S&P 500 Futures Daily Insights for Fri 3 Mar 2023

Has a short covering rally just started?

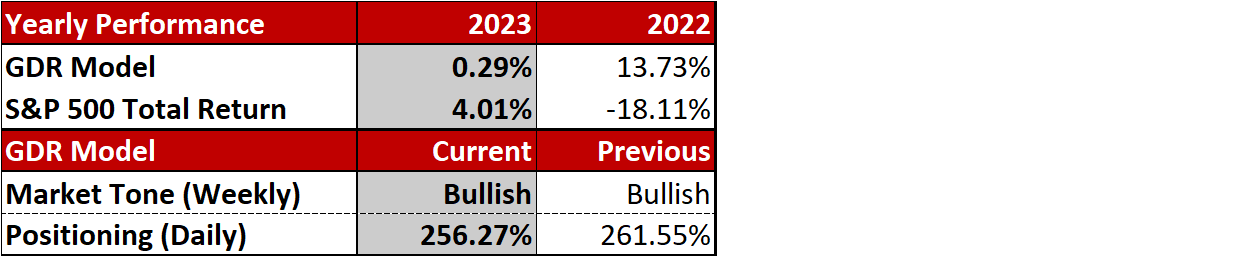

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

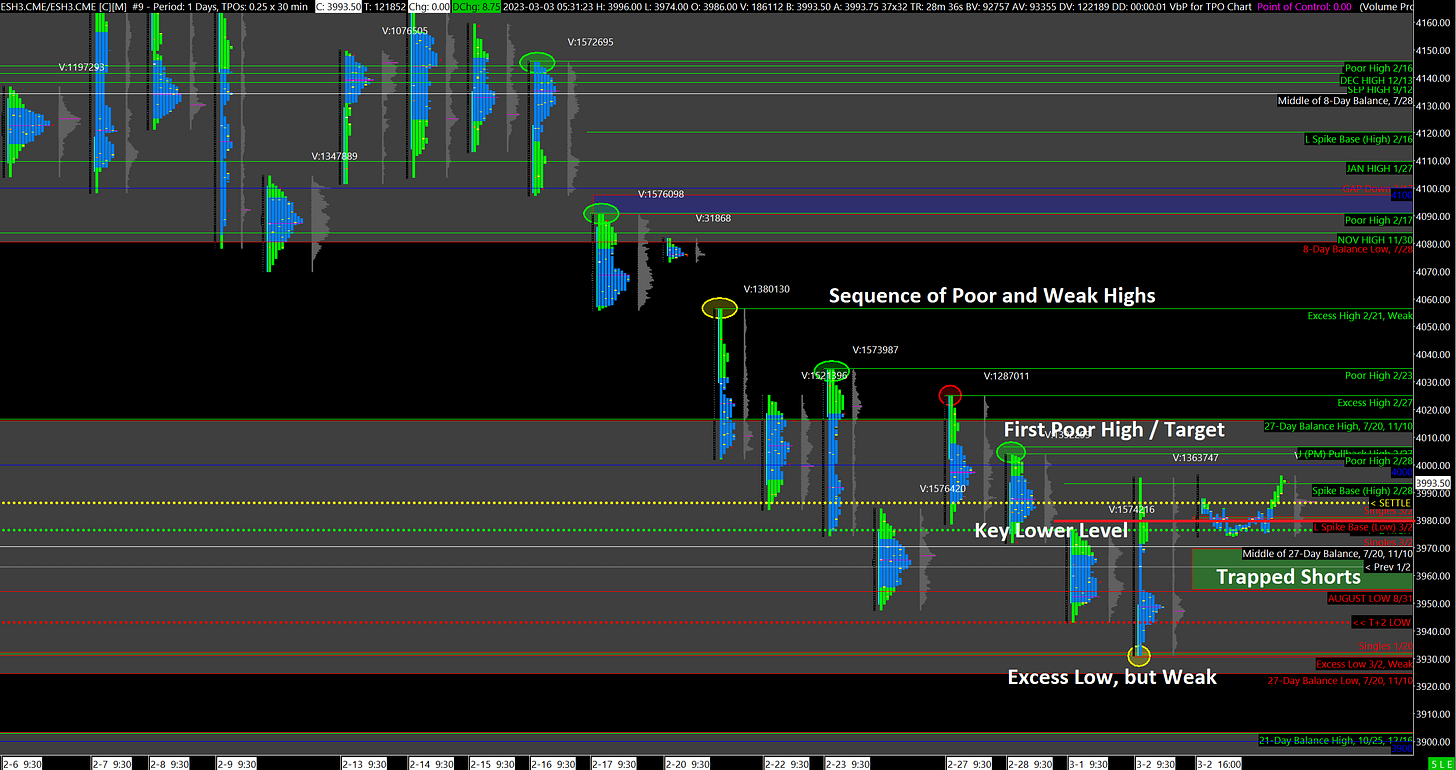

Near-Term Outlook: At Balance Zone Low

Yesterday the market opened on the Gap Lower that was quickly filled. More importantly, based on yesterday’s trading there are signs that Scenario 2 highlighted on Wednesday’s Daily Insights may be playing out: specifically momentum short-seller inventories may have gotten too short and a short-covering rally may be underway.

This is not an ideal scenario for longer-term investors as short-covering can weaken the market, but should there be followthrough then at least it will provide some relief. Note that yesterday’s Excess Low is Weak because it was made where it would close a set of Trapped Short positions to the tick - it’s an exacting level.

Going into today, Spike Rules apply. You can treat the scenario as a short-term Balance with edges at the Spike Base (3980) and Yesterday’s High (3996).

Potential Market-Moving Events Today

09:45am - Markit Services PMI

10:00am - ISM Non-Manufacturing PMI

11:45am - FOMC Member Bostic Speaks