S&P 500 Futures Daily Insights for Fri 17 Mar 2023

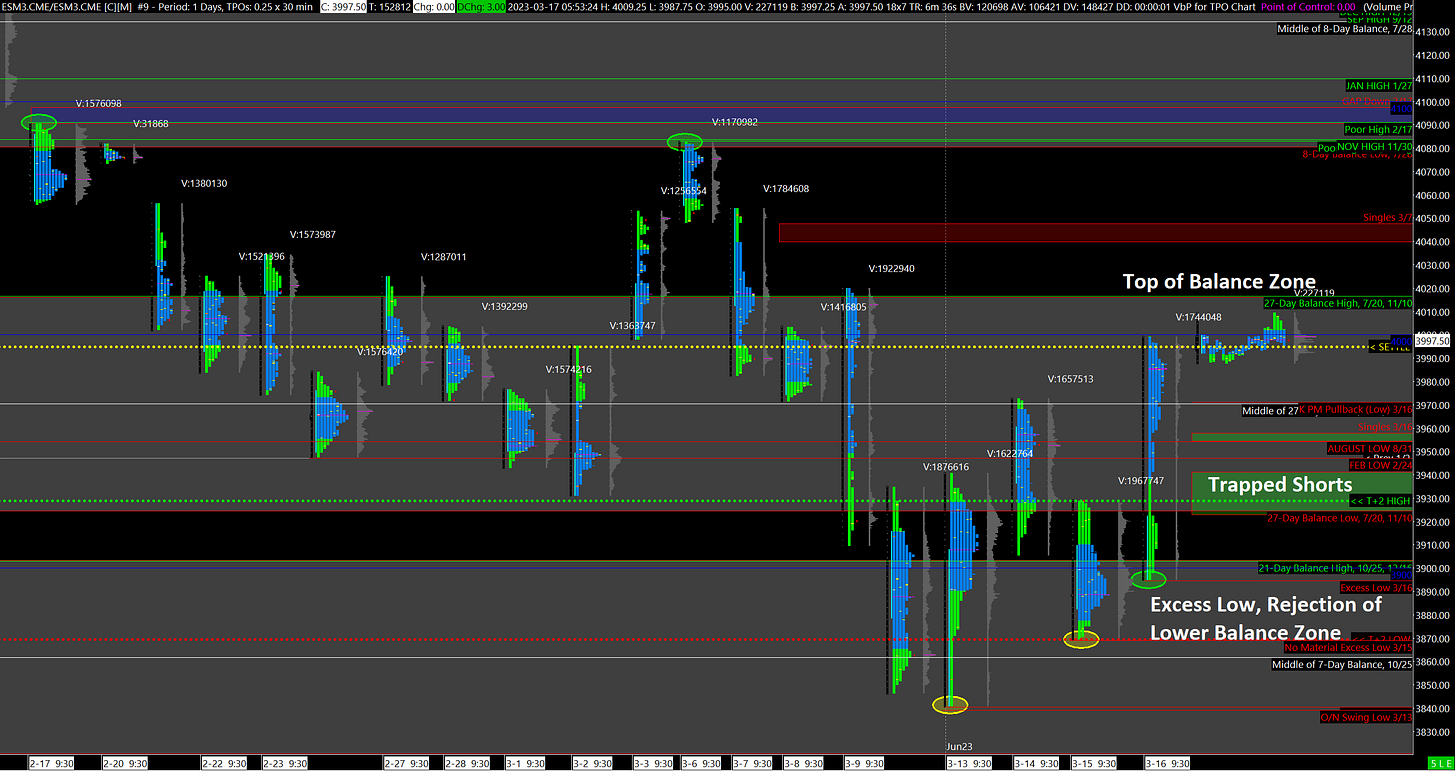

Rejected Lower Balance Zone after Short Covering Rally

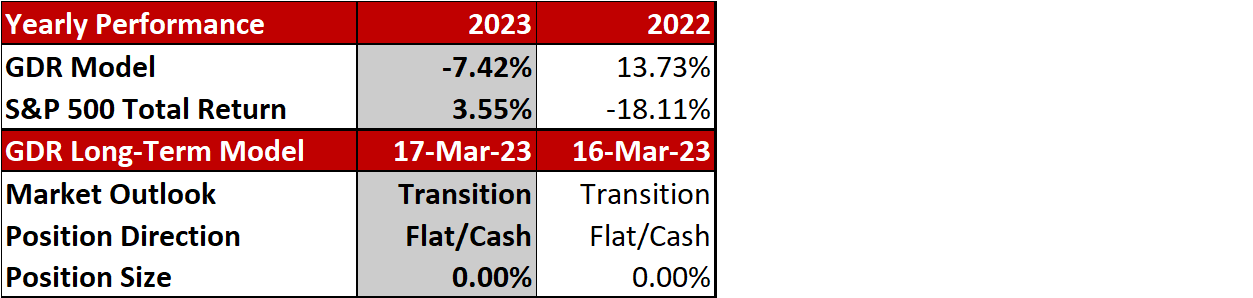

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Bullish following Rejection of Lower Balance Zone

Counterpoint: Potential Weakness after Short-Covering Rally approaching top of Balance Zone

Yesterday’s trading was an emphatic rejection of the Lower Balance Zone leaving behind an Excess Low. The market then traded markedly higher, but given the two Poor Highs from 3/14 and 3/15 that it repaired in the process, there are good chances that short-term Inventories got too short and yesterday was just a short-covering rally. Today it will likely be important to remain aware of the potential for failure near the top of the current Balance Zone.

Here are the key levels for today:

Bullish: Top of Balance Zone (4016), Trapped Long Position (4048), Bottom of next Balance Zone (4080)

Bearish: Y’day Afternoon Pullback Low (3971), Trapped Short Position (3954), Bottom of current Balance Zone (3924)

Potential Market-Moving Events Today

09:15am - Industrial Production

10:00am - Michigan Consumer Sentiment