S&P 500 Futures Daily Insights for Fri 10 Feb 2023

Yesterday's Liquidation ending in a Spike Lower suggests a potential change in tone, but beware the edge of the Balance Zone

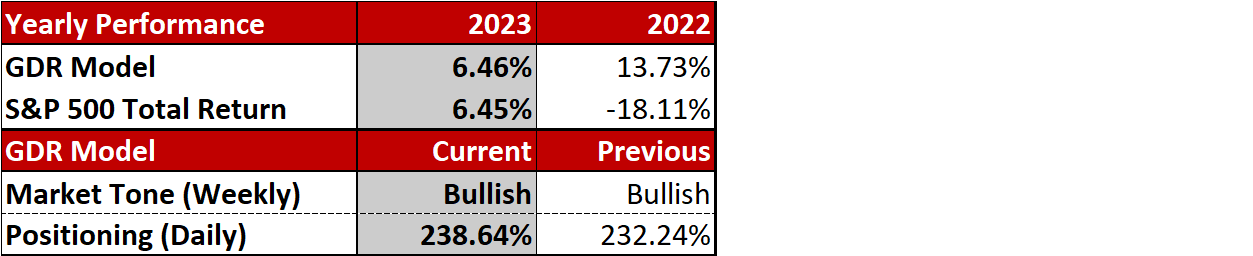

GDR Model Insights for the Current Week

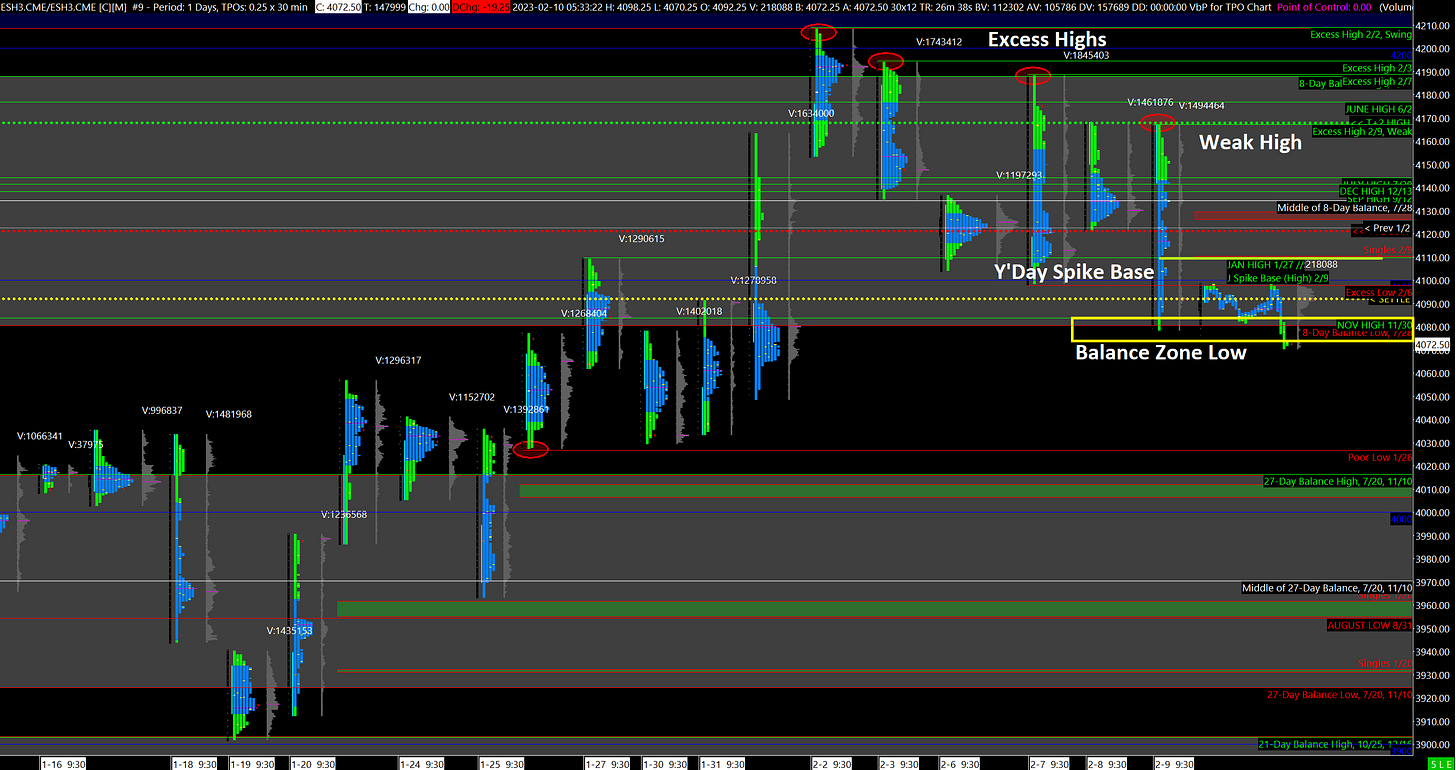

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Spike Rules, near Balance Zone Low

Yesterday was a Trend Day down that ended with a Spike Lower around the bottom of the current Balance Zone. Spike Rules will apply with the following scenarios:

Bearish: open and accept below the Spike Low (4078)

Bullish: open and accept above the Spike Base (4110)

Balance: open and accept within the Spike (4078-4110)

A day like yesterday can flag a change in tone to a more Bearish market, but do note that

yesterday’s High is Weak as it coincides with the T+2 High,

yesterday left Poor Structure above

the Spike Base coincides with the last month’s High

there doesn’t seem to be a lot of Inventory above to drive further Liquidation, and

the ES is approaching the Low of a major Balance Zone.

There are strong points supporting both Bullish and Bearish views, therefore it is key to read the market in real-time to discern which way it will go to end the week.

Potential Market-Moving Events Today

10:00am - Michigan Consumer Expectations

12:30pm - FOMC Member Waller Speaks

04:00pm - FOMC Member Harker Speaks