S&P 500 Futures Daily Insights for Tue 28 Mar 2023

Short-Term Momentum Traders Dominating the Market Again. Bearish Edge Today

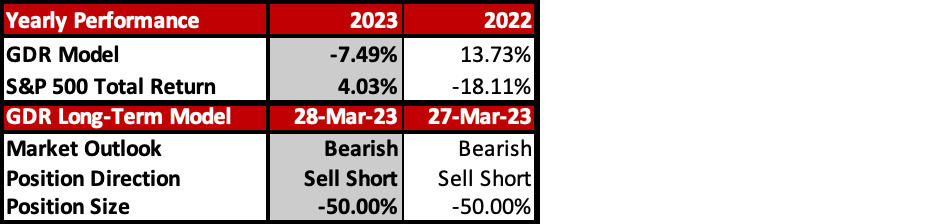

GDR Model Insights for the Current Week

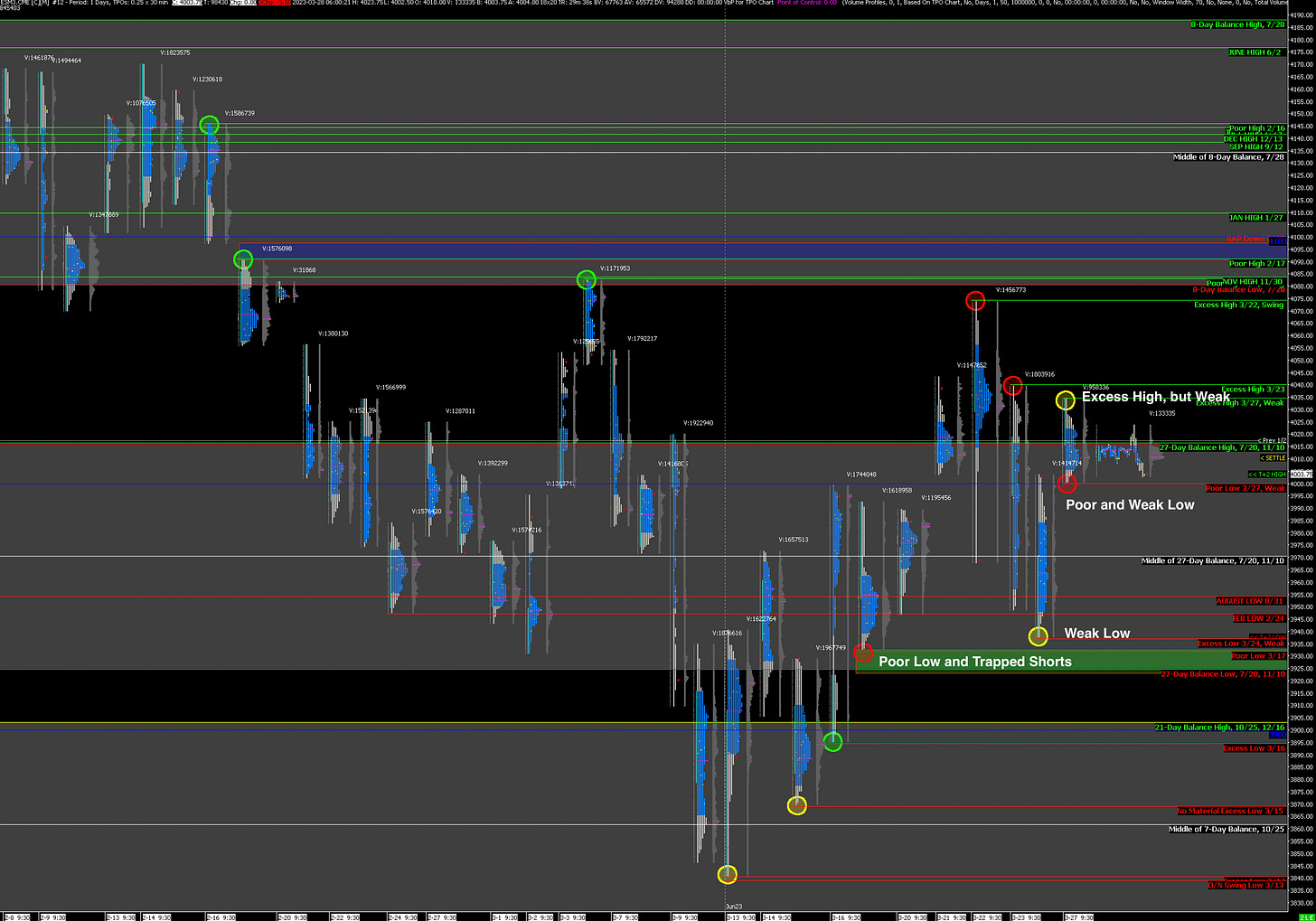

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Market Rejects Top of Balance Zone

Counterpoint: Fresh Liquidity from Fed Continues Driving Market Higher

Key Levels for Today:

Bullish: 4016 (Current Balance Zone High, Y’day Halfback), 4080 (Upper Balance Zone Low), 4098 (Closes Gap Down)

Bearish: 4000 (Y’day Poor and Weak Low), 3937 (Prev Low, Weak), 3924 (Current Balance Zone Low / Trapped Short Position)

There isn’t much change to the near-term outlook from yesterday as ranges have been tight. The most notable remark regarding yesterday’s trading is the ubiquity of weak references, suggesting that short-term momentum traders have dominated the market. Notably, yesterday’s High is Weak as it matched the Overnight High. The Low is both Poor and Weak as it has no Excess and it is made at a very exacting level (4000).

Based on collecting all the references from the past few days I would say there is a Bearish edge going into today. However, always keep in mind that short-term momentum traders are fickle and shift positions on a dime, hence the term weak-hands traders.

Potential Market-Moving Events Today

8:30am - Retail Inventories

9:00am - S&P/Case-Shiller HPI Composite

10:00am - CB Consumer Confidence, FOMC Member Barr Testifies on SVB Failure (SIVB 0.00%↑)