S&P 500 Futures Daily Insights for Wed 30 Nov 2022

GDR Model flagged today as a strongly Bullish day ahead of a heavy release tomorrow

GDR Model Insights for the Current Week

GDR Model Performance (2022): +21.72%

Market Tone: Bullish (previous week: Bullish)

Positioning: +250.90% Long (previous day: +249.77% Long)

Commentary: even though the S&P 500 was slightly down, as far as GDR Model is concerned today was a solidly Bullish day. It’s an opportune time to highlight that GDR Model’s Market Tone portion is entirely price blind; the goal is not to identify price trends, but rather to take advantage of favorable market structure.

S&P 500 Futures Market Profile Insights for Tomorrow

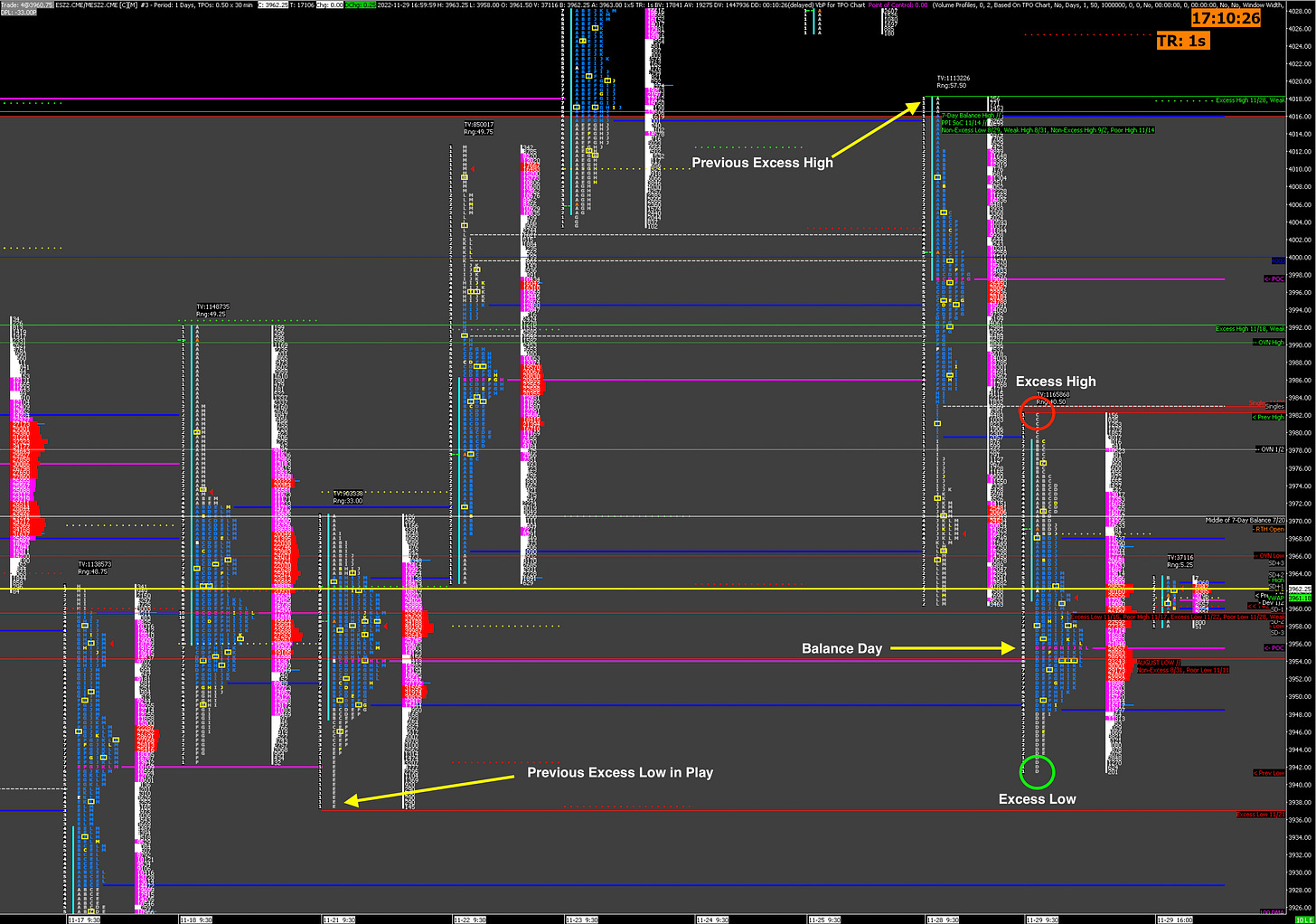

From a Market Profile perspective, today was a Balance Day that also traded around the middle of the current Balance Zone. Moreover, the fact that there are now two consecutive Excess Highs counterbalances today’s Excess Low and the general upward trend. This makes sense given that tomorrow is a release heavy day with key employment reports in the morning and Powell speaking in the early afternoon.

Given the potential for volatility, Balance rules are especially important heading into tomorrow. In short, 1) go with a break out of Balance, and 2) fade failed breaks from Balance.

Potential Market-Moving Events Tomorrow

08:15am - ADP Nonfarm Employment Change

08:30am - GDP Revision, Retail Inventories

09:45am - Chicago PMI

10:00am - JOLTs Job Openings, Pending Home Sales

01:30pm - Fed Chair Powell Speaks

02:00pm - Beige Book