S&P 500 Futures Daily Insights for Thu 16 Mar 2023

The market remains undecided on which direction to go next

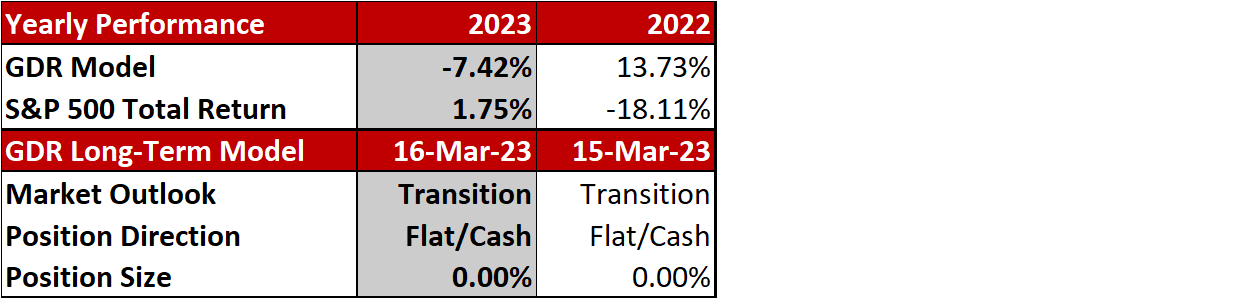

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

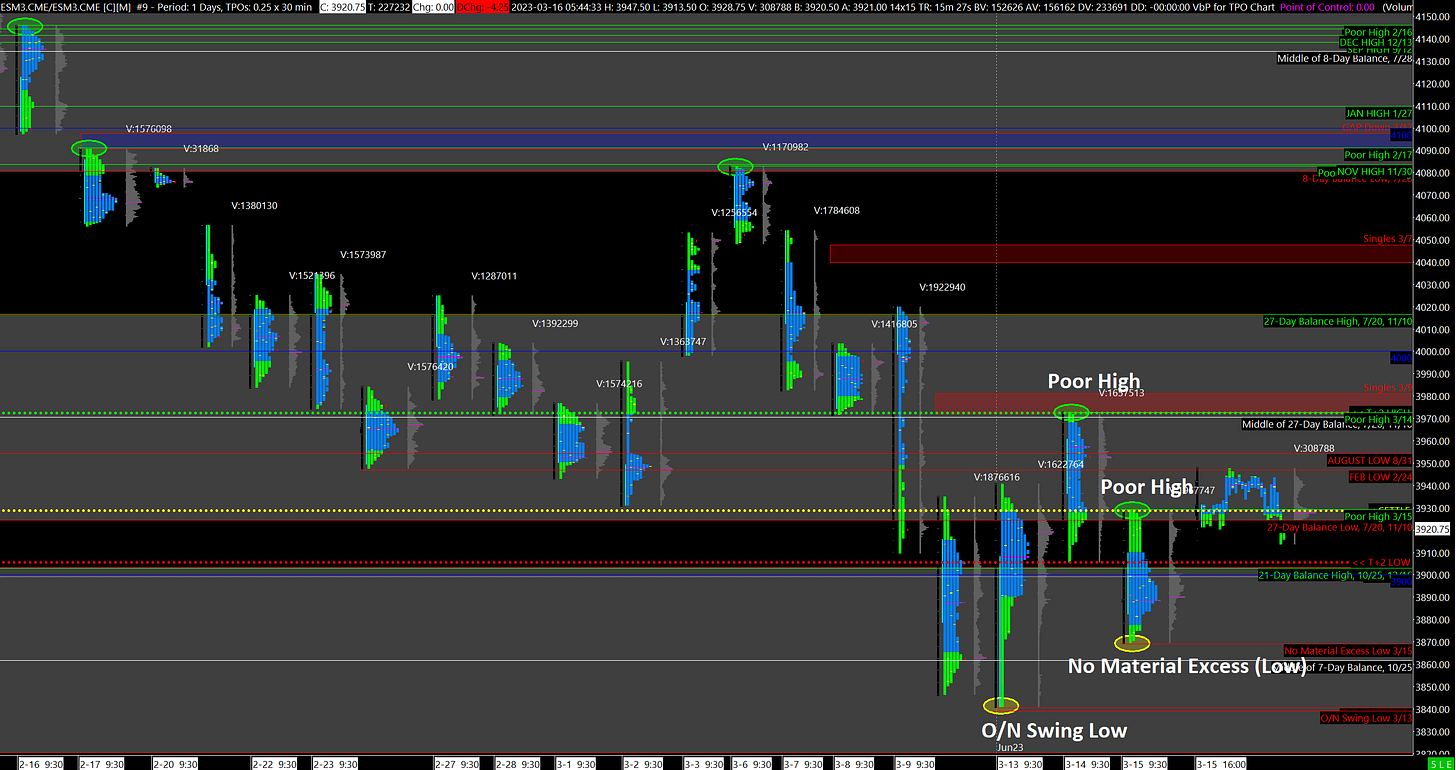

Near-Term Outlook: Short-Term Balance / Indecision

Counterpoint: Taking out and accepting above or below yesterday’s range

Yesterday’s market continued to trade in a Balanced and Rotational fashion as markets remains undecided on which direction to go next. This is a sign of traders awaiting further information/data. Moreover, trading was dominated by short-term momentum players as evidenced by the Poor High and Low without Material Excess.

Neither yesterday’s High or Low look very secure and taking them out and accepting new price levels has a good chance of starting the next direction move however short-lived that may be.

Bullish: if the Poor High is taken out then the 3/14 Poor High (3973) is a reasonable 1st target, followed by the top edge of the Upper Balance Zone (4016)

Bearish: taking out yesterday’s Low and accepting below would put the Overnight Swing Low (3839) in play, followed by the bottom edge of the Lower Balnace Zone (3820)

Potential Market-Moving Events Today

08:30am - Building Permits, Housing Starts, Philly Fed Manufacturing Index, Initial Jobless Claims