S&P 500 Futures Daily Insights for Thu 16 Feb 2023

Short-Term Bullish heading into more critical data

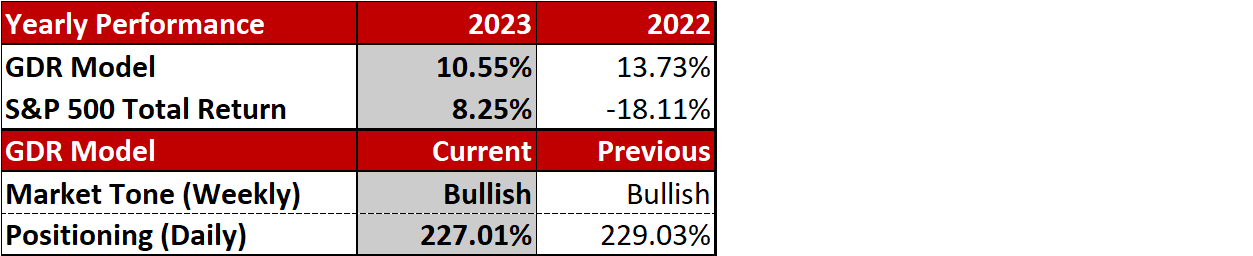

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish, but in Short-Term Balance

In terms of structure, yesterday leaves a Bullish outlook near-term: it was a Trend Day that left behind an Excess Low. It also allowed for short-term Inventory corrections during the day and ended with a strong close on a Spike Up. However, we must always take care to include the surrounding context.

The market trading relatively close to the middle of the current Balance Zone, and yesterday was an Inside Day, meaning yesterday’s range is entirely within the previous day’s (T+2) range. Going into today, the short-term Bullish outlook is maintained if the ES does not trade and accept below yesterday’s Spike Base at 4154. Moreover, taking out the prominent 4 prominent Excess Highs would likely get the next leg higher going.

The Bearish view is currently more difficult to defend. Before a change in tone would happen, the market would not only need to accept below yesterday’s Spike Base, but also take out the current 4 conseuctive Excess Lows.

Potential Market-Moving Events Today

08:30am - PPI, Housing Starts and Permits, Philly Fed Manufacturing Index, Initial Jobless Claims

08:45am - FOMC Member Mester Speaks

01:30pm - FOMC Member Bullard Speaks

06:00pm - FOMC Member Mester Speaks