S&P 500 Futures Daily Insights for Thu 22 Dec 2022

Market Profile suggests relatively balanced odds for today

GDR Model Insights for the Current Week

GDR Model Performance (2022): +13.73%

S&P 500 Total Return (2022): -17.31%

Market Tone: Potential Transition to Bearish (previous week: Bullish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

S&P 500 Futures Market Profile Insights for Tomorrow

Near-Term Outlook: Could Go Either Way

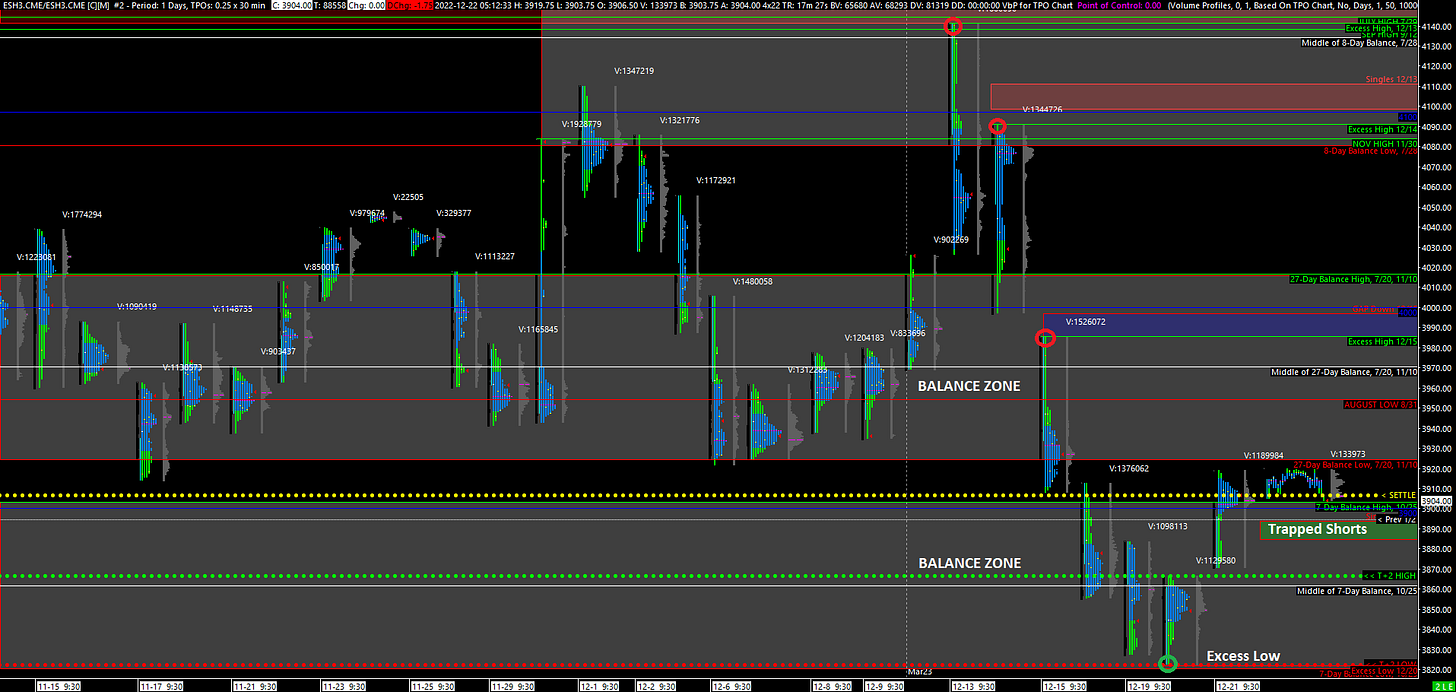

Yesterday’s Market Profile suggests there was more short-covering, this time with poor structure and no follow-through. In addition, the market closed just above the most recent Balance Zone so there is potential for a return to it. This materially raises the odds of downside today relative to yesterday.

On the Bullish side, the market has 2 consecutive Excess Lows and if the break out of the recent Balance Zone is accepted, then there are high chances the ES returns to the massive Balance Zone just above. This implies that there are still good odds for further upside.

All in all, today could go either way and will probably favor more mentally flexible traders who can shift between Bullish and Bearish ideas on a dime.

Potential Market-Moving Events Tomorrow

08:30am - Initial Jobless Claims, GDP (Q3 Final)