S&P 500 Futures Daily Insights for Wed 8 Mar 2023

Expect big ranges as Powell's testimony continues today

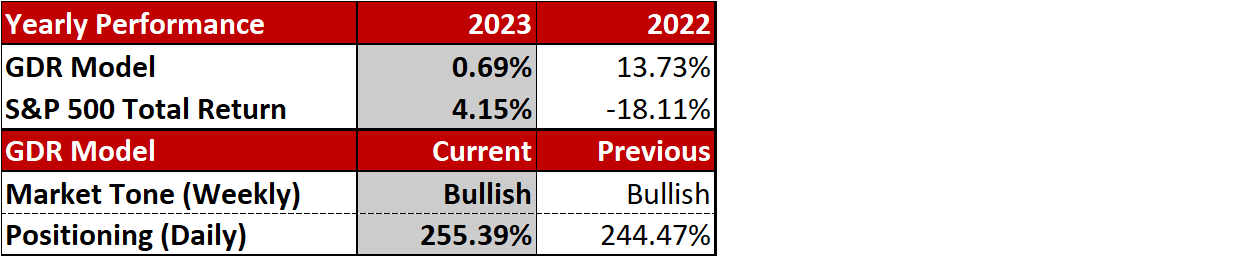

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Big Range, could go either way

Yesterday the market reacted negatively to Powell’s testimony in Congress. Today his testimony continues again at 10am. Given the current Market Structure, expected elevated volatility to persist.

Today the ES can go either direction so I have marked off the key levels in the chart above. You can loosely treat it as a small Balance.

Bearish: the market breaks down below yesterday’s Low (3982), which lacks Material Excess. In this scenario, the Trapped Short Position and Weak Low from 3/2 become the obvious targets

Bullish: the market pushes above yesterday’s midday Pullback (4027). In this scenario, the Trapped Long Position from yesterday and the Poor High from Monday become the obvious targets

Should the Bullish scenario unfold, consider it a continuation of the Short-Covering Rally that started on 3/2.

Potential Market-Moving Events Today

08:15am - ADP Nonfarm Employment Change

10:00am - Fed Chair Powell Testifies, JOLTs Job Openings

02:00pm - Beige Book