S&P 500 Futures Daily Insights for Tue 14 Feb 2023

CPI data release today can fuel another leg higher - initial reaction is likely critical

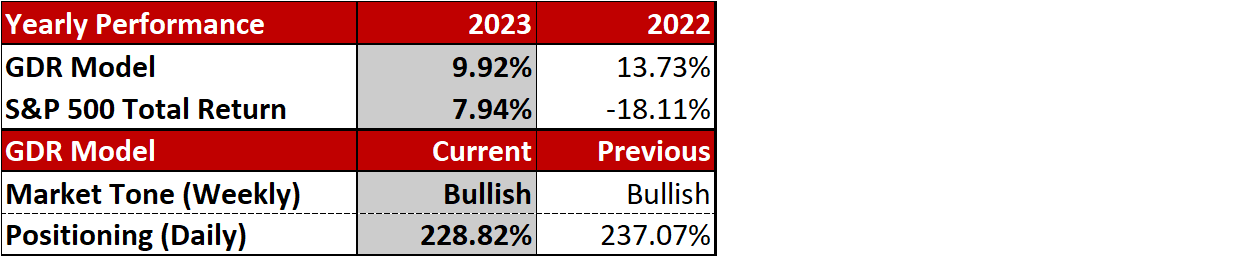

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Potential Upside Breakout with Key Data Pending

The market trended higher yesterday in the morning before consolidating, which suggests the trading session was dominated by short-covering without significant new money buying. Treat today as a Short-Term Balance between yesterday’s Value Area Low (4131) and last Thursday’s High (4168).

On the Bullish side, the 2 Excess Lows over the last 2 trading days are very encouraging and breaking above the sequentially lower highs made earlier this month can easily lead to a new leg higher.

On the Bearish side, remember that short-covering always has the potential to weaken the market. Yesterday’s Market Structure also isn’t great. A negative reaction to CPI would likely see the ES at least revisit the low of the current Balance Zone once again.

The reaction to the CPI data release at 8:30am has good odds of defining the tone for the day and potentially for the rest of the week.

Potential Market-Moving Events Today

08:30am - CPI

11:30am - FOMC Member Harker Speaks

02:05pm - FOMC Member Williams Speaks