S&P 500 Futures Daily Insights for Fri 24 Feb 2023

The pressure for further upside continues to mount...

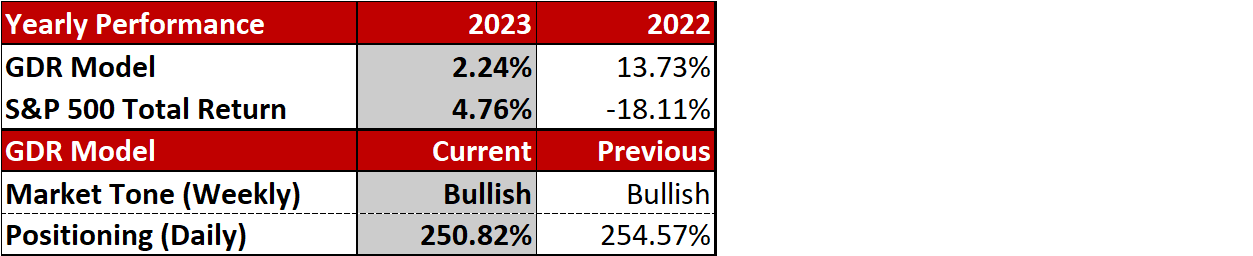

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Still Short-Term Balance with odds favoring upside

Even though yesterday explored breakouts on both edges of short-term Balance, both failed and the market is in short-term Balance once again. However, note that there are now 4 consecutive Highs that are not secure.

The benefit of using Market Profile analysis is that it allows us to get a good sense of who is dominating the market at any point in time. Poor Highs and Weak Highs suggest that short-term oriented sellers are in control rather. This is in contrast to liquidation by longer-term investors for which there hasn’t been much evidence recently. The crucial implication here is that short-term momentum traders are much quicker to fold under the pressure of underperforming positions than long-term investors.

Nevertheless, it’s important to understand that this is odds-based analysis that doesn’t speak to timing. Odds are that short-term momentum traders have pushed the market down, which increases the probability that the market will see more upside soon. Defining when “soon” is is tricky. Moreover, Bad Structure does not have to be repaired. It could hold forever, it’s just unlikely to.

If you’re a short-term/day trader, you have to analyze how any given day is unfolding rather than blindly trying out long after long just because there are multiple recent Poor/Weak Highs.

If you’re a swing trader, keep this in mind: it’s always better to be a little late than a little early to a move. Don’t blindly fight the trend by putting on longs because of the Poor/Weak Highs - that will likely deplete your emotional capital. Be patient. Wait for the market to show its hand and allow yourself to be a little late to the next move. You don’t have to catch the exact bottom (or top) to be a successful and profitable trader.

Potential Market-Moving Events Today

08:30pm - PCE

10:00am - New Home Sales, Michigan Consumer Sentiment

10:15am - FOMC Member Mester Speaks