S&P 500 Futures Daily Insights for Wed 5 Apr 2023

After yesterday's limited Inventory Correction, Market can go either way

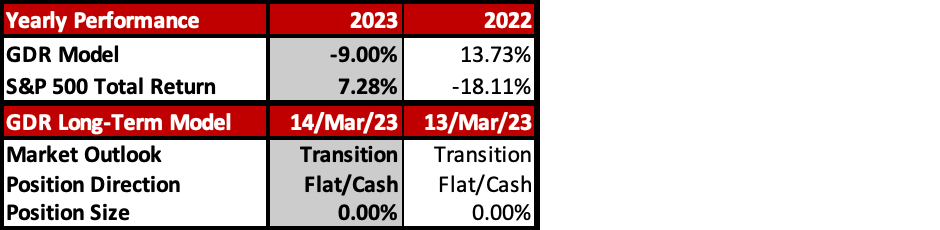

GDR Model Insights for the Current Week

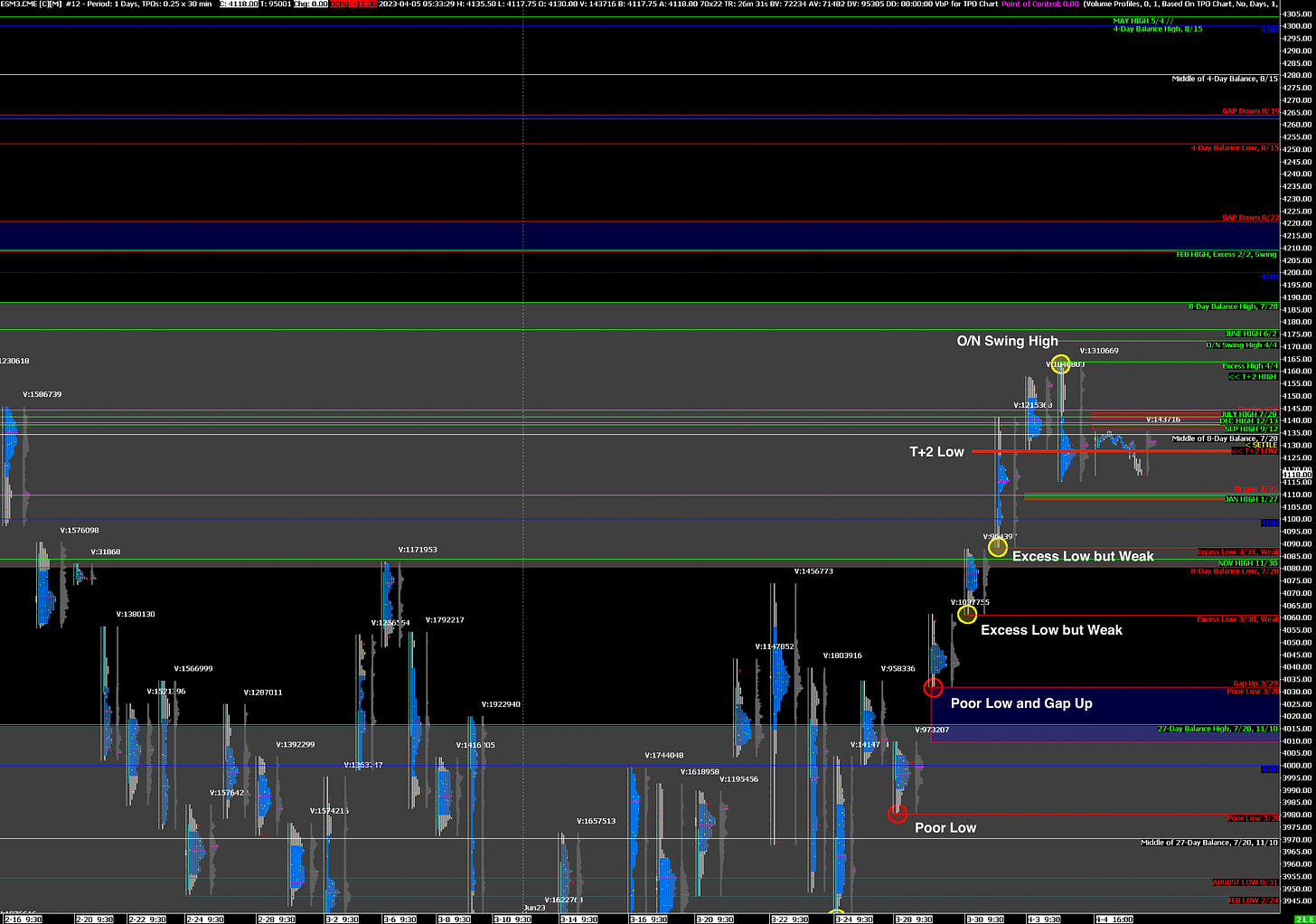

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bearish after Failure Above 4/3 High

Alternate Outlook: Bullish following Yesterday’s Inventory Liquidation

Key Levels for Today:

Bullish: 4143 (Trapped Long Position), 4172 (O/N Swing High), 4188 (Balance Zone High)

Bearish: 4088 (Friday Weak Low), 4061 (Weak Low), 4032 (Poor Low)

Yesterday the market gave us the Liquidation Break we have been waiting for, however there is a chance that it may have been too limited. The ES looked above the 3/31 High (now T+2) early in the trading day before failing the Breakout. It is now trading below the T+2 (Settlement) Low with plenty of Poor Structure below to tackle.

On the other hand, there’s a solid case to be made on the Bullish side. Selling pressure yesterday was relatively limited despite the Excess High, so I doubt there was serious long-term money liquidating. The current Swing High was also made in the Overnight session and those tend to not last very long. There are relatively good odds that the market may also go higher after yesterday’s Inventory Correction.

Potential Market-Moving Events Today

8:15am - ADP Nonfarm Employment

9:45am - S&P Global Composite PMI

10:00am - ISM Non-Manufacturing PMI