S&P 500 Futures Daily Insights for Fri 10 Mar 2023

Key data today with inventories looking potentially too short

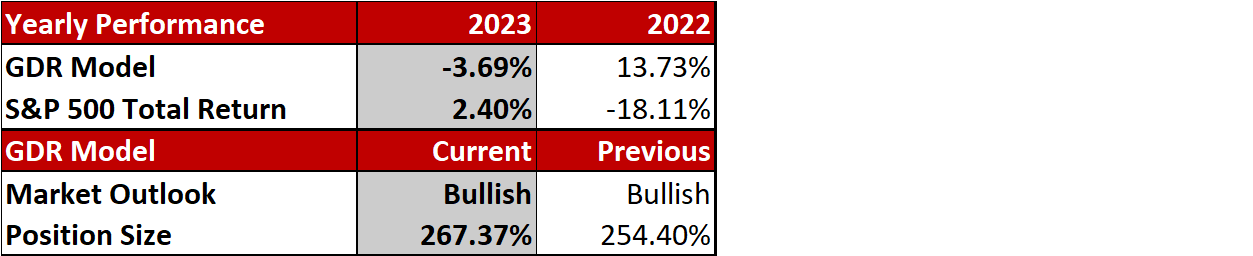

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Inventories likely too Short, Bullish Edge into Data

Yesterday started with the ES taking out Wednesday’s Poor High, but soon after it rejected a Breakout of the current Balance Zone. When the edges of Balance are tested but the break fails, it’s not uncommon for the market to swing to the opposite edge of that Balance Zone and that’s exactly what happened yesterday.

In the process, the market repaired some Poor Structure including Trapped Short positions and the Overnight Swing Low from 3/2. However, Inventories are looking stretched on the short side heading into key data at 8.30am. This gives the market an upside edge in reaction to unemployment data.

Reading Inventories is always much more of an art than a science, so we can only speak in terms of probabilities, but the logic going into today is the following: if everyone is already as short as they can possibly be then, regardless of the actual data release, there is no way to go but up. Note that I’m not advocating carrying a long position into the data release; this is just preparation to avoid surprises when the release comes.

Potential Market-Moving Events Today

08:30am - Nonfarm Payrolls