S&P 500 Futures Daily Insights for Thu 2 Mar 2023

At Balance Zone Low, will the market breakdown or find the bid?

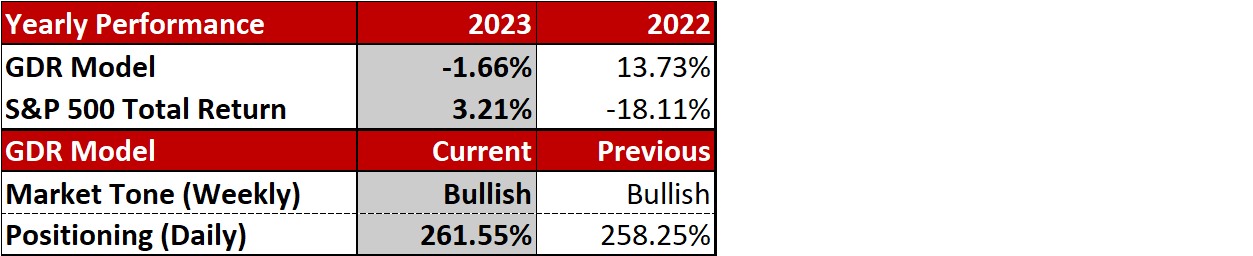

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

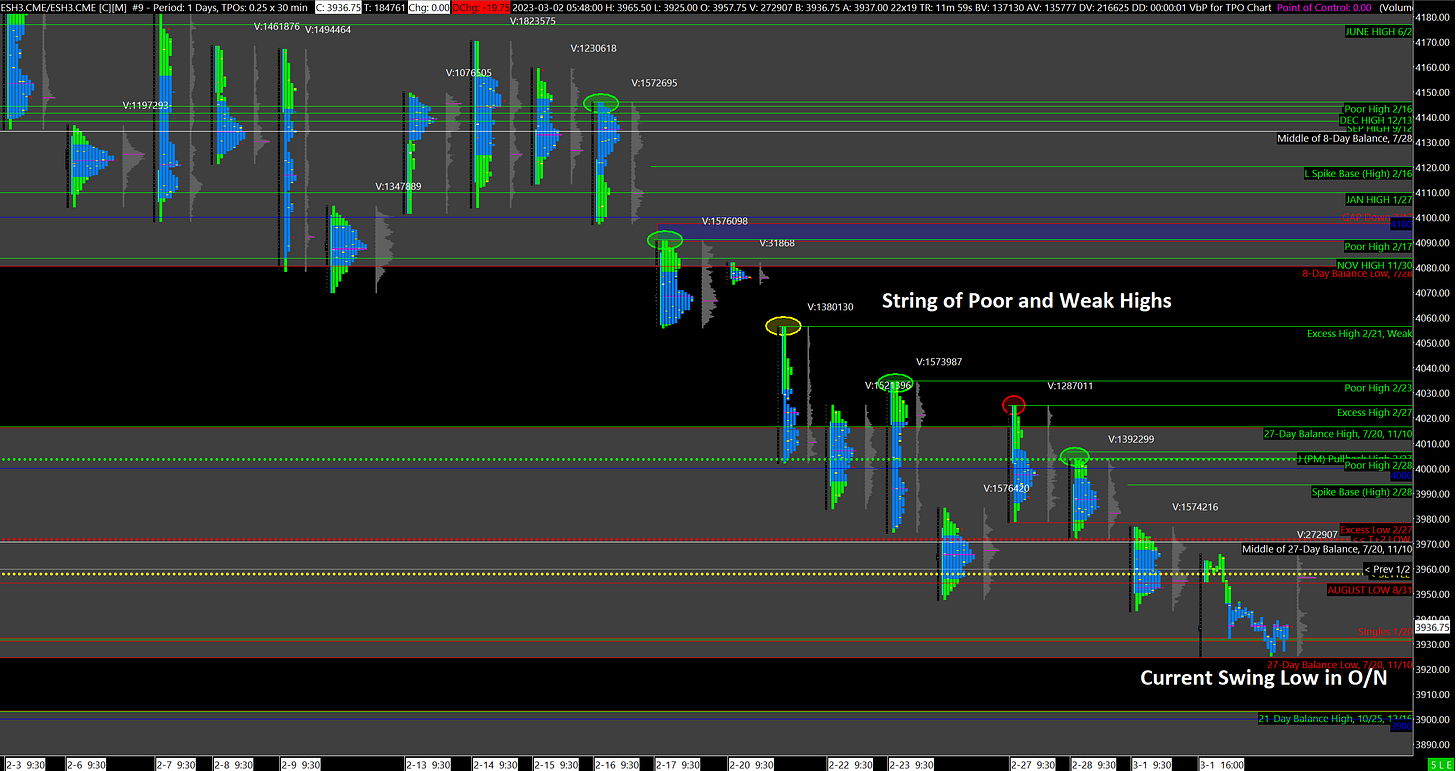

Near-Term Outlook: At Balance Zone Low

Yesterday was a balancing day that was once again dominated by short-term momentum traders. There is just enough Excess on the High to escape the definition of Poor High, but it’s still questionable. On the other hand, while the Low had a fair amount of Excess, the Overnight session is currently trading well below it and as of now the market seems set to open on a Gap Down.

If the status quo remains, Gap Rules will apply, the most important of which is that you should go in the direction of a Gap that is not filled quickly. More importantly, note that the ES is currently trading at the Low of the current Balance Zone and that Swing Lows made in the Overnight session are very likely to be re-tested during Regular Trading.

If the market tests the Overnight Low during Regular Trading, monitor for continuation. If a breakdown from the Balance Zone is rejected then odds are that the ES will swing back to the top of the Balance Zone at around 4015.

Potential Market-Moving Events Today

09:45am - Nonfarm Productivity, Initial Jobless Claims

04:00pm - FOMC Member Waller Speaks

06:00pm - FOMC Member Kashkari Speaks