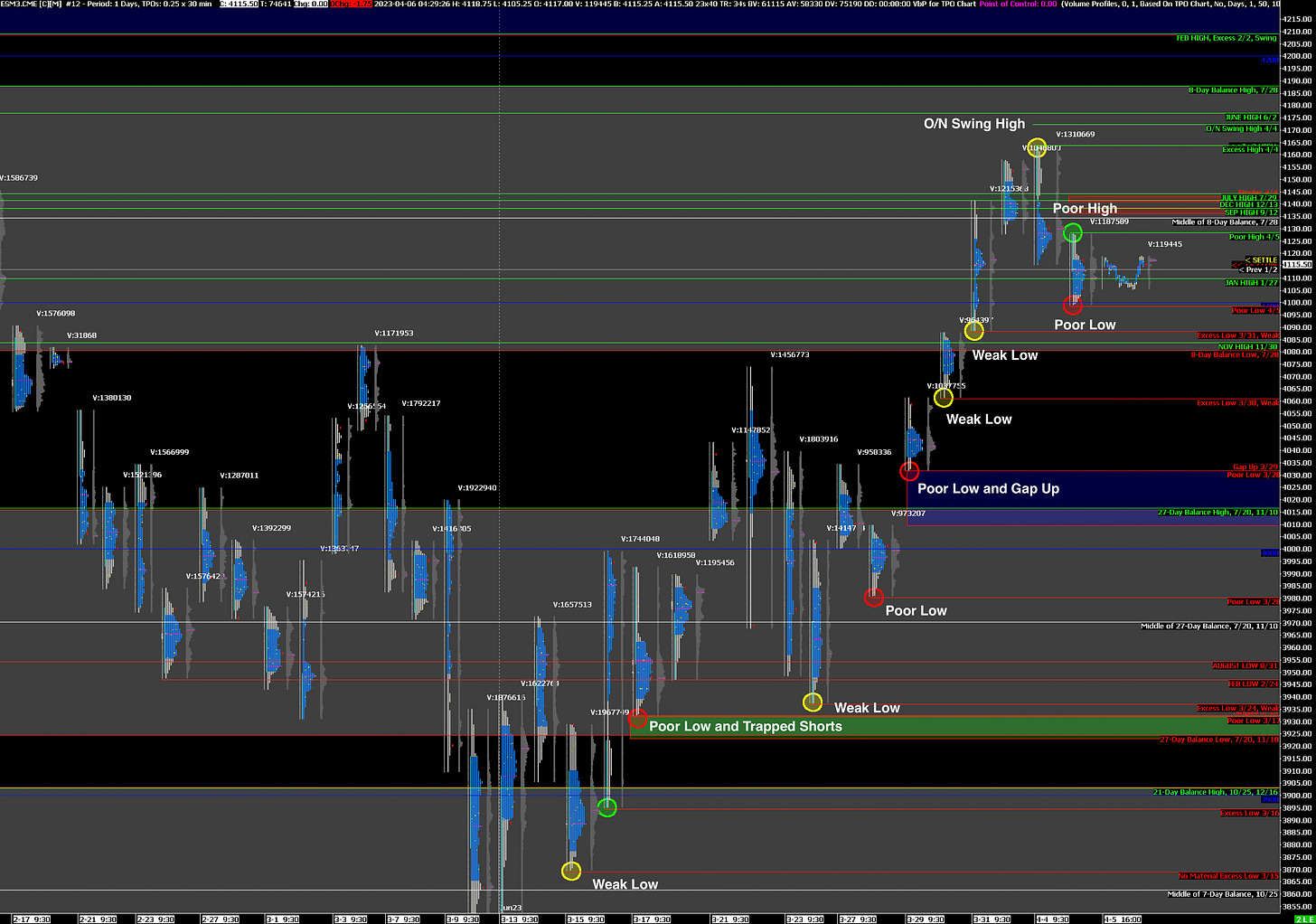

Near-Term Outlook: Bearish after Failure Above 4/3 High

Alternate Outlook: Bullish following recent Inventory Liquidation

Key Levels for Today:

Bullish: 4128 (Y’day Poor High), 4143 (Trapped Long Position), 4172 (O/N Swing High)

Bearish: 4098 (Y’day Poor Low), 4088 (Weak Low), 4061 (Weak Low)

While the market was down for a second consecutive day, once again there was no serious selling present. Nonetheless, this does serve to bring short-term Inventories closer to Balanced. There is Poor Structure both below and above, so while the Near-Term Outlook is for further declines, the market has good odds of going either direction.

I would treat today’s Poor High and Poor Low as the edges of Short-Term Balance going into today’s trading. Further Balance is a real possibility given the lack of participation of stronger-hand traders.

Potential Market-Moving Events Today

8:30am - Initial Jobless Claims