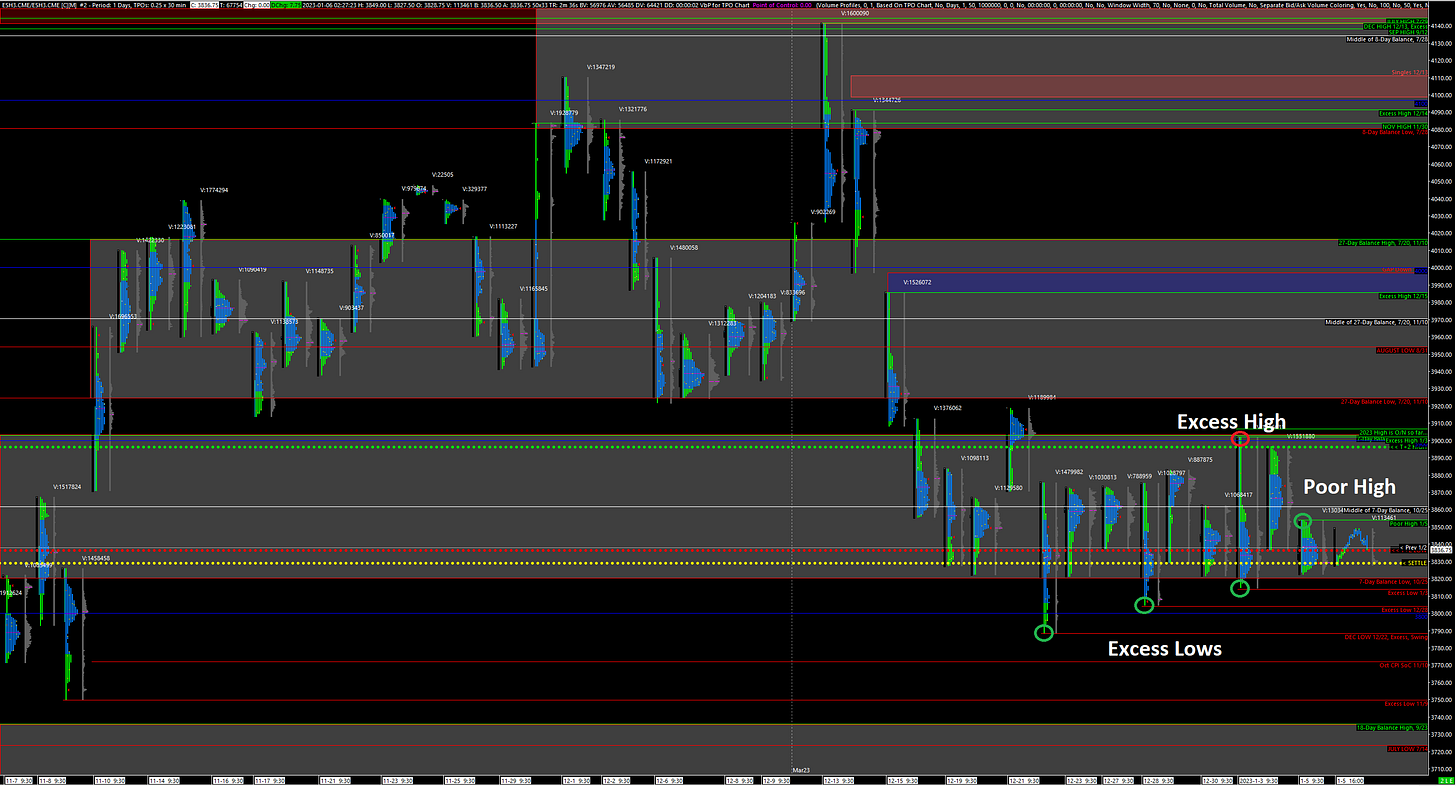

S&P 500 Futures Daily Insights for Fri 6 Jan 2023

Poor High from yesterday places greater odds on a Bullish reaction to Employment Data today

GDR Model Insights for the Current Week

GDR Model Performance (2023): +0.40%

S&P 500 Total Return (2023): -0.79%

Market Tone: Bearish (previous week: Transition)

Positioning: -50.00% Short (previous day: -50.00% Short)

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish, near Balance Edge, but beware of data releases

While yesterday took out 1 of the 4 Excess Lows, it failed to break below the current Balance Zone in a tight range trading day. More importantly, that yesterday left behind a Poor High makes me more confident in the Bullish scenario going into Unemployment Data today. Over at least the last trading year or so, Poor Highs and Lows have rarely avoided repair for more than a day.

Most importantly, the ES has been in the current Balance Zone for 13 trading days now. Whenever it breaks out of it (could well be today) it will have the potential to sustain a trend for some time.

Potential Market-Moving Events Today

08:30am - Nonfarm Payrolls

10:00am - ISM Non-Manufacturing PMI, Factory Orders

11:15am - FOMC Member Bostic Speaks

03:30pm - FOMC Member Bostic Speaks (yes, twice on the same day)