S&P 500 Futures Daily Insights for Fri 24 Mar 2023

Potential Bearish Turning Point

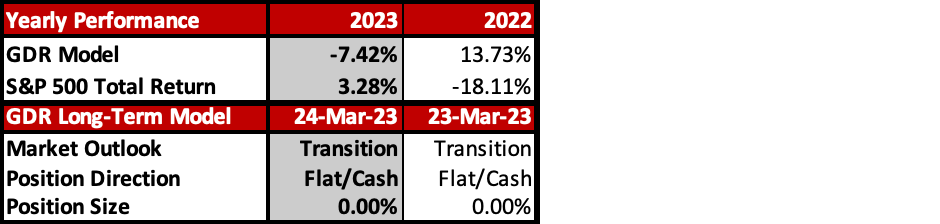

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Potential Bearish Turning Point

Counterpoint: Overly Short Inventories Trigger Another Short-Covering Rally

Key Levels for Today:

Bullish: 3994 (Prev Halfback), 4016 (Current Balance Zone High), 4080 (Upper Balance Zone Low)

Bearish: 3946 (Weak Low), 3924 (Current Balance Zone Low / Trapped Short Position), 3903 (Top of Lower Balance Zone)

Yesterday in the morning the market tried to break out of the current Balance Zone again but was rejected. Liquidation followed and Value developed lower with the POC shifting in the last half-hour of trading. There are good odds that the market has rolled over and is not targeting the Poor Structure below (this is highlighted in the chart and the Bearish levels above).

Ranges have been extreme and with liquidations there is always the possibility of (at times unexpected) short-covering rallies. The path of least resistance right now is down, but never underestimate the potential for change in markets.

Potential Market-Moving Events Today

8:30am - Durable Goods Orders

9:30am - FOMC Member Bullard Speaks

9:45am - Manufacturing PMI