S&P 500 Futures Daily Insights for Fri 18 Nov 2022

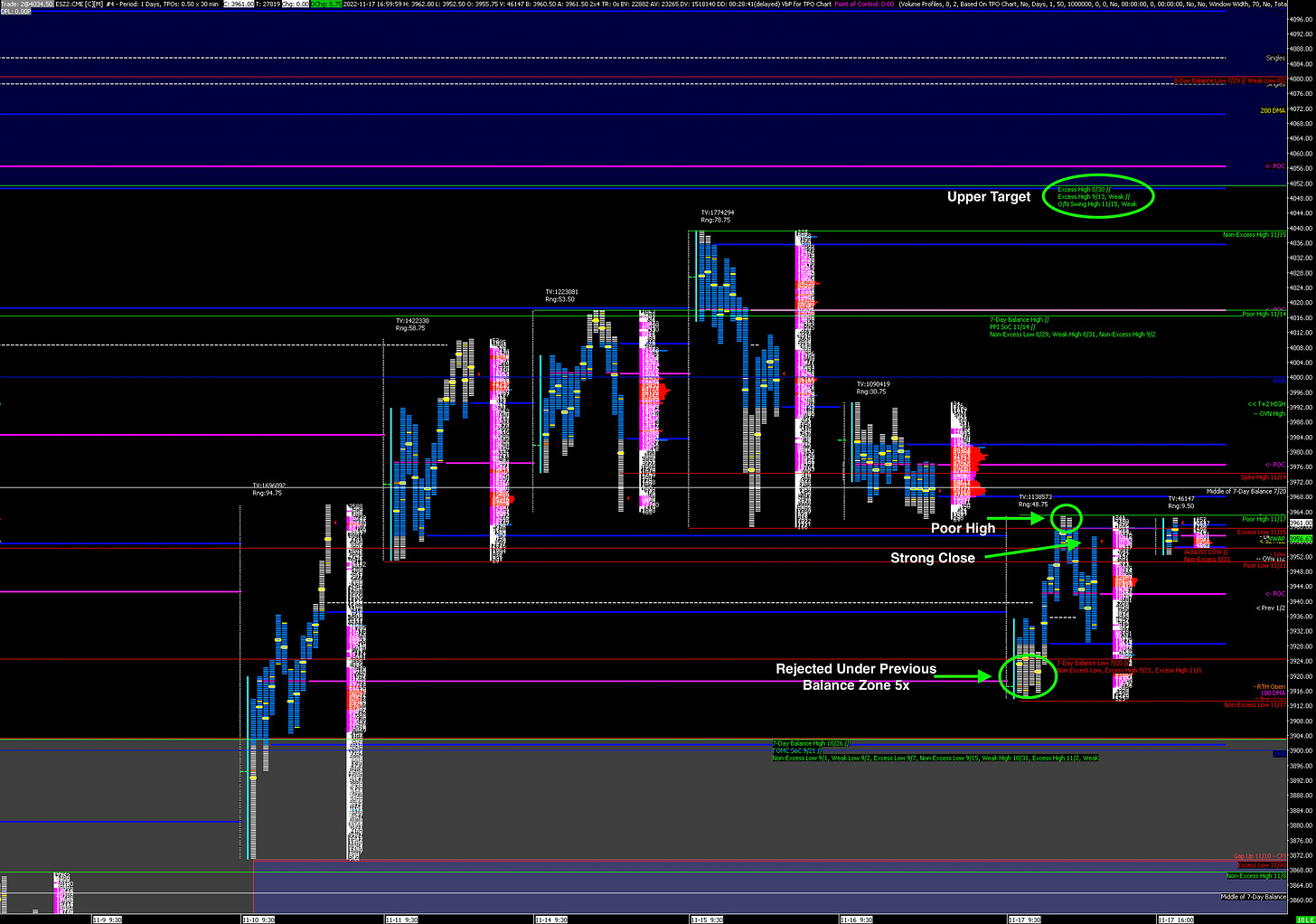

Rejections, a Gap fill, a Poor High and a Strong Close - the path of least resistance is most likely up

GDR Model Insights for the Current Week

GDR Model Performance (2022): +22.21%

Market Tone: Potential Transition to Bullish (previous week: Bearish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

Commentary: not much changed for GDR Model today - the Bullish idea continues to be tested and tomorrow’s action will ultimately determine Market Tone for next week.

S&P 500 Market Structure Insights for Tomorrow

While today may have seemed like a Bearish day given the large Gap down on the open and the negative return, I believe today was actually very Bullish for the S&P 500. Here are the (many) reasons why:

In the morning, the ES rejected a breakdown from the current Balance Zone 5 times in a row

Previous poor market structure below was entirely cleaned up

By early afternoon the entire ~50 handle Gap down had been filled

Today’s session left behind a Poor High

Long inventories corrected near the end of the session

The day ended on a strong close

There is a logical upper target at around 4050

At the start of the week I had pointed out that a liquidation break to today’s levels was likely so that poor Market Structure could be repaired. Now that that is out of the way, there aren’t many Market Structure clues that support a Bearish idea so the path of least resistance is most likely up. As always though, don’t take anything for granted and monitor for continuation.

Potential Market-Moving Events Tomorrow

10:00am - Existing Home Sales