S&P 500 Futures Daily Insights for Thu 19 Jan 2023

MP suggests more Information needed before next move

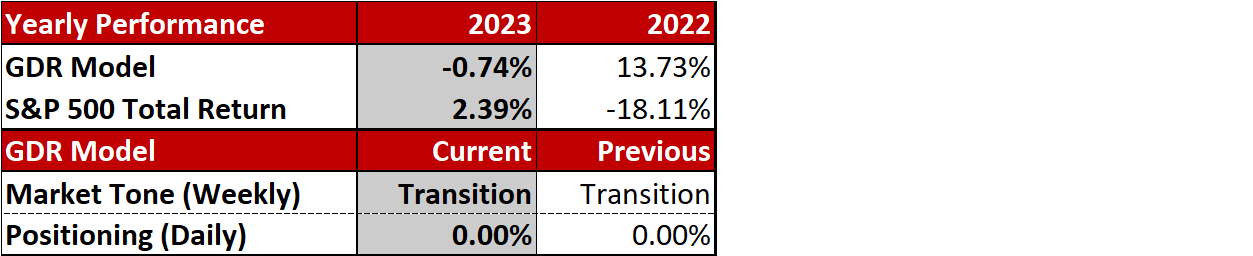

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Mixed pending additional MGI

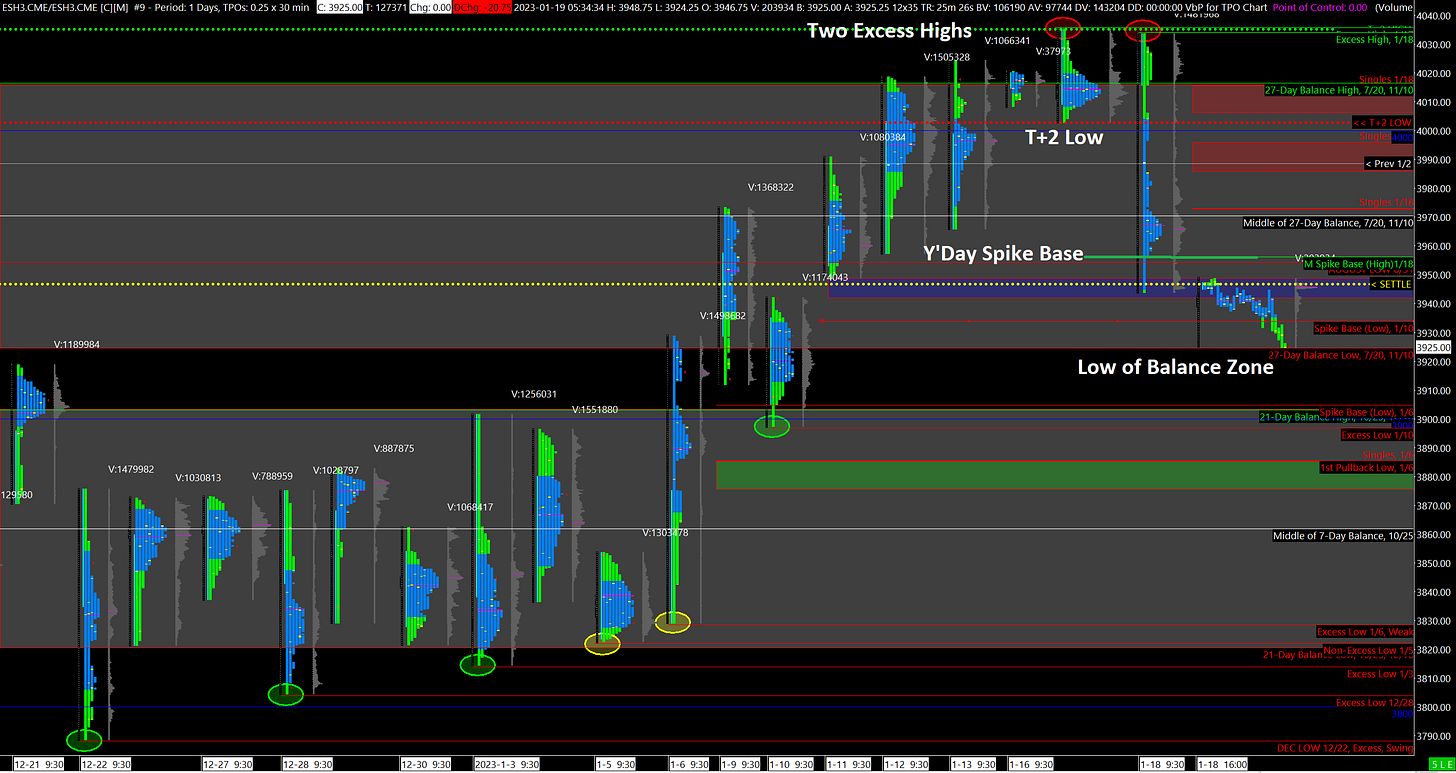

Yesterday I flagged that there were strong odds of a selloff due to the combination of an Excess High and the market being near the top of a significant Balance Zone, and that’s what happened. The market traded sharply lower and in overnight trade it is at the bottom of the Balance Zone. The outlook is now mixed and it behooves traders to await additional Market-Generated Information (MGI) before making the next move.

Here are the key factors supporting each scenario:

Bullish: Possibility of Balance Area Low rejection, emotional selling from yesterday left behind Bad Structure that needs repair

Bearish: 2 consecutive Excess Highs, ES trading well below T+2 (Settlement) Low, potential for break down below current Balance Zone and into lower Balance Zone

The market also seems to be shifting from the Inflation narrative to the Recession one. As such, today’s data releases are likely to prove critical and may cause volatile trading.

Potential Market-Moving Events Today

08:30am - Initial Jobless Claims, Housing Starts and Permits, Philadelphia Fed Manufacturing Index

01:15pm - FOMC Member Brainard Speaks

06:35pm - FOMC Member Williams Speaks