S&P 500 Futures Daily Insights for Thu 23 Mar 2023

Potential End of Upward Auction with Excess High

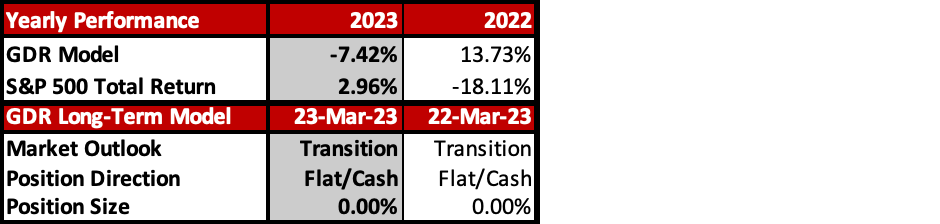

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Potential End of Upward Auction with Excess High

Counterpoint: Recent Upward Trend Remains Intact

Key Levels for Today:

Bullish: 4005 (Downward Spike Base, T+2 Settlement Low), 4043 (T+2 Settlement High), 4080 (Upper Balance Zone Low)

Bearish: 3946 (Weak Low), 3924 (Current Balance Zone Low / Trapped Short Position), 3903 (Top of Lower Balance Zone)

The market had a volatile reaction to the Fed and Powell’s press conference yesterday. While initially it pushed higher, it was unable to enter the Upper Balance Zone leaving behind an Excess High in a classic sign that overly long Inventories needed liquidation.

There is a good chance that the trend turns lower here. Should this happen, expect some back and forth initially has laggard momentum traders continue to try to buy the dip for a while before throwing in the towel. However, if the market is able to accept above yesterday’s Donward Spike Base at 4004 and value continues to build higher then the uptrend may continue for the near-term.

Potential Market-Moving Events Today

8:00am - Building Permits

8:30am - Initial Jobless Claims

10:00am - New Home Sales