S&P 500 Futures Daily Insights for Wed 29 Mar 2023

Market set to open on Gap Higher in potential breakout from Balance Zone

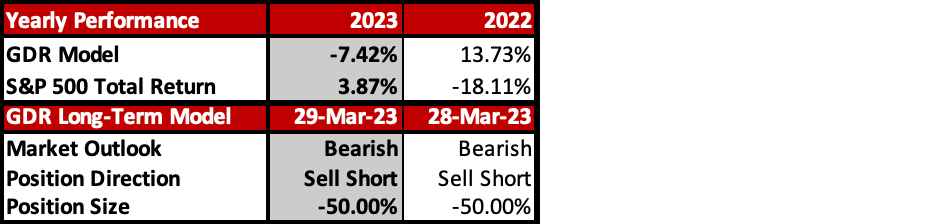

GDR Model Insights for the Current Week

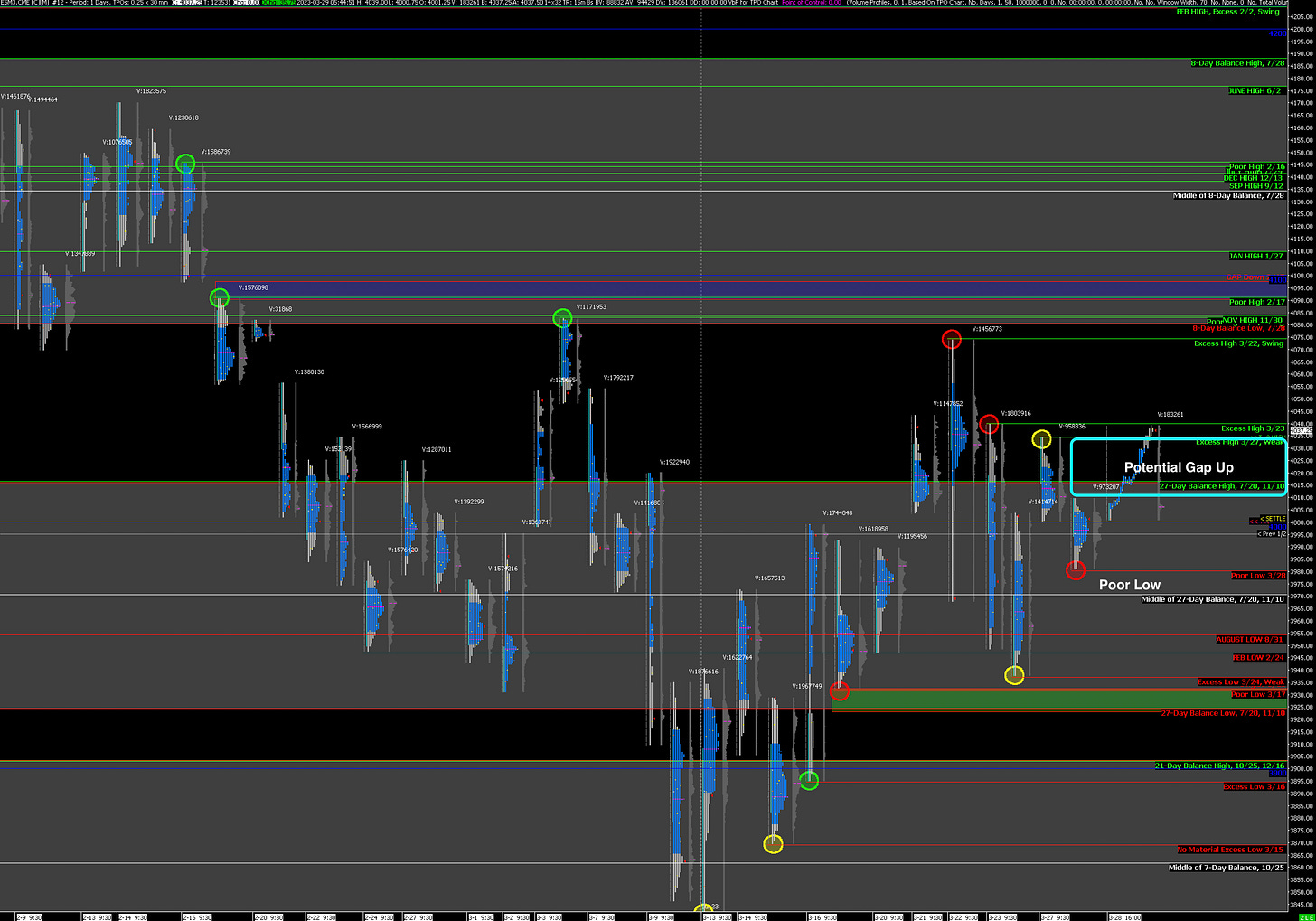

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish Breakout of Balance Zone on a Gap Up

Counterpoint: Gap Fills and Value Reverts to Unchanged

Key Levels for Today:

Bullish: 4080 (Upper Balance Zone Low), 4098 (Closes Gap Down), 4145 (Poor High)

Bearish: 4016 (Current Balance Zone High), 4010 (Y’day High, Closes Potential Gap Up), 3980 (Y’Day Poor Low

Yesterday was yet another episode of short-term momentum traders ruling the market. While the Poor Low from Monday was corrected, the market left behind yet another Poor Low yesterday. Regardless, the most important fact at hand going into today is that the market seems set to open on a large Gap Up. This is unquestionably Bullish and Gap Rules suggest to go with all Gaps that aren’t filled relatively soon.

While there is plenty of Poor Structure below, always avoid fighting the market as it currently seems intent on going higher. Should the Gap be filled this morning, then revert to monitoring where Value builds.

Potential Market-Moving Events Today

10:00am - FOMC Member Barr Testifies on SVB Failure (SIVB 0.00), Pending Home Sales