S&P 500 Futures Daily Insights for Wed 23 Nov 2022

GDR Bullish Market Tone cemented further on decent structure

GDR Model Insights for the Current Week

GDR Model Performance (2022): +25.17%

Market Tone: Bullish (previous week: Potential Transition to Bullish)

Positioning: +242.70% Long (previous day: +252.27% Long)

Commentary: GDR Model cemented the Bullish Market Tone further today suggesting ES futures are more likely to continue higher in the near term

S&P 500 Market Structure Insights for Tomorrow

Today was yet another strongly Bullish day for ES futures. Here are the key reasons why:

The market opened on a small Gap Up that was filled before heading higher. This is the mark of a more methodical trending market that builds on decent structure

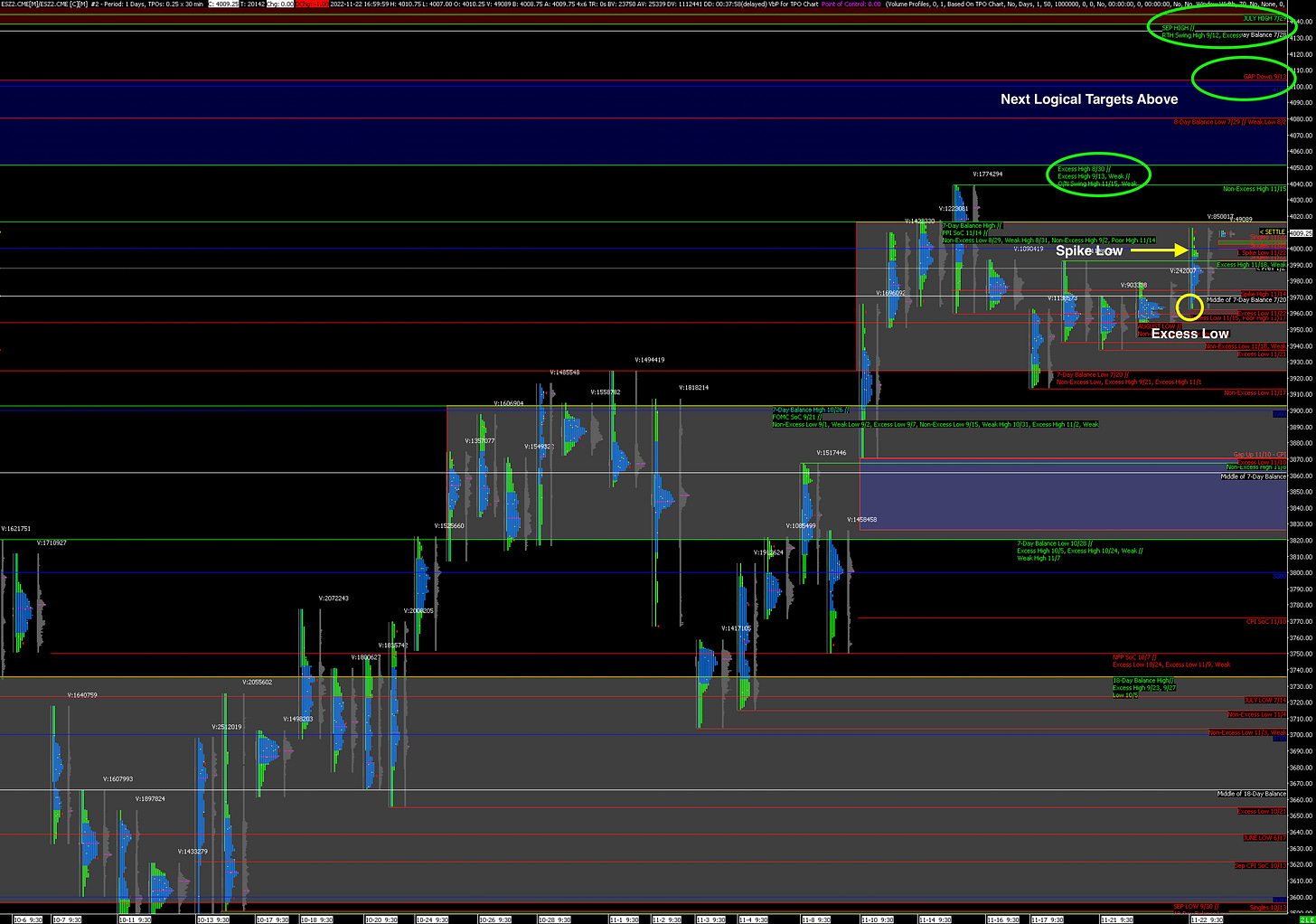

After the Gap fill, the market left an Excess Low. There are now two consecutive Excess Lows

In the process of heading higher, the market took out the Excess High from 18 Nov, a rejection of a bearish idea from last week

There are only a couple of small trapped short positions immediately below

Strong close on a spike up

The first key for the Bullish idea tomorrow is to accept above today’s Spike Low just below 4000. Beyond that, ES futures look set to try and breakout of the current Balance Zone. A breakout was attempted on 15 Nov but was rejected so the next attempt will be important.

Assuming a breakout is successful, the next logical targets are the most recent Swing High made in the Overnight session on 15 Nov just above 4050, followed by the high of a Gap Down from mid-September just above 4100. Beware of the many key events happening tomorrow ahead of the Thanksgiving holiday (see below).

Potential Market-Moving Events Tomorrow

08:00am - Building Permits

08:30am - Initial Jobless Claims, Durable Goods Orders

09:45am - PMI Composite Flash

10:00am - New Home Sales, Michigan Consumer Sentiment

02:00pm - FOMC Meeting Minutes

Super helpful commentary today. Got long with the model this week and quite happy I did!