S&P 500 Futures Daily Insights for Fri 31 Mar 2023

Market continuously building Long Inventories going into key PCE data today

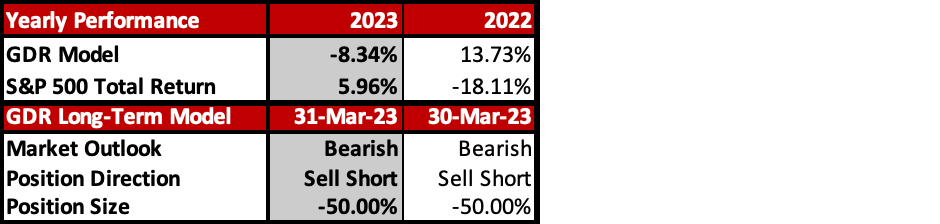

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish on acceptance of Upper Balance Zone

Counterpoint: Rejection at Upper Balance Zone Low on Overly Long Inventories

Key Levels for Today:

Bullish: 4098 (Closes Gap Down), 4145 (Poor High), 4188 (Upper Balance Zone High)

Bearish: 4080 (Upper Balance Zone Low), 4032 (Poor Low), 4010 (Closes Gap Up)

Yesterday the market sold off during the first half of RTH until it almost exactly closed the Gap Up. Then it rallied to close near the top of the range. The prevailing trend is higher and there is no use fighting that, but make not mistake: this uptrend is very likely being driven by fickle momentum traders who reverse course on a dime.

The point is: go with the trend until the trend stops. Set your expectations for the potential of a violent reversal so that when it comes you’re nimble enough to participate. The reversal could be a fullon change of trend, or just a short liquidation break. Unfortunately, I can only see that Inventories have consistently been becoming more imbalanced, but I can’t tell when the tipping point may come.

Potential Market-Moving Events Today

8:30am - PCE

9:45am - Chicago PMI

10:00am - Michigan Consumer Sentiment

3:05pm - FOMC Member Williams Speaks