S&P 500 Futures Daily Insights for Tue 24 Jan 2023

After two days of emotionally trading higher, Market Profile now suggests a slightly Bearish outlook

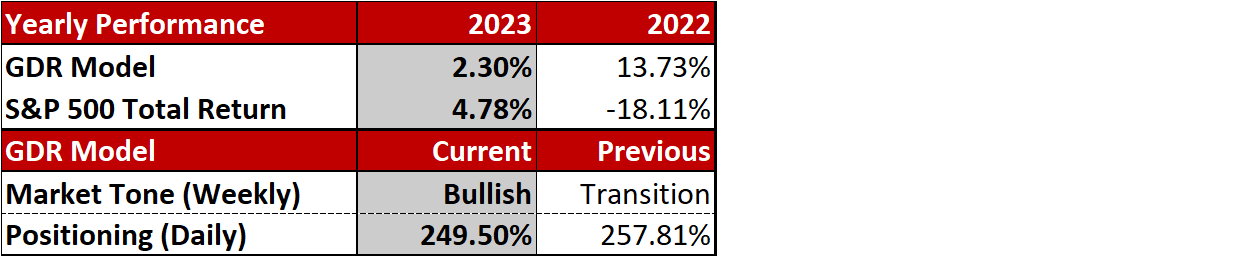

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

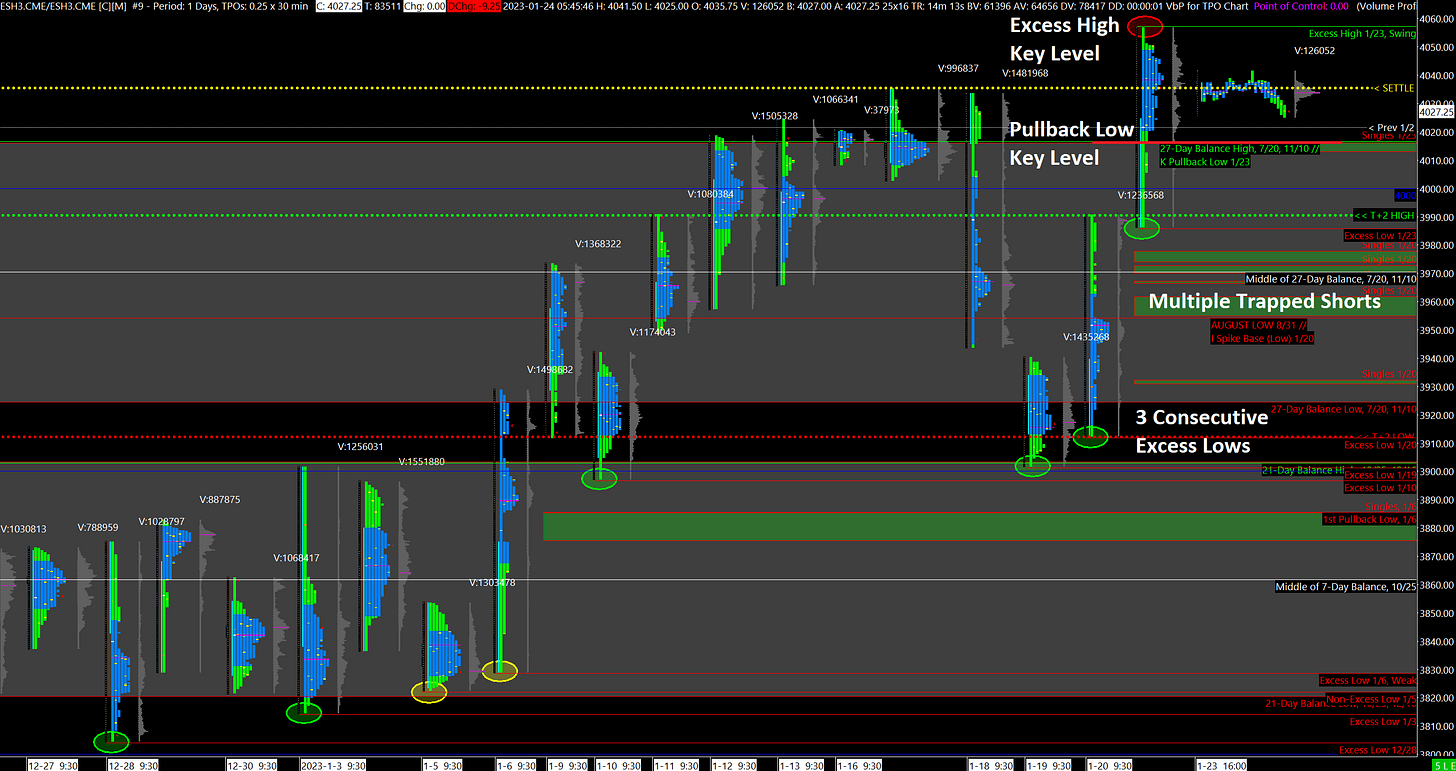

Near-Term Outlook: Tilt Bearish, awaiting further MGI

Yesterday was a second consecutive trend day up, however at this point it is best to await further MGI (Market-Generated Information) before the next move as there are markers evenly supporting trade in either direction.

Bullish: most importantly, the market seems to have accepted prices above the recent Balance Zone. In addition, while yesterday opened on the Gap Up, it was filled before the trend day got under way. There was also a textbook Pullback in the afternoon to allow short-term inventories to come back into Balance. Key Level is yesterday’s high at 4058.

Bearish: the last two trading days saw prices dramatically higher with poor structure below, implying emotional short-term trading, and most likely plenty of short-covering. Keep in mind that short-covering can weaken a market, and additionally yesterday left behind an Excess High. Key Level is yesterday’s afternoon Pullback low at 4017.

Treat the 4017-4058 range as a small, short-term Balance Area.

Potential Market-Moving Events Today

09:45am - PMI Composite Flash

Key Earnings After Close: MSFT 0.00%↑