S&P 500 Futures Daily Insights for Wed 8 Feb 2023

A Breakout from the current Balance Zone could be the starting point of another leg higher in the market

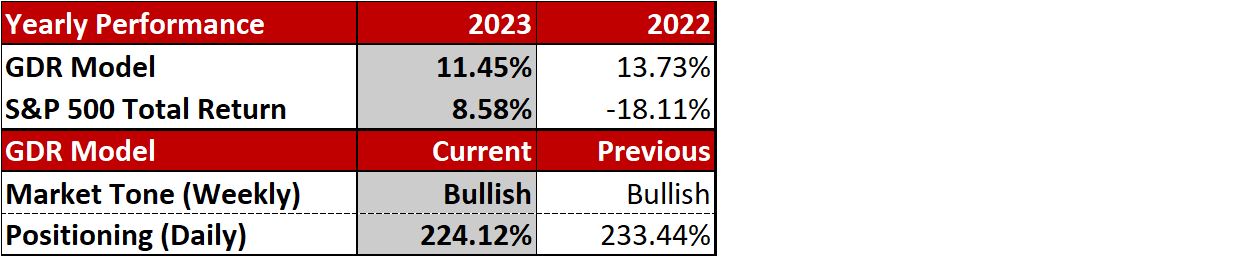

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

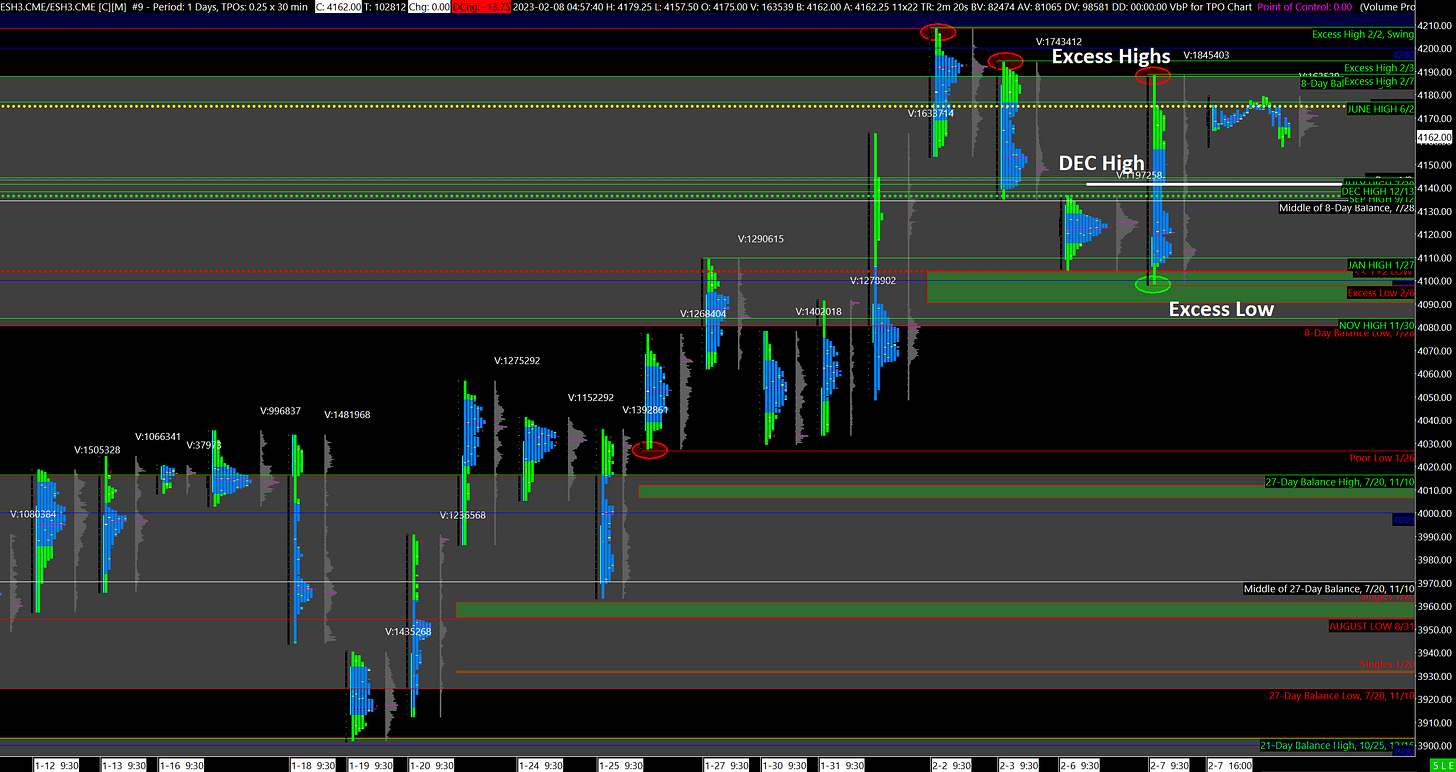

Near-Term Outlook: Short-Term Balance, Bullish Edge

Yesterday was a nuanced day with weak-hands dominating the market all the way through the initial reaction to the Powell speech. The Low of the day was subsequently set as short-term traders brought overly long inventories into balance, leaving behind an Excess Low. The High of yesterday also has significant Excess and is yet another breakout rejection from the current Balance Zone.

I am treating the area between the December High (4142) and yesterday’s High (4189) as Short-Term Balance. I am also leaning Bullish and here is why:

The previously mentioned Excess Low from yesterday

Since at least 1/24, every day the market rallied NYSE Volume was higher while on days when the ES pulled back NYSE Volume was lower. In other words, lower prices are cutting off activity while higher prices are attracting it.

We have had 3 recent failed attempts at breakouts from the current Balance Zone. The more this happens the greater the odds that there will be an actual Breakout.

It’s not a slam dunk though; there is a fair amount of Poor Structure from yesterday and the combination of an Excess High with a failed Breakout leaves me cautious despite believing there are greater odds of further upside in the near-term.

Potential Market-Moving Events Today

09:15am - FOMC Member Williams Speaks

01:45pm - FOMC Member Waller Speaks