S&P 500 Futures Daily Insights for Fri 30 Dec 2022

Currently in a sticky Balance Zone as market awaits more information

GDR Model Insights for the Current Week

GDR Model Performance (2022): +13.73%

S&P 500 Total Return (2022): -17.91%

Market Tone: Transition (previous week: Potential Transition to Bearish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Balance Rules, slightly Bullish but could go either way

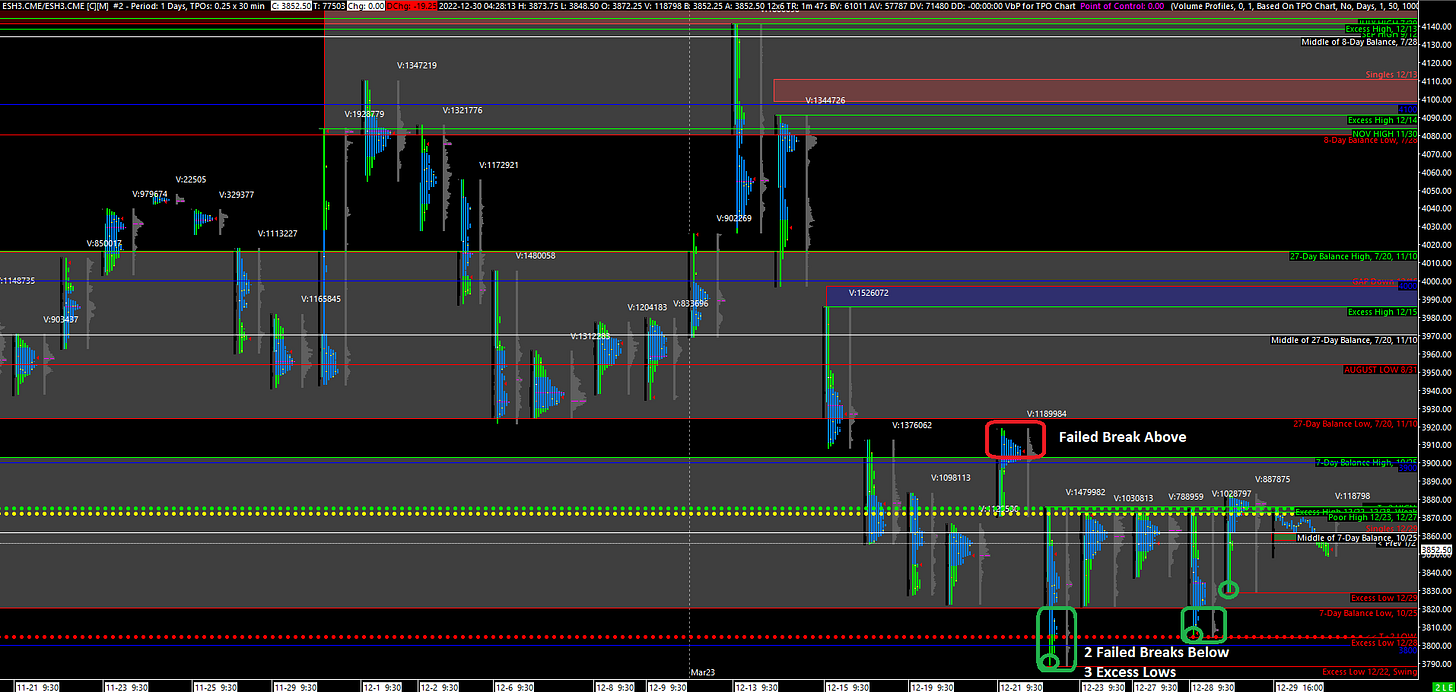

It is not surprising that the market’s attempt to break down from the current Balance Zone (marked as the grey box) failed and the ES is trading again near the middle of that Balance Zone once again. Long Balance Zones such as the current one happen when the market is awaiting further data/information before making a decisive move either way. This makes sense as we’re in a period of the year when new data/information is scarce.

I am pegging the current status as slightly Bullish solely based on the fact that the ES has been making higher lows, but that could change on a dime so don’t take it for granted. Balance Rules apply: 1) go with a break from Balance that is accepted, 2) fade a break from Balance that is rejected

Potential Market-Moving Events Today

09:45am - Chicago PMI