S&P 500 Futures Daily Insights for Thu 30 Mar 2023

Bullish on another Potential Gap Up, but Inventories seem to be getting overly Long

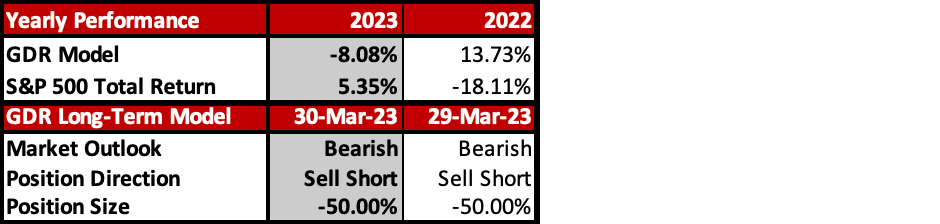

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish on another (potential) Gap Up

Counterpoint: Rejection at Upper Balance Zone Low on Overly Long Inventories

Key Levels for Today:

Bullish: 4080 (Upper Balance Zone Low), 4098 (Closes Gap Down), 4145 (Poor High)

Bearish: 4052 (Y’day Spike Base), 4032 (Poor Low), 4010 (Closes Y’day Gap Up)

Yesterday the market opened on a large Gap Up that was only partially filled. Even though yesterday’s Low is Poor, the day ended on a Spike Higher. Today looks set to open on yet another Gap Higher, which would be undeniably Bullish. Re-entry into a higher Balance Zone looms with the potential for rejection.

Despite the clearly Bullish near-term outlook, it would be foolish to ignore the myriad signs that short-term Inventories are likely getting too long. For example, the two most recent RTH Lows are Poor Lows, and the current Overnight Low coincides exactly with the Base of yesterday’s Spike Up to close the trading day. When signs of overly imbalanced Inventories begin to stack up like this, reversals can hit like a ton of bricks.

Beware of money managers pushing the market higher at the end of the quarter just so their Q1 returns look good…

Potential Market-Moving Events Today

8:30am - GDP Q4 Revision, Initial Jobless Claims

3:45pm - Treasury Secretary Yellen Speaks