S&P 500 Futures Daily Insights for Wed 1 Feb 2023

Spike Rules will apply at today's open, but recent trading suggests a market dominated by weak-hands traders over the last few days

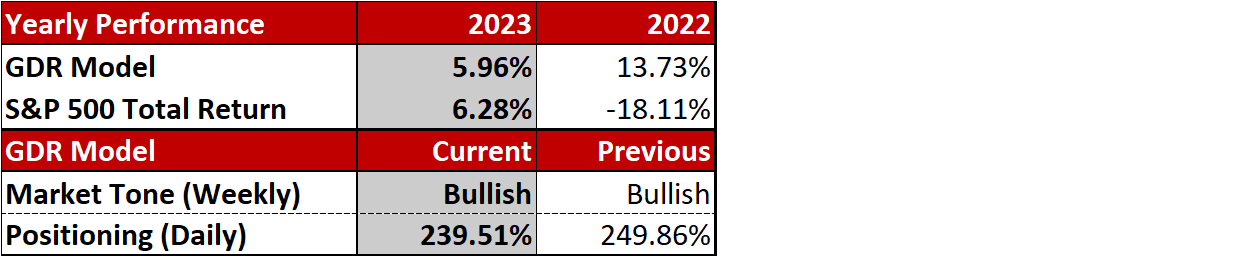

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Fed Day, could go either way

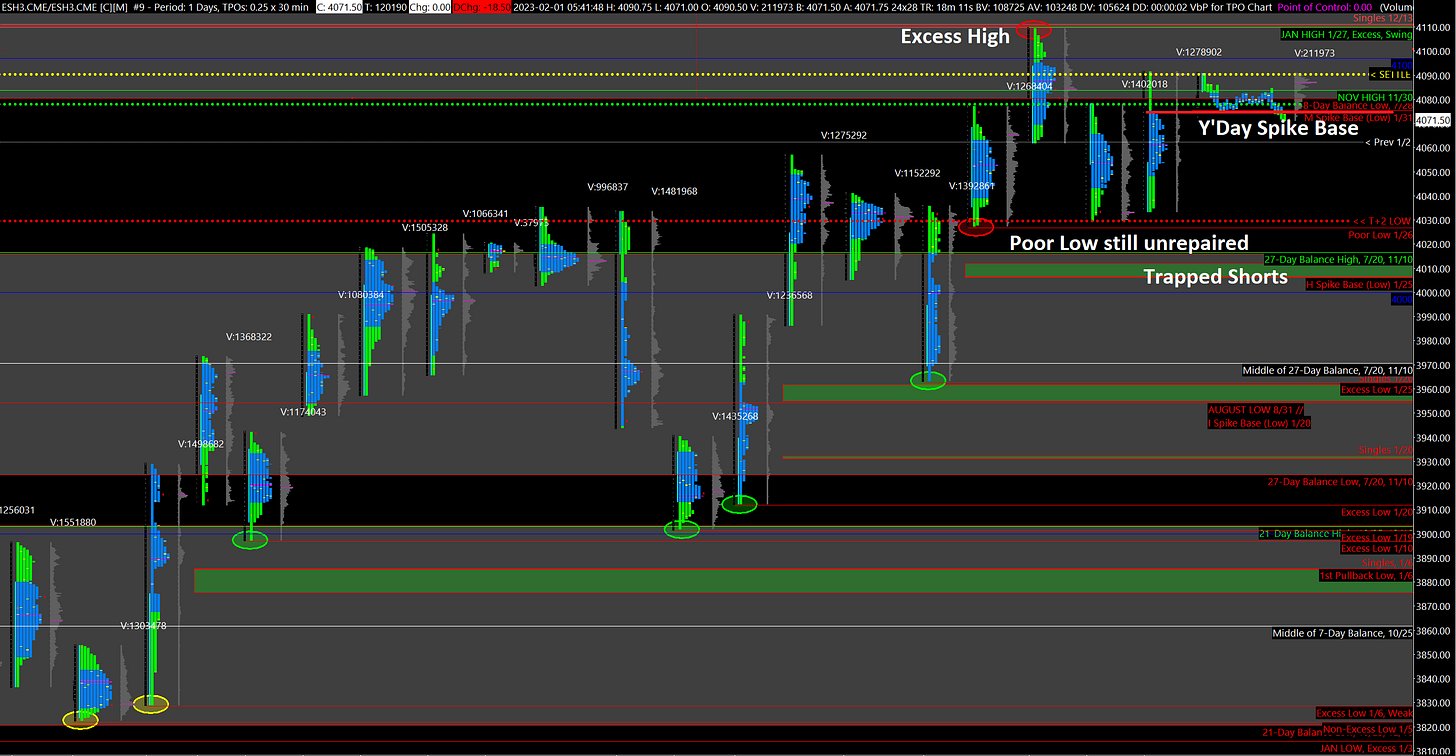

Ordinarily yesterday’s trading might have been considered Bullish on balance, but the context is that the closing rally in the final minutes of the day probably had more to do with end of month rebalancing rather than an expression of Bullish outlook by traders ahead of the Fed’s interest rate announcement today.

Indeed, during the day most of the trading was made from exacting levels, which suggests the presence of weak-hands momentum traders. In addition, last Thursday’s Poor Low, which still needs reapiring, suggests that strong-hands, longer-term investors have been absent for a while. Nonetheless, Spike Rules will apply at today’s open:

Bullish: open and accept above yesterday’s High (4091)

Bearish: open and accept below yesterday’s Spike Base (4075)

Balance: open and accept within yesterday’s Spike Range (4075-4091). Balance Rules apply in this scenario

As always, be aware of the potential for greater volatility given the Fed’s announcement at 2pm.

Potential Market-Moving Events Today

08:15am - ADP Nonfarm Employment Change

09:45am - Manufacturing PMI

10:00am - ISM Manufacturing PMI, JOLTs Job Openings

02:00pm - Fed Interest Rate Decision

02:30pm - FOMC Press Conference

Key Earnings After the Close: META 0.00%↑