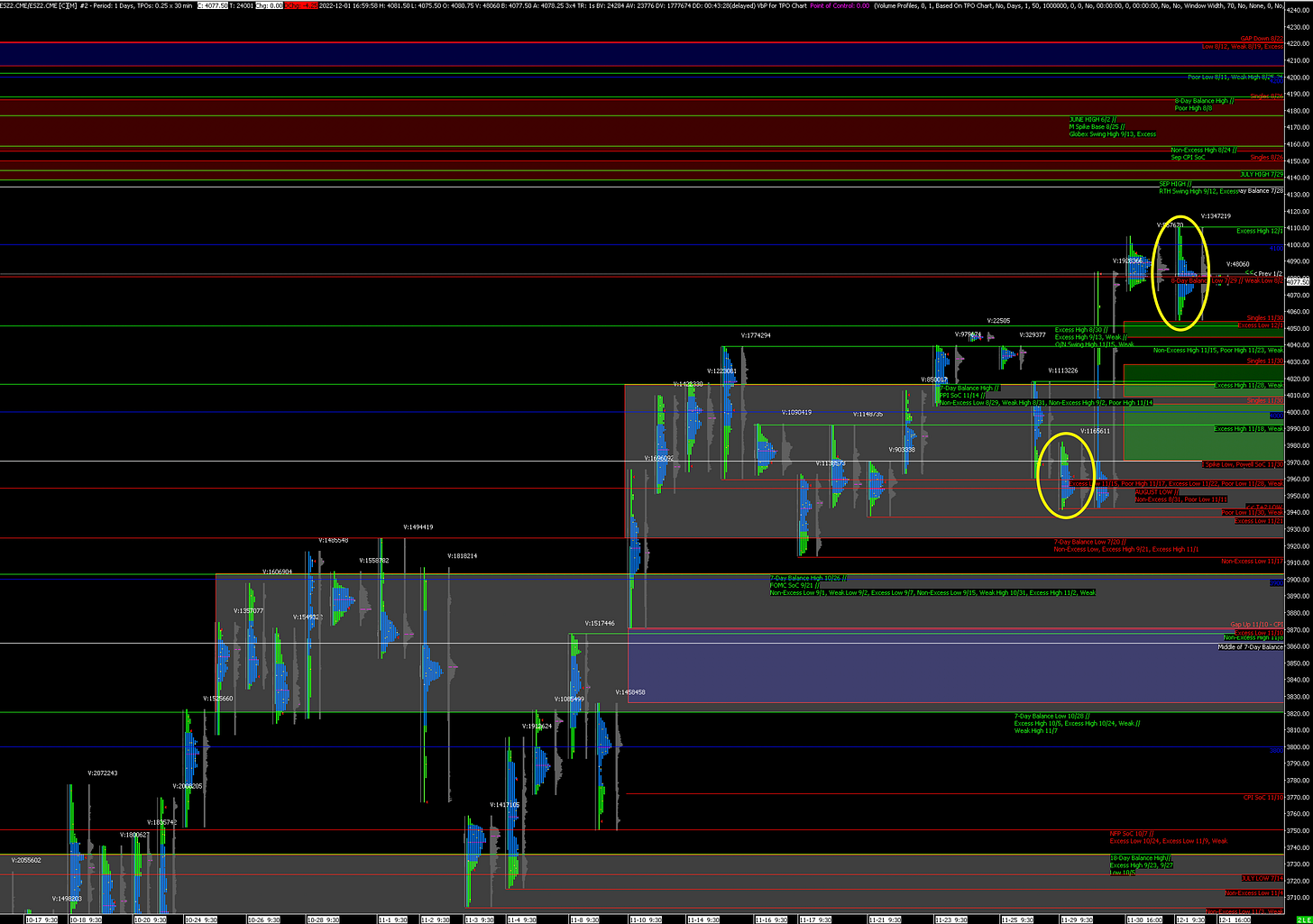

S&P 500 Futures Daily Insights for Fri 2 Dec 2022

Another Balance Day before a key economic data release - Balance Rules apply

GDR Model Insights for the Current Week

GDR Model Performance (2022): +30.90%

Market Tone: Bullish (previous week: Bullish)

Positioning: +233.43% Long (previous day: +232.86% Long)

Commentary: not much of a change in GDR today as it continues in solidly Bullish mode.

S&P 500 Futures Market Profile Insights for Tomorrow

Today was another Balance Day with Excess High and Excess Low. It is very similar to how Tuesday 11/29 turned out, which was the day before Powell’s latest speech. Similarly to 11/29, today is the day before the monthly employment numbers come out, so as I had suggested for Wednesday 11/30: Balance Rules apply, specifically 1) go with a break from Balance that is accepted, and 2) fade a break from Balance that is rejected.

In addition to Balance rules, I will point out that the potential volatility from the employment report provides a good opportunity to clean up bad structure below, especially the Poor Low left behind yesterday. Mental flexibility will likely be key tomorrow.

Potential Market-Moving Events Tomorrow

08:30am - Nonfarm Payrolls