S&P 500 Futures Daily Insights for Tue 6 Dec 2022

GDR flagged some Bearishness - will it turn out to be yet another test?

GDR Model Insights for the Current Week

GDR Model Performance (2022): +25.07%

Market Tone: Bullish (previous week: Bullish)

Positioning: +247.22% Long (previous day: +233.43% Long)

Commentary: GDR flagged some serious bearishness today. Time will tell if this is yet another test of the Bullish idea or if it will lead to a switch back

S&P 500 Futures Market Profile Insights for Tomorrow

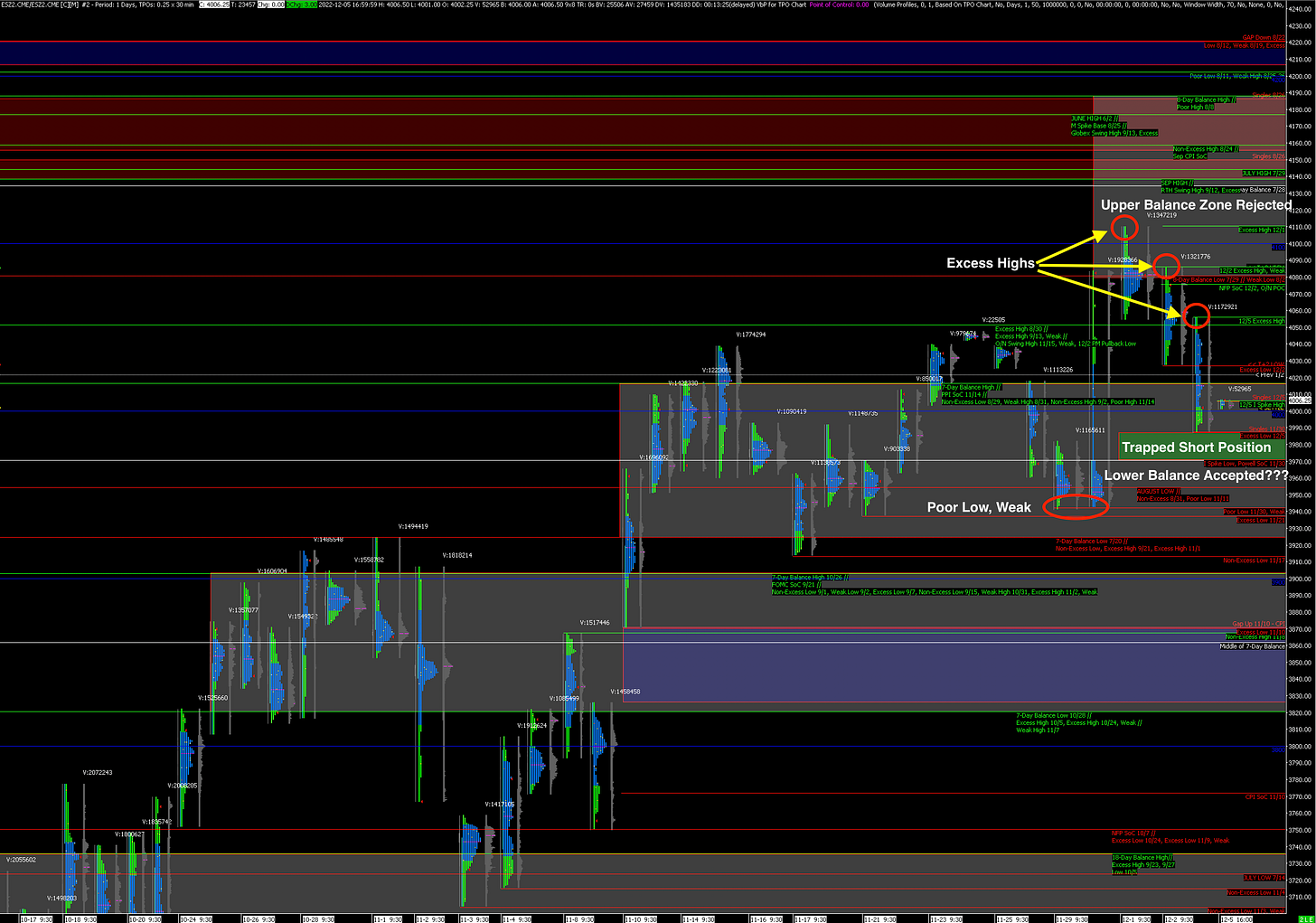

Today was a strong confirmation of yesterday’s Market Profile analysis, which still holds, except that now there are 3 consecutive Excess Highs and the ES closed weak today. In addition, the upper Balance Zone has definitively rejected. At this point the key question is whether the previous lower Balance Zone the ES is currently re-entering will be accepted once again.

The ES did clean up some of the poor structure below, but there is still more to go. Specifically, the Trapped Short Position and the Poor Low from 11/30 are still in need of repair. Those are the next logical targets.

Potential Market-Moving Events Tomorrow

08:30am - Trade Balance